While we still have some time before the January 2026 tax season arrives, CPA firms across the USA are already asking themselves, “How are we going to survive another tax season?” With already piling client queries, changing regulatory requirements, and ever-deepening talent shortage, the problems for CPA firms in the USA just don’t seem to go away. For clients, their demands remain unchanged, with faster turnaround times and utmost accuracy. As a result, every CPA firm is battling staff burnout before tax season stress even peaks.

If you, too, are facing the same, let us tell you that you are not alone. The accounting profession is facing a storm of challenges. However, the good news here is that you can come out of this storm untroubled. And we are going to tell you exactly how. Our latest blog highlights how to tackle tax season stress head-on and build a sustainable practice that works for everyone.

Prepare Your CPA Firm for a Stress-Free 2026 Tax Season

Designed for CPA firm owners, partners, and professionals preparing for a busy season. Stay organized, boost efficiency, and reduce last-minute extensions with this complete checklist.

Free DownloadWhy Does Tax Season Stress Keep Getting Worse Every Year?

Ideally, it shouldn’t, but somehow tax season keeps getting worse every year. The traditional approach to handling tax season just doesn’t work anymore with complex regulatory changes and increased client demands. According to a recent FloQast survey, nearly 99% of accountants reported burnout, with 24% experiencing moderate to severe burnout. For a CPA firm, nearly its entire workforce is facing some form of unsustainable pressure.

If you look at the data for your firm, you’d find that you or some of your team members would easily have worked around 60-70 hours/week last year. Furthermore, many talented accountants quit right after April 15th, and still barely kept up with client demands. This seems to be the trend every year. The US Bureau of Labor Statistics reports that over 190,000 accounting jobs were vacant in 2022, with projections that this number will surpass 200,000 by 2025.

The increasing staffing shortage automatically translates to an ever-growing workload. In the meantime, client expectations keep rising. They need instant responses, real-time updates, and complex tax planning strategies, all delivered with the same personalized attention that your firm provided when it was double the size it is now. As a result, your team’s well-being and your profitability both take a hit.

Key Takeaway: The tax season stress stems from too much work, too few qualified professionals, and client expectations that outpace traditional capacity.

What Are the Real Costs of Tax Season Stress on Your Firm?

While the tax season has direct impact on the wellbeing of your employees, the ripple effect of it all directly impacts your firm’s financial health. Accountants under severe stress tend to make more mistakes with requiring them to reopen their books to fix their mistakes. As a result, the work gets delayed and your client satisfaction takes a hit. The time spent on fixing the mistakes cost you real money, which ideally should be hitting your bottom line.

However, the financial problems doesn’t end there. Stressful tax season results in higher turnover rates, which when combined with ongoing talent shortage in the accounting industry can severely affect your operations. Every time a talent staff leaves your firm, you end up spending a lot of time and money in getting the replacement in and your exsisting staff gets overworked due to staff shortage, accelerating their path to burnout.

Here’s what the annual cycle of tax season stress costs your firm:

| Hidden Cost Category | Estimated Annual Impact per Employee | Estimated Firm-Wide Impact (10 employees) |

|---|---|---|

| Recruitment & Training | $5,000 – $15,000 | $50,000 – $150,000 |

| Error Correction | $3,000 – $8,000 | $30,000 – $80,000 |

| Lost Productivity | $8,000 – $12,000 | $80,000 – $120,000 |

| Healthcare/Sick Days | $2,000 – $5,000 | $20,000 – $50,000 |

| Total Annual Cost | $18,000 – $40,000 | $180,000 – $400,000 |

How Can You Transform Your Approach to Tax Season Stress?

Successfully overcoming tax season stress requires a fundamental shift in how CPA firms think about staffing and capacity. While traditional solutions such as hiring more local staff, working longer hours, and turning away clients have proven somewhat effective, as a CPA firm, you need strategies that add flexibility, maintain quality, and protect your team’s well-being.

It means you need to reimagine your entire operational model, viewing tax season as an annual occurrence that every employee must survive by effectively managing his or her workload. You can do so by enabling your senior staff to focus on high-value client advisory data rather than spending time on data entry. You can also collaborate with outsourcing service providers to gain the ability to scale your capacity up or down, without the need to hire local staff every time there is a surge in workload.

