For CPA firm owners/partners, the feeling of being under severe stress just never goes away. Client demands keep growing, the tax season continues to get more complex, and the challenge of finding qualified accounting staff in the US is omnipresent. That is exactly why offshore accounting services for CPA firms are no longer a fringe idea; they have firmly become a competitive necessity.

If you own or run a CPA firm in 2026, you know what we are talking about. And if you are serious about growing your firm, you perhaps would have considered offshore accounting services for CPA firms as a potential solution at some point. However, questions surrounding outsourcing make you question whether this is the right move for your firm.

So, after working with 200+ CPA firms globally, we feel we have the know-how to help CPA firms successfully transition to offshore models. The accounting landscape has undergone significant change in recent times. What once seemed risky has become a strategic necessity for firms that want to remain competitive and profitable.

Why Are CPA Firms Turning to Offshore Accounting Services?

To understand the reality of the situation, let’s look at AICPA’s 2024 Trends Report, which states that nearly 75% of CPA firms cite a talent shortage as their top business challenge and that the profession faces a projected shortfall of 340,000 accountants by 2025. For any profession, that’s a clear worrying sign. And if you’re from the accounting industry, you would’ve faced it firsthand. You would’ve posted numerous job ads, only to get underwhelming or even worse, zero responses. There would also have been instances when your best resources would’ve parted ways in search of remote opportunities with tech companies offering significantly higher salaries.

Offshore accounting is now a strategic way to access a global pool of qualified accountants, often with U.S. GAAP training and CPA-equivalent certifications. Countries like India, the Philippines, and Eastern Europe have strong accounting education systems designed for Western firms.

Outsourcing also brings in significant financial benefits. Partnering with offshore accounting services for CPA firms can help you achieve cost savings of as much as 50-70% in comparison to hiring equivalent U.S.-based staff. However, outsourcing is not only about the salary difference. By partnering with an outsourcing service provider, CPA firms also gain the ability to eradicate benefits expenses, recruitment costs, office space requirements, and the constant churn of training new employees who leave within 18 months.

Most seasoned accounting outsourcing service providers also have large pools of specialized expertise in specific industries or software platforms that are difficult to find locally. Overall, by partnering with accounting and bookkeeping outsourcing service providers, you’re not compromising on quality, you’re often enhancing it while simultaneously improving your margins.

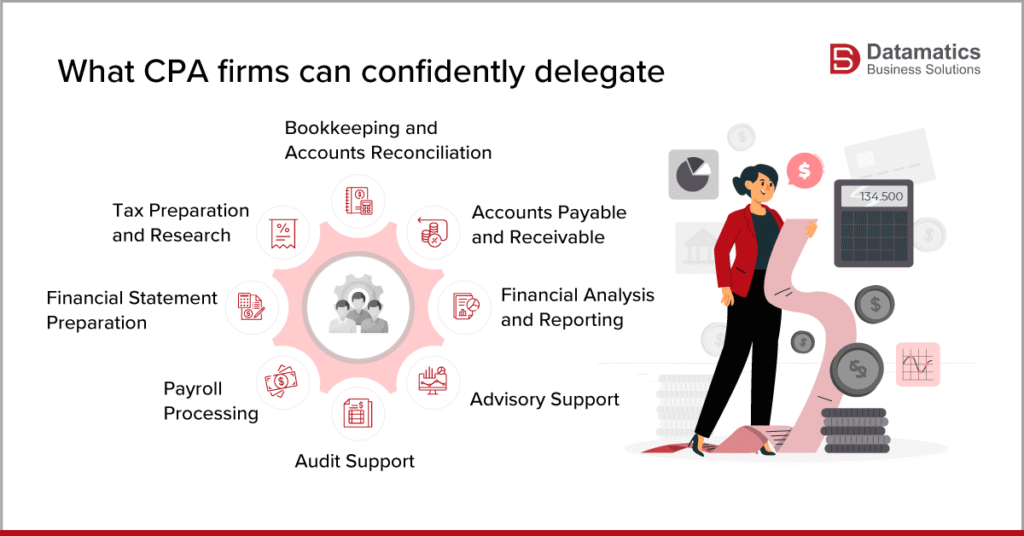

The most common misconception around offshore accounting services is that only bookkeeping can be handled offshore, but the reality is far more expansive. Modern offshore accounting services providers for CPA firms can cover virtually every back-office function, except those that require physical presence or state-specific licensing.

