Every year, the month of October presents CPA firms with perhaps the most daunting task of the year – overcoming the October 15 tax deadline preparation. This is the last leg of the yearlong marathon of preparing and filing an accurate tax return on time. However, it does not have to be that way. What if we told you that you can sale through this turbulent period not only by merely surviving the last-minute rush, but also by thriving in it. With the right strategies and a seasoned tax preparation outsourcing partner by your side, you can easily conquer the mountain that is the October 15 tax deadline.

In order to thrive in the October 15th deadline rush, you must understand that your firm’s systems are its backbone. Just as with any smoothly operating machine, these systems need to be finely tuned and optimized to handle the increased volume and pressure. Preparing such proactive systems is not only about avoiding last-minute panic, but also about optimizing every single step of your workflow for maximum accuracy and delivering exceptional client service. In this blog, we will share some industry insights that will help you make this period not just manageable, but also successful.

What are the essential steps CPA firms should take to prepare their systems for the October 15th tax deadline?

To prepare your firm for the October 15 tax deadline, you must begin by carefully evaluating your internal systems. It is not only about ensuring that all your software is updated, the compliance checklist is ready, and you have sufficient resources to navigate this, but it is also about establishing a workflow that reduces bottlenecks along the way.

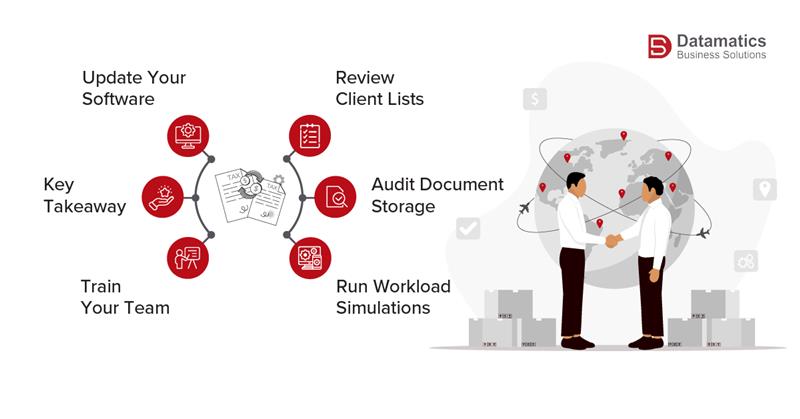

Here are the key steps that you can take to prepare your systems for the October 15th tax deadline:

- Update Your Software: You must update all your software to its latest versions, ensuring that all security patches and compliance updates are installed.

- Review Client Lists: If you cater to multiple clients from different industries, ensure that you have segregated your clients by complexity and filing needs for proper workload prioritization.

- Audit Document Storage: Ensure that all client documents are digital, organized in a proper manner, secure, and accessible to your teams at all times.

- Run Workload Simulations: Perform a test run on your systems to estimate tax return volumes and deadlines.

- Train Your Team: With constantly evolving IRS guidelines, even the most seasoned accounting professionals can go out of touch. This is why your staff needs refreshers every now and then.

Key Takeaway: If you truly want to get your team ready for the October 15 tax deadline preparation, start by updating your software, having organized data, and a clear client prioritization.

How Can Outsourcing Help Your CPA Firm Manage Workload and Meet the Extended Tax Filing Deadline Efficiently?

If your clients have requested tax deadline extensions, it is likely that they will have complex requirements, and reviewing and analyzing these requirements will take more than normal hours. All of this creates a unique workload crunch that can stretch your teams thin, especially if you are short-staffed or lack skilled professionals.

This is where outsourcing can be a game-changer. Accounting outsourcing services providers have dedicated teams that can handle:

- Complex data reconciliations and data entry, allowing your staff to focus on higher-value client interactions.

- Preparing and filing tax forms for both businesses and individuals who have requested extensions.

- Implement quality checks to minimize the risks that could lead to unwanted penalties.

Taking over your repetitive or mundane tasks allows you to focus on delivering high-value advisory work.

According to a Deloitte survey, 59% of companies outsource to cut costs, but CPA firms find an equally important benefit—faster turnaround during crunch time.

