Table of Contents

Introduction

In today’s digitally-driven accounting and finance landscape, how CPAs innovate, operate, and serve their clients is undergoing a profound shift—largely fueled by the rise of digital transformation in accounting. While some traditional accounting and CPA practices of the old days are still rooted in scrupulous paperwork and manual processes, all of that is about to become a thing of the past.

With technological advancements gaining pace across industries, embracing digital transformation in accounting and finance is not only the need of the hour for CPAs and accounting firms but also an imperative strategy for survival and growth.

This blog will delve into the transformative journey of CPA and accounting firms while exploring some of the critical nuances of ‘Embracing Digital Transformation in Accounting and Finance.’ We will go through the intricate layers of this technological revolution individually as we decipher the technologies shaping this transformation while sharing some valuable insights to help firms embark on their digital transformation journey.

Defining Digital Transformation in Accounting and Finance for CPAs

Understanding the true definition of digital transformation in accounting and finance is pivotal for Certified Public Accountants (CPAs) looking to navigate the intricate landscape of modern finance. In simple terms, digital transformation in the context of accounting and finance can be defined as the immense integration of digital technologies into every aspect of a firm’s financial operation and management.

However, it is way more than the mere adoption of new software; digital transformation in accounting for CPAs is how a firm utilizes, processes, and analyzes its financial data.

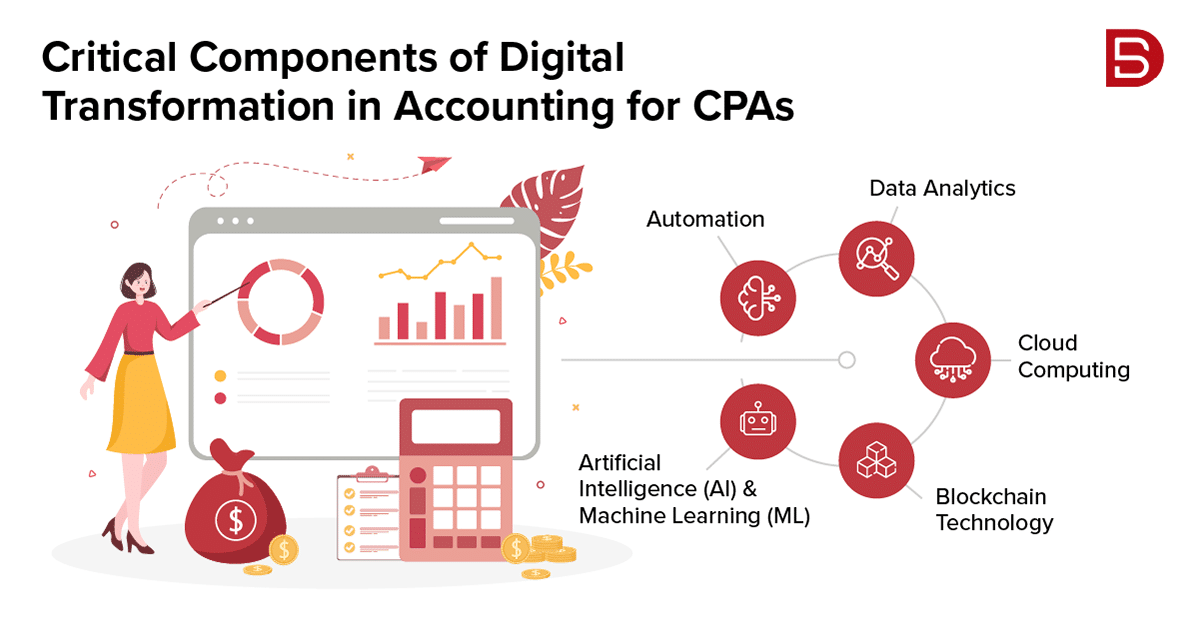

Critical Components of Digital Transformation in Accounting for CPAs

• Automation:

Digital transformation in accounting and finance begins by automating repetitive and time-consuming tasks such as reconciliation, data entry, and report generation. The use of automation for such studies not only minimizes the margin of error but also significantly boosts the financial data accuracy.

• Data Analytics:

Digital transformation empowers CPAs with advanced analytical tools, allowing them to quickly derive actionable insights by processing vast datasets. Using advanced data analytics tools, CPAs can promptly identify trends, anomalies, and patterns in financial data for strategic financial planning and informed decision-making.

