We have just crossed into the second half of 2025, presenting US CPA firms with a perfect opportunity to reassess and realign their tax strategies. More often than not, mid-year tax planning, despite its critical nature, is overlooked in favour of other deliverables by a CPA firm. As we turn the calendar to July, proactive tax planning becomes essential for businesses and individuals looking to maximize savings, minimize liabilities, and ensure complete compliance with US tax laws. With 2025 witnessing significant legislative changes, there is a plethora of opportunities on offer for CPA firms in the tax advisory sector.

In our latest blog, we will take a closer look at some of the best mid-year tax planning strategies for CPA firms. We will also explore actionable insights for Q3 and share a concrete tax-planning checklist tailored for CPA firms for July 2025.

Mid-Year Tax Planning – Why Does It Matter for CPA Firms?

For CPA firms, the mid-year mark in the financial year signifies a crucial landmark as it presents them with an opportunity to assess the year-to-date financial landscape and make necessary adjustments that can significantly influence the year-end tax outcomes. By adopting a proactive approach, CPA firms help their clients avoid any possible last-minute surprises, optimize deductions and credits, and introduce tax-saving strategies that can make a significant difference when implemented early.

Key benefits include:

- Early identification of tax-saving opportunities

- Ability to adjust withholding or estimated tax payments

- Opportunity to address life or business changes (e.g., job changes, new investments, or business expansions)

- Enhanced client relationships through proactive advisory services

2025 Tax Strategy for Businesses: Key Updates

The 2025 tax season is being shaped by new and evolved tax rules, expanded credits, and ongoing legislative uncertainty. By staying on top of these changes, CPA firms gain the ability to offer effective tax planning to their clients.

- Corporate Tax Rate Adjustments: Potential changes to corporate tax rates and the phase-out of pandemic-era reliefs require vigilance.

- Expanded Tax Credits: The Inflation Reduction Act (IRA) continues to offer significant incentives, including Investment Tax Credits for renewable energy and the Advanced Manufacturing Credit. It is worth mentioning that these provisions might face some hindrance under the current administration.

- R&D Payroll Tax Credits: Businesses investing in innovation can benefit from expanded research and development credits.

As a CPA or a CPA firm owner, you must monitor these developments and recommend your clients on how to leverage new opportunities while mitigating risks.

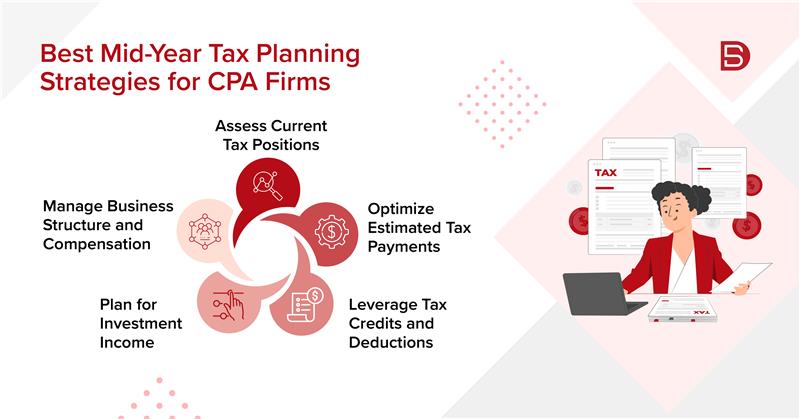

For the US CPA firms, mid-year tax planning for their clients is not only about staying compliant; it is all about adding value through strategic advisory. Here are some of the most effective strategies for CPA firms in 2025:

- Assess Current Tax Positions

As a CPA firm, you must review year-to-date income, deductions, and credits. It will help you identify any possible changes in client circumstances, which can have significant impact on the tax client liability. - Optimize Estimated Tax Payments

You must adjust any possible withholding or estimated payments based on the updated projections to avoid any possible underpayment penalties and boost cash flow. - Leverage Tax Credits and Deductions

You must identify and maximize available credits (e.g., R&D, clean energy) and deductions (e.g., business expenses, asset write-offs). - Plan for Investment Income: For the CPA firms you need to advise clients on strategies for managing capital gains, losses, and the Net Investment Income Tax (NIIT), including harvesting losses to offset gains.

- Manage Business Structure and Compensation

CPA firms must always consider changes to the existing business structure, retirement plans, or compensation strategies for optimizing tax outcomes.

For any mid-year tax strategy to work, effective deduction planning is key. Thus, as a CPA firm, you must guide your clients through:

- Accelerating or deferring expenses: Time deductible expenses to maximize tax benefits.

- Asset write-offs: You should also take advantage of extended or improved asset write-off incentives before they phase out.

- Employee benefits: You must review and optimize benefit plans, including health insurance and retirement contributions.

- Mileage and travel: You need to ensure proper documentation to maximize deductible mileage and travel expenses.

If you are planning your mid-year tax strategies, here is your guide to mid-year tax planning:

- Review year-to-date income and expenses

- Adjust estimated tax payments or withholding

- Maximize available tax credits (R&D, clean energy, etc.)

- Plan for deductible expenses and asset write-offs

- Evaluate retirement and health savings contributions

- Review payroll and compliance

- Update tax projections based on current data

- Communicate with clients about changes and opportunities

Many CPA firms face the conundrum of whether to outsource their mid-year tax planning. If you are in the same boat, let us tell you that mid-year tax planning can be effectively outsourced, especially the administrative and data-heavy components. The benefits of outsourcing mid-year tax planning include:

- Access to offshore professionals skilled in tax preparation and strategy

- More time for in-house teams to focus on advisory work

- Faster turnaround times

- Cost efficiency without compromising compliance

It is worth mentioning that outsourcing mid-year tax planning is particularly effective if you are looking to scale your operations without expanding your local teams.

It is worth mentioning that mid-year tax planning is not a checkpoint—it is a launchpad for U.S. CPA firms. Every year, July presents CPA firms with a critical opportunity to implement strategic tax planning, strengthen advisory positioning, and optimize client outcomes.

Focusing closely on mid-year tax planning allows CPA firms to unlock tax savings for their clients while future proofing their practices against seasonal slowdowns and margin pressures. If you are planning to outsource your mid-year tax planning to scale your operations, write to us at marketing@datamaticsbpm.com, and we will have, our tax experts reach out to you with an outsourcing strategy perfectly aligned with your business needs.

Why is mid-year a good time for tax planning?

Mid-year offers a clear view of YTD financials, allowing CPA firms to spot opportunities for deductions, adjust tax payments, and offer forward-looking advice while there’s still time to act before the fiscal year-end.

Can mid-year tax planning be outsourced?

Yes, mid-year tax planning tasks such as data collection, document review, and projections can be effectively outsourced. This allows CPA firms to focus on high-value strategic consulting while improving turnaround time.

How can CPA firms use mid-year reviews to increase client retention?

Mid-year reviews show proactive engagement, uncover new opportunities for tax savings, and open doors for broader financial discussions. This builds trust, enhances perceived value, and increases client retention through ongoing advisory support.