Here’s what CPA firms can confidently delegate:

- Bookkeeping and Accounts Reconciliation: Bank reconciliations, everyday transaction processing, and general ledger maintenance

- Tax Preparation and Research: Individual, corporate, and partnership returns; multi-state compliance; tax research and planning support

- Financial Statement Preparation: Monthly, quarterly, and annual compilations following U.S. GAAP standards

- Payroll Processing: Multi-state payroll, tax filings, and quarterly reporting

- Accounts Payable and Receivable: Invoice processing, payment runs, and collections management

- Financial Analysis and Reporting: KPI dashboards, Budget vs. actual analysis, and management reporting

- Advisory Support: Financial modeling, forecasting, and business valuation assistance

- Audit Support: Workpaper preparation, testing procedures, and documentation

When contemplating offshoring services for your CPA firm, you need to understand the distinction between task-based offshoring and relationship-based work. Depending upon the nature of the business, you’d want to keep business development, client-facing advisory work, and complex tax strategy discussions in-house. On the other hand, the time-consuming tax preparation, tax processing, and analytical work, which consumes nearly 60-70% of your team’s time, is perfect for offshore delegation.

We have also seen several firms successfully offshoring everything from simple offshore bookkeeping services to complex multi-entity consolidations and international tax compliance. Offshore outsourcing services are not limited to the complexity of the work; it depends on how neatly you document your processes and communicate your expectations.

| Service Type | Offshore Suitability | Typical Cost Savings | Quality Level |

|---|---|---|---|

| Basic Bookkeeping | Excellent | 60-70% | Equivalent to U.S. |

| Tax Preparation | Excellent | 50-65% | High (with review) |

| Financial Statements | Excellent | 55-70% | Equivalent to U.S. |

| Tax Advisory | Moderate | 40-50% | Requires senior staff |

| Audit Fieldwork | Low | N/A | Requires on-site presence |

| Client Relationship Management | Low | N/A | Best kept in-house |

Are Offshore Accounting Services for CPA Firms Secure Enough?

Security becomes of utmost importance when it comes to offshore accounting services. Hence, reputable offshore accounting services providers for CPA firms adhere to SOC 2, ISO 27001, and GDPR security standards. Furthermore, they offer end-to-end encryption, 2FA, and dedicated servers to protect client data, like Fort Knox.

Offshore bookkeeping services provider also leverages US-timezone overlaps to enable real-time audits, with NDAs and liability clauses standard. All these security measures make security breaches extremely rare, as any lapse would cause severe damage to the firm’s reputation.

If you are not sure about your potential outsourcing partner, it is always better to ask for audits and trials upfront to secure your practice while onshore talent hunts drag on.

💡 Is Outsourcing Right for Your Firm?

Take our quick self-evaluation to assess whether outsourcing or offshoring fits your firm’s goals.

Instantly discover how it can impact cost savings, capacity, and growth potential.

No commitment. Just tailored insights in less than 2 minutes.

With advancements in AI and automation, offshore accounting services for CPA firms are evolving faster than ever before. Offshore accounting service providers are now leveraging bots and advanced accounting tools to achieve 50% faster reconciliations. India’s FAO boom elevates to advisory, blending human insight with tech. We will further virtualize global teams to handle analytics much more effectively, as talent shortages push 25%+ AI adoption. Furthermore, new hybrid AI-human models will emerge to further slash costs. If you are thinking of harnessing the power of offshore accounting services for your CPA firm, the time is now.

Conclusion: Is Your Firm Ready for Offshore Accounting Services?

The accounting profession globally has reached an inflection point. The talent shortage is not slowing down anytime soon, client expectations are growing by the day, and CPA firms are seriously struggling to keep up with changing regulations. In such times, any firm that fails to adapt its operating models to the new norm will struggle to remain competitive and profitable. Offshore accounting services for CPA firms have evolved from an experimental cost-cutting tactic to a strategic imperative for growth-oriented practices.

If you are ready to explore how offshore accounting services can grow the capacity of your CPA firm without putting a huge dent in your annual budget, write to us at marketing@datamaticsbpm.com. The future of your firm depends on the decisions you make today.

What are typical costs for offshore accounting services for CPA firms?

$15-30/hour for seniors, 40-60% below US rates, scaling pay-per-task.

How secure is offshore bookkeeping services?

SOC 2/ISO certified, with encryption and US-compliant protocols—risks lower than many internals.

Can offshore accounting handle US tax compliance?

Absolutely. Certified teams manage IRS filings, GAAP, multi-state seamlessly.

How long to onboard offshore bookkeeper?

2-4 weeks, with full productivity by month-end.