Key Takeaway: By partnering with an accounting outsourcing service provider to overcome the October 15 tax extension deadline, you gain the ability to create breathing space for your team while seamlessly handling both volume and complexity without sacrificing accuracy.

What common challenges arise during the October 15th tax filing period and how can they be mitigated?

For most CPA firms despite excessive planning, the October 15 tax deadline extension comes with several complex challenges. However proper identification of these challenges can help you build proper risk mitigation strategies for them.

Here are some of the Top Challenges CPA Firms Face:

- Staff Burnout CPA Issues: Extended deadlines often comes with extended working hours, which can then lead to increased chances of mistakes and lowered morale for your teams.

- Tax Extension Workflow Management Inefficiencies: If you do not manage the tax deadlines efficiently, it can lead to you missing out critical deadlines and consequently penalties.

- Last-Minute Client Submissions: If you cater to different clients, chances are that you will often encounter clients that often delays their filing until October resulting in compressed deadlines.

- Technology Hiccups: If your systems are not updated to their latest versions, they can crash when processing heavy volume of tax preparation. Hence, it is always advised to test your systems for workload management and compatibility.

Mitigation Strategies:

- Harness the power of advanced resource capacity planning tools for proper workload allocation.

- Use automation to communicate with your clients regarding submission of documents ahead of the impending deadlines.

- Establish outsourced backup teams to step in when internal resources are maxed out.

- Conduct pre-deadline system audits to ensure no last-minute glitches.

Key Takeaway: The October 15 tax preparation challenges are not new, however, with proactive tax extension workflow management and outsourcing can keep them from derailing your operations.

Which accounting and tax functions are best suited for outsourcing to ensure timely and accurate filings?

While outsourcing does help CPA firms overcome the October 15 tax deadline extension issue, not all accounting functions should be outsourced.

Depending upon the nature of your business and exact business need, you can choose the tasks that can be outsourced during the October 15 tax deadline preparation. Outsourcing these functions will help your team focus on building strong client communication and strategy building:

- Function Why It’s Ideal for Outsourcing Impact on Deadline Readiness

- Data Entry & Bookkeeping Time-consuming, repetitive Frees staff for review and filing

- Tax Return Preparation Straightforward, rules-based Speeds up client turnaround

- Payroll Processing Monthly/quarterly compliance Reduces distractions during busy season

- Accounts Payable/Receivable Management Ongoing volume tasks Keeps client finances organized

- Quality Review/Double-Checks Second-layer review Ensures accuracy before submission

By outsourcing tasks such as tax return preparation you can cut down your turnaround time by as much as 40%, which allows firms to handle clients more efficiently without the need of hiring additional staff.

Key Takeaway: The most effective outsourcing for tax deadline strategies focus on repetitive, rules-based, and time-intensive tasks that free your CPAs to deliver higher-value services.

The October 15 tax deadline preparation can be a stress test for your firm’s systems, staff, and client management. However, by systematically updating tools, organizing client workflows, and leveraging the power of accounting outsourcing services, you can transform this deadline from a high-pressure crunch into a manageable and predictable process.

If you’re ready to reduce stress, boost efficiency, and keep your clients happy this October, now is the time to act. Write in to us at marketing@datamaticsbpm.com, and we will have our tax experts reach out to you with a solution perfectly tailored to keep you stress-free this tax season.

What should CPA firms prioritize for October 15 tax deadline preparation?

CPA firms should focus on updating tax software, organizing client records, training staff, and implementing efficient tax extension workflow management to avoid last-minute bottlenecks.

How can outsourcing help during the October 15th tax filing period?

Outsourcing for tax deadline tasks like return preparation, reconciliations, and quality checks reduces workload pressure, prevents staff burnout, and ensures accurate, timely filings.

Which tax and accounting tasks are best suited for outsourcing?

Functions such as data entry, bookkeeping, payroll processing, and tax return preparation are ideal for outsourcing. These repetitive yet time-intensive tasks free CPAs to focus on client strategy and deadline compliance.