Table of Contents

Simplifying the Convolutions of International Taxes

Before discussing the role of global tax outsourcing companies, it is only fair to understand the convolutions of international taxes. It will highlight this tax outsourcing companies’ role for modern CPAs and accounting firms and present a convincing argument to partner with one of them. So, let us get started.

Irrespective of how you view it, international taxation is multifaceted and complex. Whether you are a business, or an individual involved in cross-border transactions or business, you will have to navigate through the tricky waters of international taxation.

At the risk of sounding scary, here we have listed some fundamental complexities frequently associated with international taxes to help you understand the challenges that global tax outsourcing companies must overcome to serve you.

Some of the biggest challenges include –

- Territorial vs. Worldwide Taxation

- Double Taxation

- Tax Jurisdictions and Residency

- Tax Compliance and Reporting

- Foreign Tax Credits

- VAT/GST and Customs Duties

- Base Erosion and Profit Shifting (BEPS)

- Digital Economy and Taxation

- Legal Structures and Tax Optimization

To serve you well, global tax outsourcing companies need to understand these complexities and make informed decisions to help you minimize your tax liabilities while ensuring complete compliance with relevant laws and regulations.

In this blog, we will discuss some of the intelligent solutions and strategies these outsourcing companies adopt to overcome the complexities of international taxes effectively.

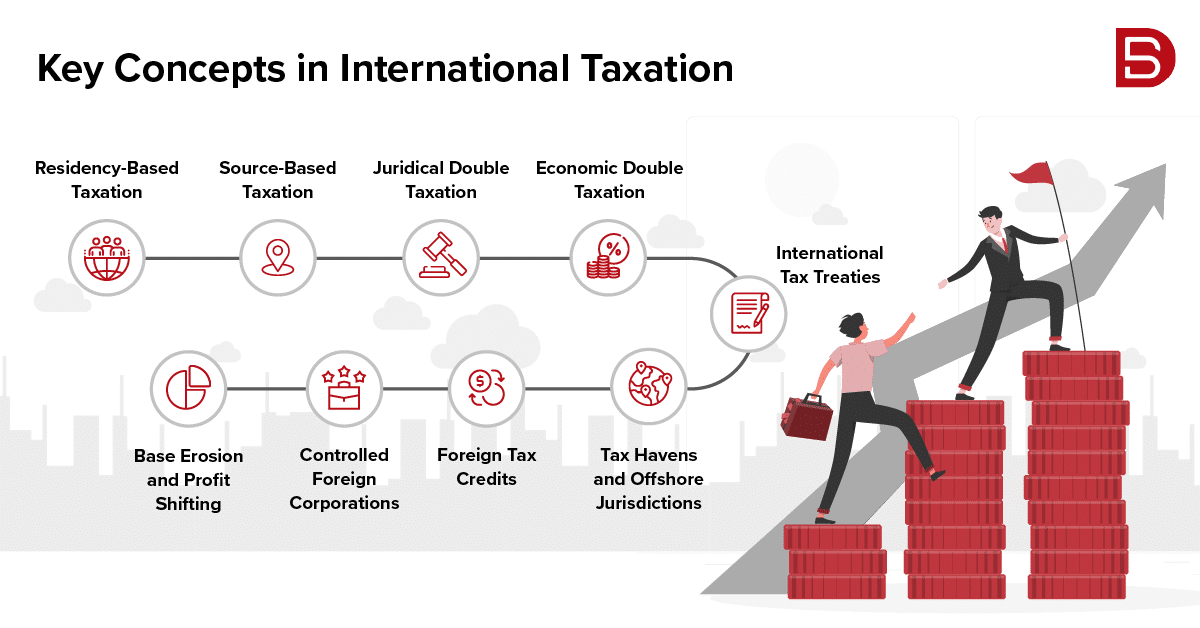

Key Concepts in International Taxation

International taxation is a complex process combining many cross-border records involving income, assets, and profits across national borders. As an individual accountant or professional CPA firm, you must know these critical concepts to engage in global economic activities.

- Residency-Based Taxation: Residents will be taxed on their worldwide income. It is applied by only some countries, such as The United States, Canada, and most European countries.

