The traditional image of the accountant, hunched over ledgers, is rapidly becoming a relic of the past. The UK accounting industry has reached £39.8 billion in revenue as of 2025, growing at 5.8% annually. Yet, the UK accounting space is in perpetual state of unrest, thanks to the ever-evolving customer demands and the stringent regulatory requirements. Needless to say that staying ahead of the cure is not only a goal for the accountancy firms, it is a necessity. As we hurtle towards 2026, the uncertainties over the future of accountancy continues to grow. Moreover, after spending five decades in the accounting space, we can with certain degree of conviction say that the future of accounting is full of unprecedented opportunities, along with significant challenges. While the obvious route seems to be the one of technology adoption, leveraging AI, automation, and new software; but in order to succeed in the accounting world of tomorrow, as an accountancy firm you need to fundamentally rethink how you operate, serve your clients, and attract top talent.

So, are you ready to embrace the transformation?

The Future of Accountancy is Already Here

While most UK accountancy firms are successfully keeping their heads above water with compliance, audits, and tax changes, the overall shape of their practices is about to change in 2026. The forces transforming the future of the accountancy profession in the UK include:

- The Scale of the Profession: The UK accountancy sector, including accountants across business, contributed nearly £98 billion to UK and Irish GDP in 2022, supporting nearly ~911,800 jobs. (Source: ICAEW)

- The Optimism of Firms: According to a 2025 Xero survey, 77% of UK accountancy practices were optimistic about their outlook, with nearly 79% reporting an increase in revenue and ~74% reporting a profit uplift. (Source: Accountancy Today)

- The Rapid Technology Adoption: Nearly 91% of UK accountants are already embracing AI as part of their everyday operations, or at least planning to do so. (Source: Wolters Kluwer)

The aforementioned indicators make it clear that the future of accountancy firms is already shaping up. Ignoring these parameters can put your firm behind while peers surge ahead. As an accountancy firm owner, you need to understand that your business model needs to evolve because your clients’ expectations certainly are evolving.

Artificial intelligence and the future of accountancy are now inseparable. With the tremendous development in the AI space, it is safe to say that AI is fast becoming essential infrastructure for UK accounting firms.

According to stats from accountingweb, nearly 30% of UK firms are already using AI, with another 23% intending to implement it by the end of 2025. Furthermore, nearly 36% of accountants are using AI weekly, and 24% use it daily. The growing use of AI in the accounting space is becoming more common than anyone anticipated.

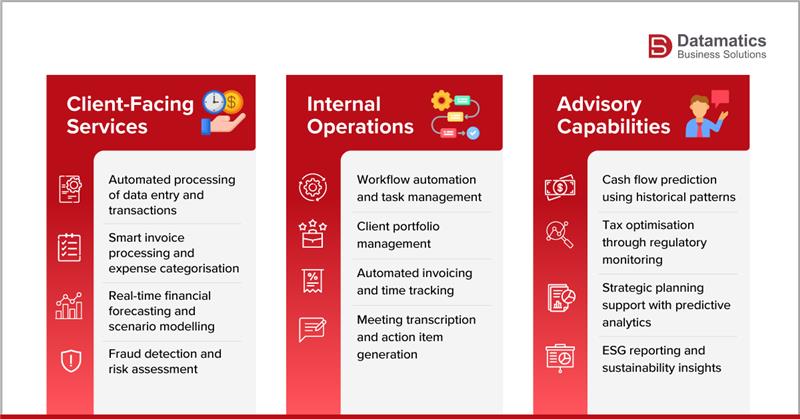

The AI applications in the UK accountancy space span across three main categories:

- Automated processing of data entry and transactions

- Smart invoice processing and expense categorisation

- Real-time financial forecasting and scenario modelling

- Fraud detection and risk assessment

- Workflow automation and task management

- Client portfolio management

- Automated invoicing and time tracking

- Meeting transcription and action item generation

- Cash flow prediction using historical patterns

- Tax optimisation through regulatory monitoring

- Strategic planning support with predictive analytics

- ESG reporting and sustainability insights

The economic impact of AI is significant. According to silverfin, AI can contribute as much as £2 billion to UK GDP through accounting sector efficiencies alone. Furthermore, the AI accounting landscape is expected to grow up to £37.6 billion by 2030, at a staggering 41% compound annual growth rate from £6.68 billion in 2025.

Most importantly, nearly 93% of professionals now use AI to deliver higher-value strategic business advisory services. This monumental shift away from compliance to advisory work in the accounting landscape represents the most significant transformation in the profession’s modern history.

However, challenges still mar the widespread adoption of AI in the accounting space. The most noteworthy challenges include:

- Data Quality: ~46% of UK accountants cite data quality concerns in Europe

- Privacy Concerns: ~41% cite privacy concerns

- Talent Shortage: ~41% cite lack of skilled talent

Overcoming these challenges will require significant investment in training, data governance frameworks, and change management.

Although not as prevalent as AI or cloud accounting, blockchain still has significant potential to transform the future of accountancy. With its transparent and unassailable ledger system, blockchain technology offers unmatched security and integrity for financial transactions. It can significantly revolutionize auditing, supply chain finance, and even compliance.

With its distributed ledger, blockchain technology makes fraud virtually impossible, with every transaction getting recorded. As a result, you get significantly straightforward audits. While the widespread adoption of blockchain is still in its infancy, understanding its application potential and implications makes it a critical aspect of preparing for the future of accountancy. Blockchain offers incredible security, transparency, and efficiency in financial transactions, making it one of the most promising areas for the future of accountancy.

In-House vs. Outsourcing: The Modern Shift

For UK accountancy firms open to adapting and innovating, the future of accountancy is bright. The UK accountancy landscape in 2026 will be dominated by a strong advisory focus, technological prowess, and a commitment to digital excellence. By harnessing the power of automation, cloud solutions, artificial intelligence, and strategic outsourcing, UK accountancy firms can not only overcome the challenges of the profession but can also unlock new avenues for growth and client satisfaction.

Don’t just observe the changes; lead them. And if you are ready to prepare your firm for the future? Contact us today at marketing@datamaticsbpm.com for a consultation on leveraging emerging technologies and strategies to thrive in the evolving accountancy landscape.

Is accounting going to be replaced by AI?

No. But the nature of accounting work will change significantly. While routine tasks (data entry, reconciliations, basic bookkeeping) are increasingly automated, the value-adding work of interpreting numbers, advising clients and guiding business strategy will remain in the human domain.

Is accounting a growing or dying field?

It’s growing, but the type of accounting work that grows is different. The profession made a £98 billion contribution to UK and Irish GDP in 2022 and supported over 900,000 jobs. The growth is in advisory, tech-enabled services, value-creation rather than pure compliance. So if a firm remains stuck in the old model, it may stagnate — but firms that evolve will thrive.

What are the challenges and future trends in UK accountancy?

Challenges include the skills gap (finding staff with tech + advisory expertise), data quality/integration, managing tech change, regulatory complexity (AI governance, blockchain), and shifting client expectations. Future trends: more advisory services, pervasive automation, hybrid outsourced/in-house models, embedded tech (AI + blockchain), real-time insights for clients and a rise in specialisms (e.g., digital assets, ESG reporting).