Introduction

Managing taxes can be a complex and time-consuming task for businesses, often taking attention away from growth. Tax preparation outsourcing provides a practical solution, allowing companies to focus on their core functions while experts handle the tax preparation.

With outsourced accounting services, businesses gain access to expert guidance without the expense of hiring a full-time team. This approach streamlines operations, reduces stress, and allows companies to focus on their core objectives.

In this blog, we’ll explore what tax preparation outsourcing is, its key benefits, and how businesses can implement outsourced accounting services effectively for smoother financial management.

Understanding Tax Preparation Outsourcing

1. What is Tax Preparation Outsourcing?

Tax preparation outsourcing is when businesses hire external experts to manage their tax-related tasks instead of handling them in-house. These experts can handle various activities, such as preparing tax returns, ensuring compliance, and providing financial advice. Outsourcing these tasks saves businesses time, reduces errors, and avoids penalties.

2. Benefits of Outsourced Accounting Services

The benefits of outsourced accounting services are numerous:

- Scalability: Businesses can easily adjust the level of service based on their needs, whether they require more support during tax season or year-round assistance.

- Timesaving: Businesses can focus on their core functions while experts handle tax and accounting tasks.

- Reduced Overheads: Outsourcing removes the need to hire a full-time in-house accounting team, significantly lowering operational and staffing costs.

- Expert Knowledge: Access to specialized tax and accounting professionals who stay updated on the latest regulations.

- Accuracy: Minimizes the risk of errors in tax filings, ensuring compliance and avoiding penalties.

3. Common Services Included

Outsourced accounting services often include tax preparation, financial reporting, payroll management, and audit support. These services ensure businesses maintain accurate financial records, file taxes on time, and comply with local and international tax laws.

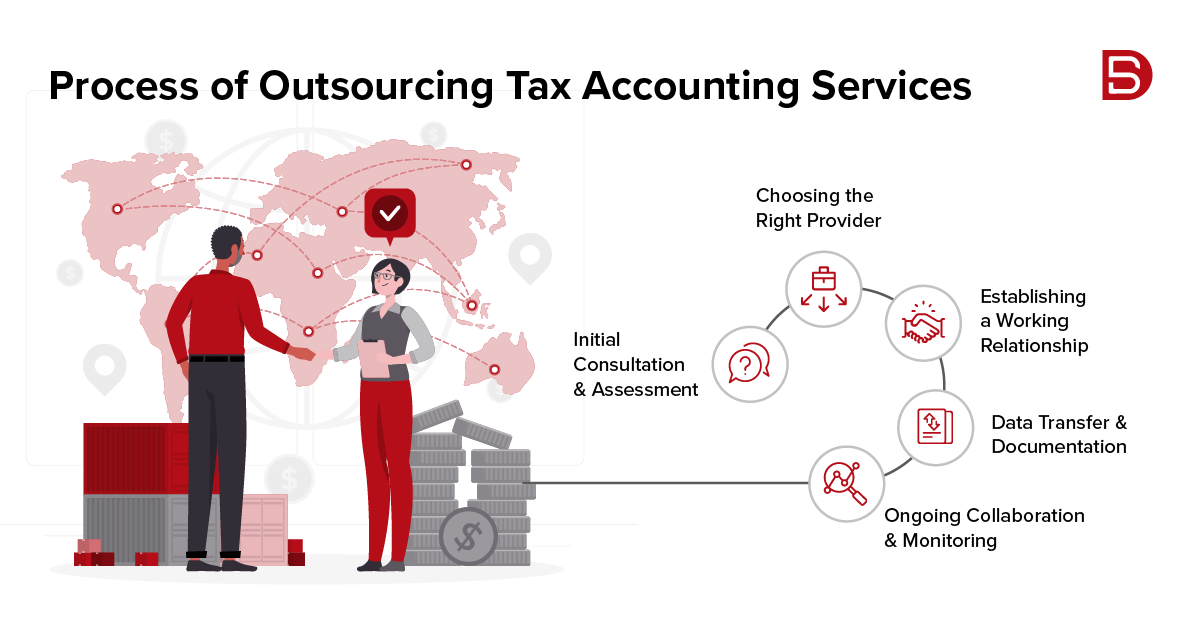

The Process of Outsourcing Tax Accounting Services

Outsourcing tax accounting services involves several steps to ensure the process runs smoothly and businesses receive accurate, timely support. Here’s an overview of the typical steps involved in outsourcing tax accounting:

1. Initial Consultation and Assessment

The first step is a consultation with the outsourcing firm to assess your business’s needs. During this stage, the tax service provider will learn about your business, its operations, and its current tax situation. This helps them understand the scope of work and determine the best approach for your company’s tax preparation.

