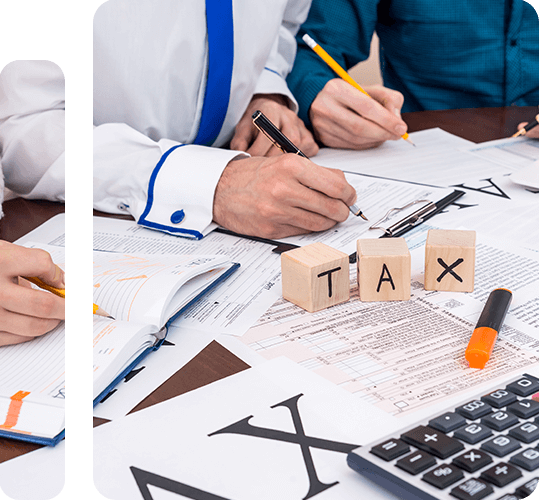

HMRC-Compliant Personal Tax Return Services for UK Accounting Firms

Self-Assessment Tax Outsourcing UK

for Accountants

According to the latest HMRC data, nearly 12 million individuals are expected to file self-assessment returns annually, with over 1.1 million people missing the January 2024 deadline. With growing complexities in the personal tax filing regulations, combined with increasing penalties for delays and errors, UK accountants and accountancy firms often find themselves under enormous pressure. If you have experienced the same, we have some good news for you.

Our self-assessment tax return outsourcing services in the UK offer accountants and accountancy firms HMRC-compliant, efficient, and cost-effective support. We help our clients navigate busy seasonal demand, meet strict deadlines, and maintain the highest level of client satisfaction. With our outsourced self-assessment tax services in the UK, you can scale seamlessly while ensuring accuracy and compliance.

If staffing shortages, last-minute client submissions, or staying on top of HMRC self-assessment changes are obstructing your firm’s growth, our self-assessment tax preparation outsourcing UK solution can deliver the expertise and reliability you need.

Client testimonials.

Usually our work speaks for itself. At times, our delighted customers say a few nice things about our teams & their work.

Play Video

Play Video

Director, Lince Salisbury Ltd.

CPA Firm from Ohio

CPA Firm in Boston

Leading CPA firm based in Florida

US Based CPA Firm

US-based CPA Firm

Book a Complimentary Call

Our UK Self-Assessment Tax Outsourcing Services.

We specialize in tax return outsourcing for UK accountants, supporting practices of all sizes from local accountancy firms in Birmingham and Manchester to national firms in London and Edinburgh.

Personal Tax Return Preparation & Filing

We offer accurate and timely SA100 filing and related schedules for individuals, directors, property owners, and high-net-worth clients.

HMRC-Compliant Review & Quality Assurance

We thoroughly review every return, ensuring complete documentation, audit trails, and compliance with HMRC’s latest guidelines.

Allowances, Reliefs & Tax Planning

We maximize personal allowances, dividend relief, property-related reliefs, and other tax-saving opportunities, minimizing liability while ensuring compliance.

Data Management & Secure Exchange

We adhere to global data security and information privacy via encrypted portals. We integrate seamlessly with leading cloud accounting platforms, aligning with Making Tax Digital (MTD) and UK data protection laws.

Ongoing Updates & Advisory Support

We stay on top of every HMRC update on tax thresholds, deadlines, and compliance shifts, ensuring your firm and your clients stay ahead.

Why Accountants Choose Datamatics’

HMRC Self-Assessment Outsourcing?

Cost Efficiency & Flexibility

We help you scale through busy tax season without increasing your overhead costs by hiring permanent staff and paying only for what you use.

Access to Specialist Expertise

With our personal tax return outsourcing services for UK accounting firms, we ensure that returns are error-free and HMRC-compliant.

Deadline Compliance

We stay on top of every HMRC update, ensuring that you never miss any HMRC filing dates.

Time Savings & Client Growth

While our experts handle your outsourced individual tax returns in the UK, your team can focus on high-value advisory services and client relationship management.

Reduced Risk

How does Datamatics’ Self-Assessment Outsourcing Work.

Onboarding & Needs Assessment

Data Collection & Documentation

Tax Return Preparation

Review & Client Sign-off

Ongoing Support

The Datamatics advantage.

We specialise in UK corporate tax compliance outsourcing tailored for accountancy firms of all sizes, from boutique practices in Manchester to national firms in London.

Experience

CPA Talk Series.

CPA Talk Series features accounting leaders navigating rapid change—AI, regulations, talent shifts, and global volatility. Here we unpack real challenges, share bold ideas, and spark fresh thinking to fuel sharper decisions, stronger teams, and future-ready finance.

Insights from the CA World.

Get the latest and hottest takes, trends, and insights on the topics relevant to CAs.

Frequently asked questions.

Can UK accountants legally outsource self-assessment tax returns?

Yes. The accountant retains ultimate responsibility, but outsourcing to an HMRC-compliant provider is fully permissible.

How do you ensure GDPR and HMRC compliance?

We use encrypted portals, NDAs, and GDPR-compliant systems. All processes align with HMRC-approved standards.

Will turnaround times meet HMRC’s January deadlines?

Yes. We work to your schedules and HMRC filing deadlines, ensuring no client misses submission.

Outsource Corporate Tax Preparation in the USA.

If your CPA firm wants to reduce workload during busy season, improve accuracy, and deliver more value to clients, our outsourced corporate tax services USA are the answer.