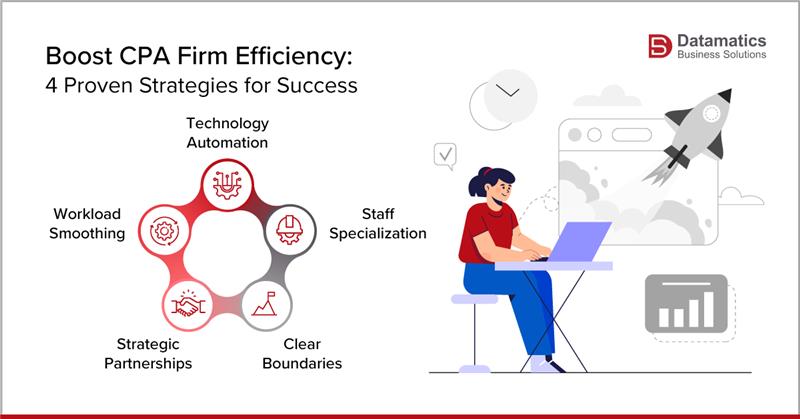

Some proven strategies that work together to reduce tax season stress include:

- Workload Smoothing: You must spread your work uniformly throughout the year through proactive client communication and extension management

- Technology Automation: Harness the power of advanced accounting tools that can help you handle routine tasks such as data entry and document management smoothly.

- Staff Specialization: Let team members focus on their strengths rather than being generalists who do everything

- Strategic Partnerships: Leverage external support through outsourcing to supplement your core team.

- Clear Boundaries: You must set realistic client expectations in terms of timelines and availability

CPA firms that successfully navigate tax season stress harness multiple approaches rather than relying on a single solution.

Key Takeaway: If you’re looking to navigate through the tax season with absolute ease, you need to think about capacity, not just tactical fixes. The firms winning today have embraced flexible staffing models that adapt to seasonal demand.

Why Is Outsourcing the Game-Changer for Tax Season Stress Management?

Outsourcing is fast becoming the most effective solution to tax season stress. While some CPA firms initially resist the idea of outsourcing, most have embraced it as a strategic growth lever. Nearly half of firms over $20M outsource staff or tax returns, and 74% plan to do more next year.

By partnering with an outsourcing services provider for CPA firms, you gain access to a global talent pool as opposed to scrambling every January to find qualified local accountants. As a result, you can scale your operations as and when needed without the long-term overhead of full-time local hires you won’t need in July.

Almost any tax preparation or accounting task can be successfully outsourced to India:

- Tax return preparation: Individual (1040), Partnership (1065), Corporation (1120), and specialized returns

- Bookkeeping services: Monthly close, account reconciliation, and financial statement preparation

- Payroll processing: Calculation, reporting, and compliance across multiple states

- Accounts payable/receivable: Invoice processing, payment management, collections support

- Audit support: Work paper preparation, testing, documentation

- Advisory support: Financial analysis, projections, business reporting

Conclusion: Your Path to a Stress-Free 2026 Tax Season Starts Now

Tax season stress should not be the reason why your profits shrink. By embracing strategic outsourcing partnerships, you can easily overcome the annual nightmare of tax season stress, report higher profitability, improve team retention, and enhance client service.

Ready to Eliminate Tax Season Stress From Your CPA Firm? Write in to us at marketing@datamaticsbpm.com, and we will have our tax experts reach out to you with solutions perfectly tailored to your business needs.

Is my client data secure with an offshore accounting provider?

Reputable offshore providers prioritize data security with robust protocols, including secure data transmission, strict confidentiality agreements, and compliance with international data protection standards. Always ensure your chosen partner has verifiable security certifications and practices.

How do I manage quality control when outsourcing tax preparation support?

Effective quality control involves clear communication, detailed process documentation, regular performance reviews, and a tiered review system. Many firms implement a final review by an in-house CPA to ensure all outsourced work meets their firm’s stringent quality standards and US tax regulations.

What's the typical timeline for integrating an offshore team into my firm's workflow?

The integration timeline can vary but generally ranges from 4-8 weeks. This period involves initial onboarding, process documentation, software training, and a pilot phase to ensure smooth collaboration and efficient workflow before the full ramp-up, especially crucial before the tax busy season.