2. Choosing the Right Provider

Selecting the right outsourcing provider is essential. Businesses should choose a provider with experience in their specific industry and a solid track record of managing tax-related tasks. They should also review their qualifications, reputation, and ability to meet deadlines.

3. Establishing a Working Relationship

Once a provider is selected, businesses will establish clear lines of communication and set expectations. This includes outlining deliverables, timelines, and the scope of services. Clear agreements and mutual understanding are key to a successful partnership.

4. Data Transfer and Documentation

To begin the process, businesses must transfer relevant tax documents and data to the outsourcing provider. This may include financial statements, past tax returns, and other important business records. Secure transfer methods must be used to protect sensitive information.

5. Ongoing Collaboration and Monitoring

The outsourcing provider will manage tax tasks as agreed upon. Businesses should maintain regular communication to monitor progress and address any concerns. This ongoing collaboration ensures that everything stays on track and tax filings are accurate and timely.

6. Review and Finalization

Businesses will review the work once the tax tasks are completed to ensure accuracy. After approval, the provider will finalize the tax documents and submit them to the necessary authorities.

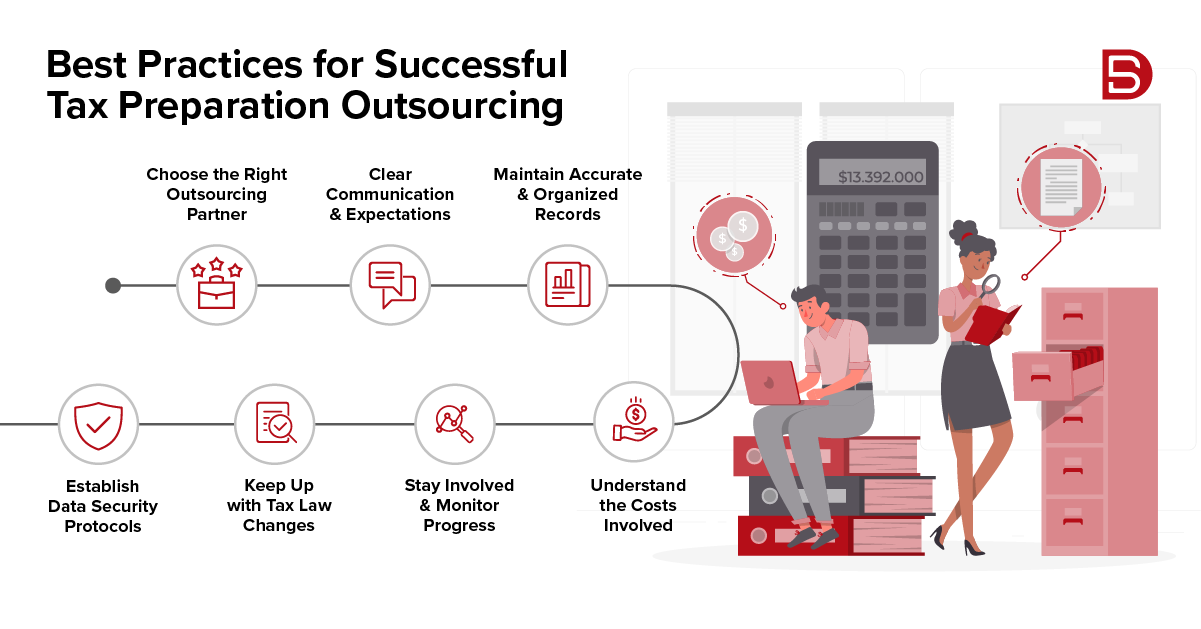

Best Practices for Successful Tax Preparation Outsourcing

Businesses must follow certain best practices to ensure a successful experience with tax preparation outsourcing. These practices help optimize the outsourcing process and ensure that both parties are satisfied with the results:

1. Choose the Right Outsourcing Partner

The most important decision when outsourcing tax accounting services is selecting the right partner. Look for a provider with a solid reputation, industry experience, and a proven track record in handling tax preparation and accounting tasks. Ensure they have the necessary expertise to meet your business’s specific needs.

2. Clear Communication and Expectations

Establish clear lines of communication from the start. Outline your expectations, project timelines, and deliverables. Regular check-ins and open communication throughout the process will help ensure that everything stays on track and any issues are addressed quickly.

3. Maintain Accurate and Organized Records

Ensure that your financial records and documents are accurate and well organized. This will help the outsourcing partner complete tasks efficiently and with fewer errors. Having clear and organized records also helps in case of audits or further clarification during the tax filing process.

4. Understand the Costs Involved

Before committing to an outsourcing arrangement, understand the costs involved. Some providers charge on an hourly basis, while others offer flat-rate fees. A clear understanding of pricing will help you avoid unexpected costs and ensure the arrangement fits your budget.

