Unpredictability – the only phenomenon that makes life as exciting as we find it to. At any given point not knowing what the future holds for us serves as a driving force for most human beings. It holds true in all walks of life; accounting is no different. Accounting, since its inception back in Ancient Mesopotamian days of around 4000 BCE to 20th century days of Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), has gone through a lot of transformation. Yet, it is tough to pinpoint the emerging accounting trends that will shape the future of accounting as we know it.

The emergence of new and advanced technologies certainly has changed accounting practice over time with old ways of doing things becoming obsolete and eventually extinct. For many accounting leaders, CPA business owners, and accounting function heads at large conglomerates the impact of automation, and the rise of high-tech systems will continue to dominate the accounting space for the foreseeable future.

A recent report by Sage suggests that “around 90% of accountants feel that accountancy is undergoing a cultural shift that is leaning more toward technology.” This cultural shift will be driven by several technological advancements and generational changes which will shape the future of accounting as a practice. In this blog, we take a closer look at the top 5 of the latest accounting trends that every accountant, CPAs, or accounting industry leader needs to watch out for.

Table of Contents

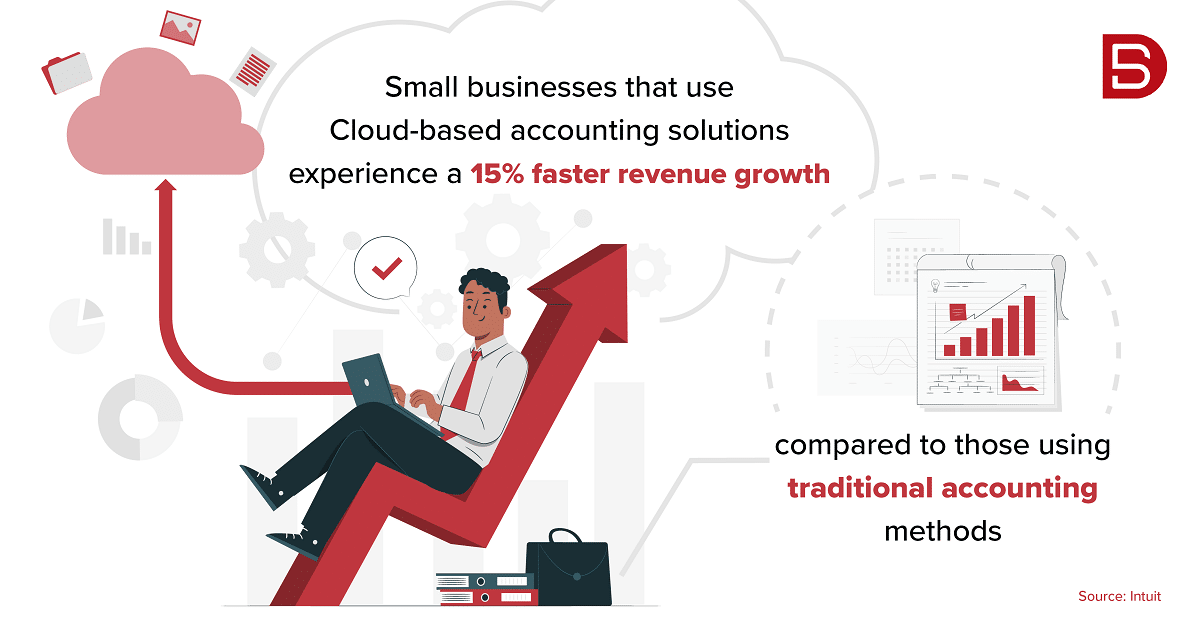

1. Cloud-Based Accounting to Become Norm

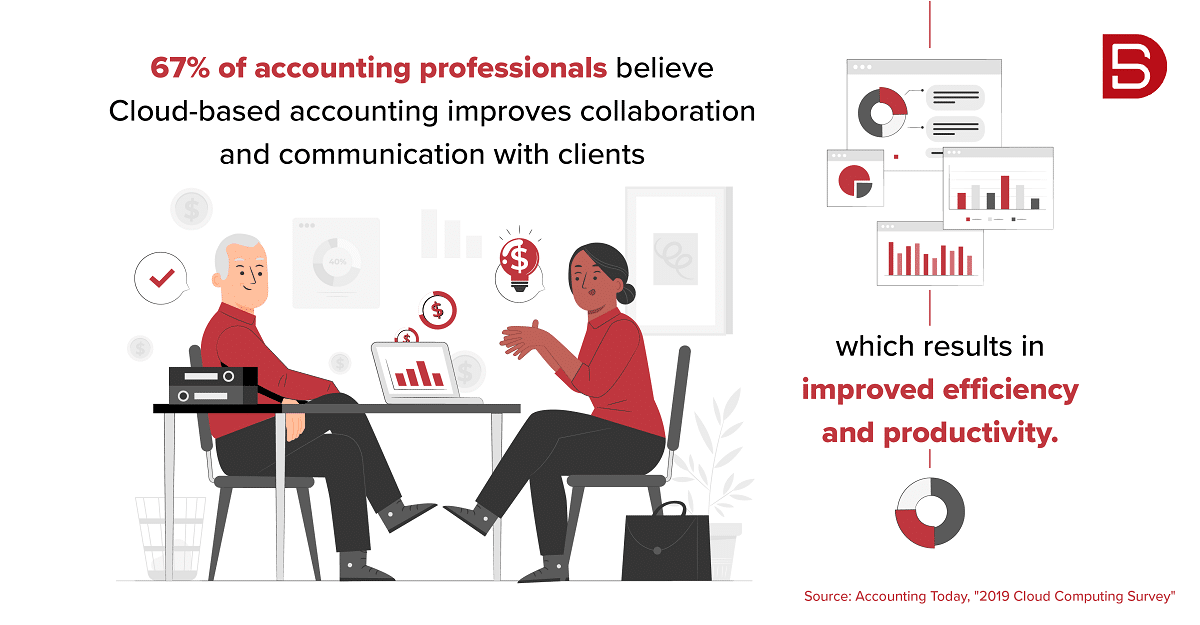

Almost every CPA or accounting function will admit to the fact that the introduction of Cloud-based accounting solutions has streamlined their work and made them even more productive. The ease of accessing digitally hosted accounting systems anytime, from anywhere, has made it easy for businesses to share, copy, or collaborate on files in real-time, boosting productivity.

However, real-time collaboration is not the only benefit that Cloud-based accounting has to offer. Some other notable features and functionalities include:

- Automatic Data Backup and Security: Cloud-based accounting tools automatically back up data to secure servers, ensuring increased data integrity and protection.

- Seamless Integration with Other Business Systems: Cloud-based accounting offers easy integration with other modern business systems such as payroll, CRM Customer Relationship Management), payment gateways, and inventory management.

- Scalability and Flexibility: Cloud-based accounting accommodates the needs of modern businesses by allowing them to scale up or down their operations as per their requirements.

- Automation for Increased Efficiency: Cloud-based accounting enables seamless automation of several financial processes such as billing, invoicing, and tax preparation and processing.

2. Increased use of Automation in Accounting

The use of automation will continue to grow in all walks of life, thanks to the emergence of tools like ChatGPT and BardAI. The need for faster and more accurate accounting computations will fuel the growth of automation in the field of accounting. CPAs who wish to streamline their accounting processes, automate mundane tasks, minimize errors, and save time and money can certainly do so by utilizing automation.

While automation will be instrumental in automating mundane and repetitive tasks, it will also be an incredible tool for handling customer service and streamlining operations. Many CPAs are already harnessing the power of automation to enhance their customer service and improve the efficiency of various processes.

3. Data Analytics and Forecasting Tools