- Source-Based Taxation: This type of taxation does not consider worldwide income and applies only to revenue generated within a country’s borders. Some of the countries adopting territorial tax include countries like Singapore, Hong Kong, and Malaysia.

- Juridical Double Taxation: This taxation happens when two or more countries claim to tax the same income or profits.

- Economic Double Taxation: This taxation happens when the same income or profits get taxed in multiple countries. This brings down the overall revenue of the individual eligible for this type of taxation.

- International Tax Treaties: International tax treaties, or double taxation treaties, are agreements between countries to mitigate double taxation and establish the right to tax for their respective country. These treaties were also created to address withholding taxes, tax rates, and dispute-resolution mechanisms.

- Tax Havens and Offshore Jurisdictions: Tax havens or offshore jurisdictions are countries/places known for absolutely none to very low taxation and high financial secrecy laws. These locations are often exploited for tax planning, financial confidentiality, and asset protection.

- Foreign Tax Credits: Foreign tax credits are designed to allow a taxpayer to offset the taxes paid to a foreign country against their domestic tax liability. This helps them reduce their domestic tax liability or eliminate double taxation.

- Controlled Foreign Corporations (CFCs): CFCs are created to allow residents to defer or avoid paying taxes using foreign corporations on the passive income they earn abroad. Revenues earned by the CFCs are attributed to the controlling resident.

- Base Erosion and Profit Shifting (BEPS): Base Erosion and Profit Shifting essentially refer to strategies that multinational companies use for shifting their profits to low-tax jurisdictions to erode the tax base of higher-tax countries.

As a CPA, you must be aware of these key concepts of international taxes as they form the foundation of international taxation principles and ways to navigate complex cross-border tax issues.

These will also help you find the best global tax outsourcing company per your needs. However, when looking for one, you need clarity on the services you can avail for them. So, here we have listed some of the prominent services offered by global tax outsourcing companies; you can help any of these from them.

Services Offered by Global Tax Outsourcing Companies

Global tax outsourcing companies offer a wide range of services to help clients comply with tax laws, optimize tax efficiency, and mitigate any possible risk associated with cross-border financial activities. Here, we have listed some of the critical services offered by these outsourcing firms:

- Transfer Pricing Services

- Cross-Border Tax Planning

- Foreign Tax Credit Optimization

- Reporting and Compliance Services

- Expatriate Tax Services

- Cross-Border Mergers and Acquisitions (M&A) Support

- Global Tax Compliance and Reporting

- VAT/GST and Customs Duties Services

- International Tax Audits and Dispute Resolution

- Tax Technology Solutions

- Country-Specific Tax Advisory

- Transfer Pricing Documentation and Benchmarking

- Customized Tax Training and Education

- Global Tax Strategy Development

If, as a CPA firm, you need any of these services, partnering with one of these tax outsourcing companies is a smart move. You will get their experience, expertise, and global networks and can expect tailored solutions to meet your business needs.

Benefits of Global Tax Outsourcing Partner

Global tax outsourcing companies offer a wide range of benefits to their clients in addition to helping their clients deal with complex international tax issues. Here are some of the vital benefits you can expect from a global tax outsourcing firm:

- Expertise in International Tax Codes

- Cost Effective International Operations

- Global Compliance and Risk Management

- Access to Global Tax Software and Tools

- Customized Global Tax Strategies

- Scalability and Flexibility of Operations

- Global Risk Mitigation:

- Strategic International Tax Insights

- Confidentiality and Data Security

International tax complexities can be a significant obstacle for CPAs in the modern global business environment. However, partnering with a worldwide tax outsourcing partner can help you overcome those challenges easily while benefiting from the arrangement.

In Conclusion

The world of international taxation is ever evolving; to stay on course with the changes, you need a global tax outsourcing company to help you make strategic decisions to reap the numerous benefits of international taxation. These outsourcing partners offer expert knowledge of international taxation and globally compliant solutions for risk management and cost efficiency.

In simple terms, these global tax outsourcing companies are an indispensable support for CPA firms handling multiple businesses and individuals dealing in cross-border taxation. If you are looking for a partner for your international taxation needs, just email us at marketing@datamaticsbpm.com, and we will get you started.