5. Stay Involved and Monitor Progress

Even though you are outsourcing tax tasks, it’s important to remain involved in the process. Monitor progress regularly, provide feedback, and address any concerns. This will help prevent mistakes and ensure your tax filings are completed accurately and on time.

6. Keep Up with Tax Law Changes

Outsourcing does not mean you can entirely disregard tax law changes. Stay updated on any significant changes that may affect your business. Your outsourcing provider should inform you of any changes, but staying informed is important to avoid last-minute surprises.

7. Establish Data Security Protocols

Since you’ll be sharing sensitive financial and tax information, ensuring that the outsourcing provider has strong data security protocols is crucial. They should also comply with data protection regulations to protect your information from breaches or theft.

Challenges and How to Overcome Them

While outsourced accounting services offer numerous benefits, businesses may face a few challenges. Awareness of these challenges and how to address them can help ensure a smooth and successful outsourcing experience. Here are a few typical challenges people face and some effective strategies to address them:

1. Communication Barriers

Communication issues between the business and the outsourcing provider can lead to misunderstandings, delays, and errors. Miscommunication may occur due to time zone differences, unclear expectations, or lack of regular updates.

How to Overcome It:

- Establish clear communication channels from the start.

- Establish consistent meetings or check-ins to review progress.

- Clearly define roles, expectations, and deadlines for both parties.

2. Data Security Concerns

Sharing sensitive financial information with an external partner raises data security and privacy concerns. Businesses worry about the risk of data breaches or unauthorized access to confidential data.

How to Overcome It:

- Choose a reliable outsourcing partner with strong data security measures in place.

- Make sure the provider adheres to applicable data protection laws (such as GDPR).

- Use secure file-sharing platforms and ensure all sensitive information is encrypted.

3. Quality and Accuracy of Work

Outsourcing tax accounting services requires trust in the provider’s ability to maintain high standards of accuracy and quality. There is a risk that the outsourced team may not fully understand your business’s unique financial situation.

How to Overcome It:

- Thoroughly vet potential outsourcing partners before making a decision.

- Make sure the provider has relevant experience working with businesses in your industry.

- Maintain an open line of communication to clarify any uncertainties or questions regarding your financial details.

4. Loss of Control

Some businesses may feel that outsourcing tax accounting services means losing control over their financial processes. This feeling can lead to hesitations and reluctance to embrace the outsourcing model fully.

How to Overcome It:

- Set clear guidelines and expectations to maintain control over key decisions.

- Work closely with the outsourcing provider to stay involved and informed about the processes.

- Use technology tools that allow you to monitor progress in real time.

5. Cost Concerns

Although outsourcing is often more cost-effective, there can be concerns about hidden fees or unexpected costs.

How to Overcome It:

- Have a detailed discussion with the outsourcing provider about pricing and ensure there are no hidden fees.

- Negotiate a fixed-price agreement, if possible, to avoid unexpected charges.

- Review the contract carefully before finalizing the agreement.

Conclusion

“Outsourcing tax accounting services can be a game-changer for businesses looking to streamline operations and enhance efficiency. By partnering with a trusted service provider, businesses can ensure their tax-related tasks are handled with expertise and precision.

If you’re ready to take the next step in outsourcing your tax preparation, Datamatics CPA offers comprehensive solutions to help your business stay on track with its financial goals. Their professional services give you the peace of mind to focus on growing your business while they handle the complexities of tax management.”

FAQs

How does outsourced accounting work?

Outsourced accounting involves hiring an external firm to manage your financial tasks, such as bookkeeping, payroll, and tax preparation. The outsourced team handles these tasks remotely, ensuring accuracy and compliance while you focus on your core business.

How much does it cost to outsource an accountant?

The cost of hiring an outsourced accountant can vary based on several factors, including the specific services required, the scale of your business, and the intricacy of your financial needs. Generally, outsourcing is more cost-effective than hiring a full-time in-house accountant, as you only pay for the services you need without the added expenses of salaries, benefits, and office space.

What are the 5 benefits of accounting outsourcing services?

Outsourcing accounting services offers several advantages for businesses, including:

- Cost savings

- Access to expert knowledge

- More time to focus on core activities

- Scalability

- Improved accuracy and compliance

What is the difference between tax preparation outsourcing and in-house accounting?

Tax preparation outsourcing involves hiring an external firm to handle tax-related tasks, while in-house accounting means having an internal team to manage these tasks. Outsourcing offers cost savings, access to specialized expertise, and more time for core business activities, whereas in-house accounting provides direct control but may involve higher costs and require dedicated resources.

What services are typically included in outsourced tax accounting?

Outsourced tax accounting services typically include:

- Tax preparation and filing

- Tax planning and strategy

- Bookkeeping and financial reporting

- Payroll processing

- Audit support

- Compliance with tax regulations