CPA firms have been using data and analytics to make smart business decisions for years now. However, with the significant advancements in data analytics and forecasting technologies, the use of these tools is more prevalent than ever.

CPAs are leveraging user data to derive insights on potential customers, markets, and competitors, among others. All this data is crucial for businesses to operate efficiently. The increasing utilization of data analytics and forecasting tools also necessitates accountants with strong data analytical skills. As a result, a majority of CPA firms are turning to accounting, bookkeeping, and tax preparation outsourcing service providers. The smart utilization of big data analytics will enable CPAs to predict upcoming trends, mitigate risks, and make informed business decisions accordingly.

4. Outsourcing Accounting, Bookkeeping, and Tax Functions

Outsourcing has emerged as a potent business move for CPAs and accounting functions in large enterprises. Outsourcing accounting, bookkeeping, and tax functions offers a myriad of benefits, including access to a rich talent pool, global accounting expertise, and significant cost savings. These advantages make it a highly profitable, cost-efficient, and smart decision that allows business owners to focus on growing their business instead of handling day-to-day operations.

With the growing culture of remote working and incredible advancements in collaboration tools, cloud technology, and data protection tools, we will continue to witness the rise of outsourcing accounting, bookkeeping, and tax functions among the CPA fraternity.

5. Agile Accounting

The recent geopolitical and social turmoil across the globe has required businesses to adopt an agile approach to conducting their operations. Accounting is no different. Agile accounting involves adapting to the latest market trends, allowing businesses to evolve with changing market conditions and gain a competitive edge.

The key to success in the modern market lies in staying updated with the latest trends. If you are looking to embrace agile technology for your business, you can do so by:

- Setting goals for your organization and working accordingly

- Effectively managing your time and reacting quickly to changes

- Asking your teams to work in short sprints

- Analyzing the success and failure of each sprint

- Harnessing the power of advanced trends and technologies

- Utilizing technologies like Cloud and data analytics for insight-driven and flexible operations

Conclusion

The advancement in technology is transforming every business it touches, evolving them into more efficient, secure, and intelligent entities. The world of accounting is no different. We have already seen CPA firms leveraging technology to automate their everyday tasks for increased productivity.

However, with the evolution of AI and ML, we can expect them to further transform their businesses and boost overall operational efficiency. This transformation not only helps them increase revenues with minimum hassle but also enables cost savings and enhances team efficiency.

However, not all CPA firms are equally adept at technology. If you are one of those struggling to leverage the technological advancements happening around you, consider partnering with an outsourced accounting service provider to help you implement technology in your business. We have a team of accounting, bookkeeping, and tax preparation experts who are proficient in both technology and accounting. We can tailor a solution that perfectly matches your requirements and get you started. Just write to us at marketing@datamaticsbpm.com, and we will assist you in getting started.