Every year, UK accountancy firms find themselves drowning in tax returns, their teams stretched thin, and constantly battling looming client deadlines. If you’ve experienced it too, let us tell you that it doesn’t have to be this way. Thousands of UK accountancy firms are exploring accounting outsourcing to India as an alternative to overcome all these challenges. Gone are the days when outsourcing was solely about cost-cutting; for modern accountancy firms, outsourcing is a strategic move that transforms the way they operate.

According to Deloitte’s Global Outsourcing Survey, 70% of businesses cite cost reduction as a primary driver for outsourcing, but 40% also point to enhanced operational efficiency. For UK CA firms specifically, India is soon becoming the destination of choice, handling everything from bookkeeping to complex tax compliance. Outsourcing your repetitive accounting tasks enables you to focus on what matters most: building client relationships and growing your practice.

In this blog, we explore why accounting outsourcing to India has become the secret weapon for forward-thinking UK firms, and how you can leverage it to transform your practice from overwhelmed to optimized.

What Makes UK Accounting Outsourcing to India So Attractive?

For the UK accountancy firms, the lure of accounting outsourcing goes far beyond simple cost savings. Outsourcing your repetitive accounting and bookkeeping tasks to an offshore location, such as India, allows you to tap into a rich pool of accounting talent, along with technical expertise, cultural compatibility, time zone advantages, and proven reliability. Indian accounting outsourcing services providers have skilled professionals who are trained in UK GAAP, IFRS, and understand the nuances of HMRC regulations better than you might expect.

According to ICAI, India produces over 1.5 million commerce graduates annually, with approximately 400,000 qualified chartered accountants, which translates to a deep talent pool specifically educated in international accounting standards. Outsourcing to India provides access to highly trained professionals who often hold multiple certifications, including ACCA, ACA, and CIMA.

Furthermore, a significant competitive advantage comes in the form of a time zone difference. When your team logs off at 6 PM, your offshore team in India seamlessly takes over the work. By morning, the large pile of VAT returns that you were dreading gets completed, reviewed, and ready for your final sign-off. It’s like having a 24-hour operation without incurring the costs of night shifts.

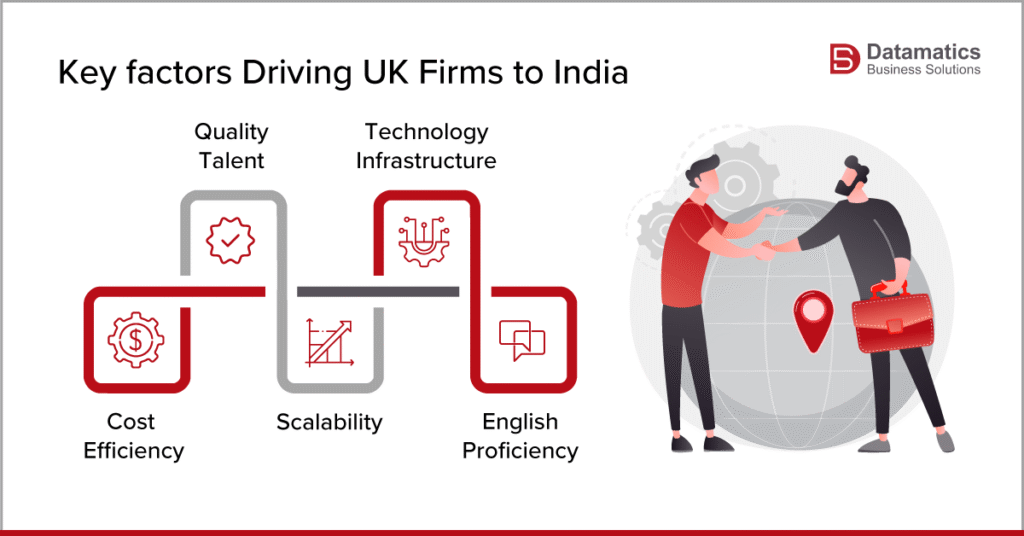

Key factors Driving UK Firms to India:

- Cost Efficiency: ~50-70% savings on operational costs compared to UK-based staff

- Quality Talent: Access to ACCA and ICAEW-qualified professionals

- Scalability: Ability to scale your operations up or down without hiring headaches

- Technology Infrastructure: Advanced cloud-based systems and data security protocols

- English Proficiency: Seamless communication with no language barriers

Outsourcing to India offers UK accountancy firms a unique blend of qualified talent, cost savings, and operational flexibility, which is hard to match elsewhere. You don’t just outsource your accounting and bookkeeping tasks; you build a strategic extension of your firm.

Nothing matters more to accountants than numbers. So let’s talk numbers. Hiring a skilled accounting professional in the UK can cost an average annual salary of £35,000-£45,000. Add to that the employer National Insurance contributions (13.8%), pension contributions (minimum 3%), recruitment costs, training, office space, equipment, and benefits, and your actual cost per employee easily exceeds £50,000 annually.

Now compare that to UK accounting outsourcing rates to India. A qualified accounting professional in India with the same credentials and experience can cost you approximately £8,000-£15,000 per year, depending on expertise level and service provider. With that, you already are saving around 60-70% without compromising on quality. For a team of 5 accountants, the total annual savings come to around £150,000-£200,000. All this money can easily be directed towards technology, marketing, or client acquisition.