• Cloud Computing:

The rise of Cloud-based accounting platforms enables real-time collaboration, allowing CPAs to access their financial data anywhere and anytime. Cloud computing also gives access to data at all times, which allows seamless collaboration between the teams and boosts overall productivity.

• Blockchain Technology:

The emergence of Blockchain has strengthened the security and integrity of financial transactions. Blockchain, with its decentralized ledger, prevents any fraudulent activities. CPAs can trace every transaction with complete security, transparency, and trust.

• Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML algorithms have allowed CPAs to process complex financial data with absolute ease. These algorithms also offer predictive capabilities to CPAs by enabling them to identify potential risks, forecast economic trends, and optimize financial strategies. As a whole, these technologies will allow them to add strategic value to their clients.

The Impact of Digital Transformation on CPA Practices

The influx of digital transformation in accounting and finance has transformed the role of traditional CPAs. Today’s CPAs are many more than number crunchers and are actively involved in strategic consulting for their clients. The rise in finance and accounting automation has allowed CPAs to focus on delivering value-added financial analysis and valuable insights to their clients instead of just overlooking the day-to-day activities.

Embracing digital transformation in accounting and finance requires CPAs to commit to a journey of lifelong learning and evolution. CPAs must stay abreast of emerging technologies and constantly update themselves with industry best practices, technologies, and cybersecurity protocols. As a CPA, you must invest in digital literacy to grow professionally and stay competent in the modern digital world.

For CPAs, digital transformation is the logical evolution in their professional world instead of the standard technological development. It enables CPAs to be proactive, agile, and strategic in their approach while significantly improving the quality of services in the digital age.

Ready to Grow Your Accounting Firm?

Discover proven strategies used by top CPA firms to scale faster. Grab your free copy of eBook and start unlocking growth today.

Future Trends in Digital Transformation in Accounting and Finance for CPAs

The modern Certified Public Accountants (CPAs) are at the forefront of the rapid digital evolution of the accounting and finance landscape. To stay ahead of the curve, CPAs must remain at the top of their game and capitalize on all the emerging trends in their space.

Here, we have listed some of the future trends in digital transformation that CPAs can anticipate:

• Advancements in Artificial Intelligence (AI) and Machine Learning (ML):

With the growth in computational power, AI and ML algorithms will become even more robust and sophisticated. This will allow them to carry on more complex and powerful tasks such as predictive analytics, anomaly detection, and data interpretation with greater ease. CPAs can also leverage AI-driven tools for accurate financial forecasting and risk assessment.

• Deeper Blockchain Integration

Advancement in Blockchain technology will be instrumental in ensuring the security and integrity of financial data. Using blockchain-based ledgers and smart contracts will allow CPAs to streamline transactions with minimum to no interference by intermediaries. CPAs will also be required to understand the implication of blockchain on taxation, auditing, and financial reporting to deliver reliable and accurate services.

• Advanced Data Analytics and Business Intelligence (BI):

With the growth in data analytics tools, modern businesses’ focus will shift more towards getting actionable business intelligence, as opposed to just data analysis. CPAs will also increase the use of advanced analytics tools for translating data into strategic client recommendations. While real-time analytics is already a reality in the current times, we will further see it become standard as we go forward.

• Cybersecurity and Data Privacy:

With the growth of Cloud-based accounting systems and digital transactions, CPAs will have to take additional safety measures to safeguard the sensitive financial information of their clients. CPAs will not only have to stay updated on the latest data privacy regulations and cybersecurity protocols but also will have to educate their teams on the same. Having robust cybersecurity measures will make CPAs more reliable and secure for their clients.

• Integration of the Internet of Things (IoT):

The increasing number of IoT devices will result in a vast amount of financial data generated by them. As a CPA, you must find ways to harness this data to gain insights into inventory management, consumer behavior, and operational efficiency. Understanding and analyzing the IoT-generated data will be valuable for the CPAs.

Conclusion

To conclude, the CPAs of this digital era are equipped with tools that can help them with a profound understanding of digital trends, enabling them with information and insights to innovate and adapt to change. If you want to transform your CPA firm to embrace these digital trends digitally, we have the solutions and resources to get you started. Just write to us at marketing@datamaticsbpm.com, and we will have our experts reach out to you with a solution to meet your needs.