Fondly referred to as the “One Big Beautiful Bill” by social commentators, the U.S. Senate earlier this year passed a legislative package encompassing tax reform, sustainability incentives, infrastructure investment, and expanded compliance measures for businesses of all sizes. The One Big Beautiful Bill CPA impact is already a hot topic across the accounting world, with U.S. CPA regulatory challenges 2025 front and center for many firms. While the jury is still out on the exact impact, for Certified Public Accountants (CPAs) in the United States, this omnibus legislation—packed with sweeping tax reforms, social program overhauls, and funding reallocations—signals one thing above all: a surge in regulatory complexity.

Under this bill, the US accounting landscape will become even more complex, demanding more than just technical expertise. Whether you are focused on accounting outsourcing for CPA firms with US clients, a UK-based accountancy firm catering to US customers, or an offshore firm eyeing new opportunities, this moment matters. The U.S. tax and compliance landscape just became heavier, bigger, and even more time-sensitive (as if it was not already). To thrive under this new legislation, the U.S. CPA firms need backup—especially as CPA compliance workload increase is now a real and pressing challenge. That is what this blog is all about.

In this blog, we will explore the new regulatory demands that the ‘One Big Beautiful Bill’ brings, why CPA capacity solutions will emerge as the biggest pain point for US CPA firms, and how partnering with outsourcing accounting services USA can deliver the much-needed respite to the US accounting fraternity. So let us dive straight in.

How one bill will redefine the future for U.S. CPAs.

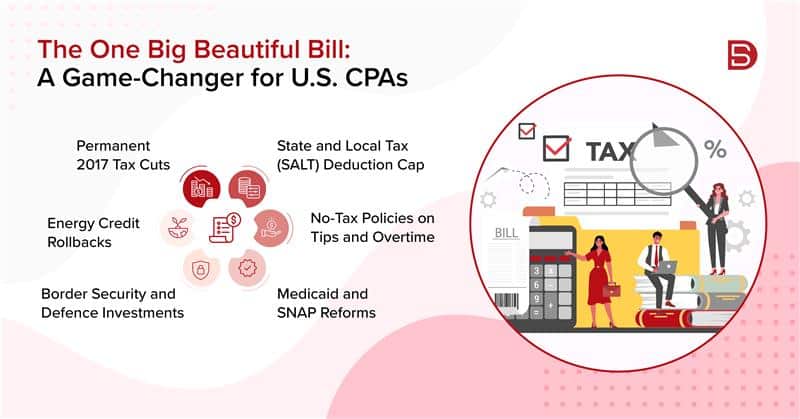

Passed with a very slender 51-50 Senate vote and a tiebreaker from Vice President JD Vance, the One Big Beautiful Bill is a sprawling piece of legislation that touches nearly every facet of the U.S. economy. The key provisions under this bill include:

- Permanent 2017 Tax Cuts: The bill ensures lower individual and corporate tax rates indefinitely by locking in the Tax Cuts and Jobs Act updates.

- State and Local Tax (SALT) Deduction Cap: The standard SALT deduction cap has also been adjusted, giving new planning challenges for high-net-worth individuals in high-tax states.

- No-Tax Policies on Tips and Overtime: Service industry workers and those earning overtime pay will now get tax exemptions, requiring CPAs to recalibrate payroll/tax strategies while managing new layers of compliance.

- Medicaid and SNAP Reforms: Healthcare providers, non-profits, and low-income clients now face stricter requirements and reduced funding, making compliance even tougher.

- Border Security and Defence Investments: Enhanced funding means opportunities for government contractors and a need for even stricter financial reporting.

- Energy Credit Rollbacks: Those in renewable sectors must re-evaluate planning, as clean energy credits phase out.

All these monumental changes directly translate into a surge of work for CPAs. Not only do U.S. CPA regulatory challenges 2025 threaten to overwhelm firms, but the expanded regulations also push CPA firm staffing challenges to new heights. CPA firms must now juggle multiple regulatory updates—often with tight deadlines driven by the July 4, 2026, target for full implementation.

New Compliance Demands on U.S. CPAs

With the U.S. tax reform CPA 2025, workload for CPA firms will see a spike. For clients, expanded credits and deductions sound great. But for CPAs, this means:

- Increased documentation to substantiate eligibility.

- In-depth tracking of qualifying expenses.

- Complex advisory conversations as businesses restructure to leverage new benefits.

- Increased risk of audits, demanding higher-quality work to withstand stricter IRS scrutiny.

Additionally, enhanced ESG reporting CPA outsourcing requirements mean new frameworks, more data collection, and potentially steep penalties for mistakes. Many small- and mid-sized CPA firms have yet to develop robust ESG expertise—making outsourcing accounting services USA an even more attractive solution for sustainable compliance.

Add to this the thriving gig economy: new tax thresholds mean millions of small sellers/freelancers will rely on expert guidance for 1099-K forms, adding substantially to CPA compliance workload increase and further stressing CPA capacity solutions.

Why Outsourcing is The Logical Next Step?

For savvy CPAs, accounting outsourcing for CPA firms isn’t just about efficiency—it’s a strategic move in a more competitive, regulated environment. Modern outsourcing partners now provide:

- Talented tax preparation experts well-versed in U.S. codes.

- Dedicated compliance support for new ESG frameworks and industry-specific reporting.

- Seasonal surge capacity for peak tax season and year-round needs.

- Advisory support, enabling senior CPAs to prioritize high-value client conversations.

Choosing the right outsourcing partner means not losing control—but gaining resilience and flexibility. This is crucial for keeping up with U.S. CPA regulatory challenges 2025 and CPA firm staffing challenges alike.

Forward-thinking CPA firms are:

- Auditing current workloads to identify which services and clients will be most impacted.

- Mapping staffing gaps and planning for cyclical spikes.

- Vetting outsourcing partners early—since top providers offering outsourcing accounting services USA often book up in advance.

- Educating clients about the changes, documentation needs, and key compliance deadlines.

A robust solution for CPA capacity solutions includes:

- Deep experience with U.S. tax code, references, and proven performance.

- Strong security and compliance credentials (SOC 2, ISO).

- Flexible models for project-based or long-term support.

- Reliable communication, SLAs, and turnaround guarantees.

💡 Is Outsourcing Right for Your Accountancy Firm?

Take our quick self-evaluation to assess whether outsourcing or offshoring fits your firm’s goals.

Instantly discover how it can impact cost savings, capacity, and growth potential.

No commitment. Just tailored insights in less than 2 minutes.

The “One Big Beautiful Bill” isn’t the end of legislative upheaval. As new laws, credits, and reporting requirements continue to emerge, and as AI and tech reshape the profession, only those firms that embrace accounting outsourcing for CPA firms and proactively address CPA firm staffing challenges will thrive.

Outsourcing accounting services USA is about more than surviving tax season. It’s about ensuring sustainable growth, cost management, and letting your most valuable people focus on delivering expert advisory services.

How soon will the ‘One Big Beautiful Bill’ changes take effect?

Many provisions start with the 2025 tax year, but some reporting requirements kick in sooner. Firms should start planning now to avoid last-minute bottlenecks.

What parts of the bill are most likely to increase my workload?

Expanded credits and ESG disclosures are two big areas. The IRS funding boost also means higher audit risk — so your tax documentation and advisory work must be airtight.

Is outsourcing secure for sensitive client data?

Reputable outsourcing partners follow strict data security standards like SOC 2, ISO, and GDPR. Always verify certifications, NDAs, and secure workflows before you sign.