Furthermore, the savings are not limited to salaries only. By outsourcing to India, you also save recruitment costs, which can range between £3,000 and £5,000 per hire, onboarding expenses, turnover costs, and the hidden expenses of managing office space and equipment. According to Clutch’s 2023 Outsourcing Statistics, 24% of small businesses outsource to improve efficiency, while 18% do so to address capacity issues without expanding their physical infrastructure.

Cost Comparison: UK-Based vs. India-Based Accounting Team

| Cost Factor | UK-Based Accountant (Annual) | India-Based Accountant (Annual) | Your Savings |

|---|---|---|---|

| Base Salary | £40,000 | £12,000 | £28,000 |

| Employer NI Contributions | £5,520 | £0 | £5,520 |

| Pension Contributions | £1,200 | £0 | £1,200 |

| Office Space & Equipment | £4,000 | £0 | £4,000 |

| Recruitment & Training | £3,000 | £500 | £2,500 |

| Total Cost | £53,720 | £12,500 | £41,220 |

| Cost Savings | 77% | ||

UK accounting outsourcing helps CA firms save up to 60-77% in comparison to maintaining an equivalent UK-based team, freeing up capital for strategic investments that drive growth rather than just maintaining operations.

The biggest concern surrounding outsourcing accounting tasks is the quality of the outcome. It is also one of the biggest reasons why UK CA firms hesitate to outsource. The reality, though, is that accounting outsourcing to India actually enhances the quality of your deliverables, not diminishes them.

The Indian accounting talent undergoes severe training and certification processes, making them fully capable of handling your outsourcing tasks. The Institute of Chartered Accountants of India (ICAI) maintains strict standards, with passing rates hovering around 5-10% for final exams, comparable to those in the UK. Many Indian accountants also pursue international certifications, such as ACCA, which enables them to fully understand the UK regulatory frameworks and global best practices.

The improvement in quality comes from specialization. By outsourcing routine compliance work, payroll processing, and bookkeeping to dedicated teams in India, these accounting professionals become specialists in their specific domains. These individuals do not juggle multiple tasks simultaneously; they focus solely on the tasks assigned to them. This focused expertise naturally leads to fewer errors, faster turnaround times, and more consistent output.

Additionally, reputable outsourcing service providers employ multi-tier quality control systems. As a result, each of your accounting tasks goes through preparers, reviewers, and quality controllers before reaching your desk. According to Deloitte’s research, 31% of businesses that outsource cite access to talent and intellectual capital as a key reason for outsourcing, recognizing that external teams often bring specialized expertise that’s difficult to maintain in-house.

Quality Assurance Mechanisms in Professional Outsourcing:

- Three-tier review process (Preparer → Reviewer → Quality Controller)

- Regular training on UK tax law updates and regulatory changes

- Standardized templates and processes aligned with UK practice standards

- Real-time collaboration tools for immediate clarification and feedback

- Annual competency assessments and performance metrics

By outsourcing, you do not actually make a compromise on quality, but enhance the overall outcomes by having specialized talent, structured review processes, and dedicated focus that your stretched UK team simply can’t maintain during peak seasons.

If you are new to outsourcing, we recommend starting with transactional and compliance tasks. Once you get comfortable with outsourcing, you can move higher up the value chain. The most commonly outsourced tasks by UK CA firms include:

- Bookkeeping & ledger maintenance

- VAT, payroll processing, and statutory filings

- Management accounts preparation

- Accounts production for small/medium clients

- Transaction processing, bank reconciliations

For UK CA firms, starting their outsourcing journey with repeatable, rule-based tasks for building trust is a smart move. Once you have established the necessary level of comfort and trust, you can move to more complex work as controls and skill sets prove out.

Modern outsourcing service providers in India complement their incredible accounting talent with state-of-the-art automation, RPA, and AI tools. It helps them not only lower labour costs but also make their teams incredibly productive and future-ready. The blend of skilled accounting talent and an advanced technology ecosystem is why so many CA firms in UA are investing in delivery centres in India. It allows them to centralise both human skills and automation capabilities to scale more quickly.

What this means for CA Firms in the UK:

- Quicker deployment of automation across client workflows.

- Lower cost per file with incremental tech uplift.

- Access to data analytics and standardised reporting templates.

By building your offshore delivery centres in India, you can achieve operational resilience and predictable quality, leveraging an advanced technology ecosystem and skilled human talent.

If you are looking to improve your profit margins, reduce partner stress, and end staff-burnout, UK accounting outsourcing to India is practical and proven way to do so. You can start by running a FREE PILOT with us, define clear KPIs, and meet the UK rules and client expectations.

Want a one-page checklist and a sample 90-day pilot plan tailored to your firm? Write in to us at marketing@datamaticsbpm.com and we will draft a ready-to-use playbook you can implement this quarter.

Will outsourcing to India risk client confidentiality?

Not if you set up robust NDAs, data encryption, role-based access and regular compliance audits. Reputable providers run ISO-grade security and regular audits.

How fast will I see ROI from outsourcing?

Many firms report measurable cost and time savings within 3–6 months of a successful pilot, depending on scope and transition effort.

Can I retain client-facing roles in the UK while offshore doing the work?

Absolutely. Hybrid model is the most common: UK partners focus on client relationships and advisory; offshore teams handle delivery.