The UK accounting and taxation landscape is undergoing a digital transformation, fundamentally changing how CA firms and businesses operate. The expansion of Making Tax Digital across income streams has put businesses and CA firms under severe stress with tighter deadlines, complex software integrations, and clients demanding seamless compliance support. The question now is not whether MTD will impact your business; it’s how you will manage your workload without burning out your team or compromising service quality. In such a time, outsourcing is fast gaining popularity among forward-thinking CA firms as a strategic solution. Outsourcing is not about cutting corners during such times; it is about leveraging specialized expertise to handle routine compliance tasks while your qualified staff focus on advisory services that actually grow your firm. In this blog, we take a closer look at how making tax digital accountants are transforming their practices through intelligent outsourcing partnerships.

Why Are Making Tax Digital Accountants Turning to Outsourcing?

You probably have already experienced the shift. The client’s demands have grown significantly in recent times. However, the capacity of your team to fulfill those demands has remained the same or, worse yet, decreased. According to ICAEW research, nearly 68% of accountancy firms in the UK have reported an increase in compliance workloads since the mainstream implementation of MTD for VAT began, with the average practice spending an additional 3-5 hours per client quarterly.

We can already see the in-house teams drowning in quarterly submissions, with advisory work taking a back seat. The cost of training to make tax digital software for accountants has also grown, with AAT estimates suggesting that CPA firms spend £2,400-£4,800 annually per staff member on MTD-related training. Furthermore, recruitment challenges persist, with AccountingWEB reporting that 73% of practices struggle to fill technical positions.

By partnering with outsourcing firms, UK accountancy practices are gaining the ability to address these pain points directly. By partnering with a team of specialized tax preparation experts who are already well-versed in MTD accounting protocols, accountancy firms can significantly reduce their overhead costs. These outsourcing partners already have a rich ecosystem of enterprise-grade software platforms and quality control systems, which otherwise would cost you heavily to build for your practice. Most importantly, they offer you instant access to expert accounting and taxation talent, which helps you scale your practice as and when needed.

Key Takeaway: Outsourcing transforms fixed compliance costs into variable expenses while accessing specialized MTD expertise without recruitment headaches or training investments.

MTD is HMRC’s ambitious move to digitize the UK tax system. The move aims to fundamentally transform how accountancy firms prepare and submit client returns. With the Making Tax Digital initiative, HMRC has mandated digital record-keeping and quarterly reporting through MTD-compatible software, thereby completely eradicating paper-based processes and manual data entry, which defined traditional tax administration.

For accountancy practices, making tax digital will introduce several operational shifts. The first, and perhaps the most significant, will be that you will now be required to maintain client records fully digitally through MTD-approved software platforms. It means that in addition to being an accounting specialist, you will have to be part technology consultant and part compliance advisor. Another significant change will be quarterly tax submissions rather than annual returns for several tax types, multiplying touchpoints with each client by 4. And another big change will be that you will have to verify that all software bridges between client systems and HMRC function correctly, which might require you to add technical troubleshooting to your service portfolio.

While HMRC intends to fully transform the UK taxation landscape, the rollout of MTD will be phased, further complicating the matter. MTD for VAT became mandatory in April 2019 for VAT-registered businesses above the threshold. According to HMRC statistics as of March 2024, over 1.6 million businesses have enrolled in MTD for VAT. For Income Tax Self Assessment, MTD will be launched in April 2026 for sole traders and landlords with annual business or property income above £50,000, with the threshold dropping to £30,000 in April 2027. The phased rollout of MTD means accountancy firms will now be required to manage clients across multiple MTD stages simultaneously.

Key Takeaway:

MTD transforms accountants from annual tax return preparers into quarterly compliance managers and technology advisors, requiring new skills and significantly increased client interaction frequency.

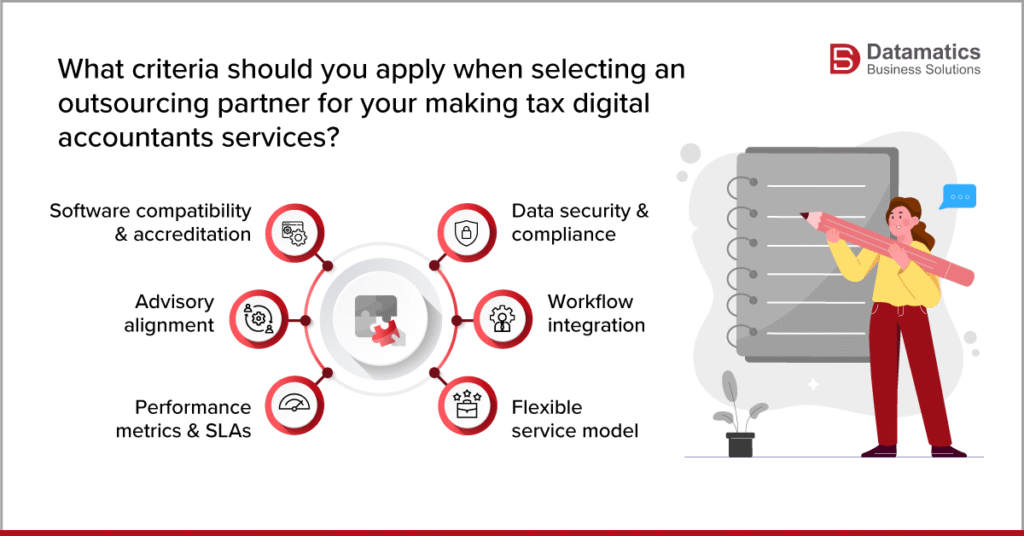

While outsourcing might seem like a straightforward decision to overcome the MTD challenges, identifying and choosing the right partner is critical. Here are some key considerations that you need to take into account when looking for the ideal partner for your MTD outsourcing requirements:

- Software compatibility & accreditation: The outsourcing tax preparation service provider must support a fully HMRC-approved MTD-compatible software environment.

- Data security & compliance: As outsourcing will require you to share your clients’ sensitive financial data, you must ensure that your outsourcing service provider has the necessary data governance and appropriate certifications (e.g., ISO 27001).

- Workflow integration: The outsourcing provider must seamlessly integrate with your internal systems (CRM/Practice Management) and allow you visibility.

- Flexible service model: They must offer scalability as your firm grows or when the MTD thresholds change.

- Performance metrics & SLAs: They must deliver quick turnaround times for quarterly submissions, significantly lower error rates, and a client escalation process.

- Advisory alignment: The outsourcing service provider must enable you to deliver advisory services and must not compete with you.

Key takeaway: Picking the right MTD outsourcing partner is critical for you to maintain client trust, efficiency, and profitability.

As an accountancy firm in the UK, if you intend to lead the market, you need to position your firm around making tax digital accountants, not just as a compliance partner but as a digital-forward adviser. By leveraging outsourcing for the heavy lifting of MTD compliance tasks such as software setup, quarterly submissions, and record-keeping workflows you will retain and grow your client relationship edge, future-proof your firm, and gain a significant competitive advantage.

Ready to transform your accountancy firm? Write in to us at marketing@datamaticsbpm.com to find out how our outsourcing services can help you deliver compliance, efficiency, and strategic value to your clients, without burning out your team. Let’s talk about how we can outsource the back-office legwork together while you elevate your firm.

What making tax digital means for accountants?

For the accountants making tax digital means guiding, supporting, and implementing a strategic shift for your firms’ traditional, year-end tax filing to continuous digital reporting. It will require using HMRC-approved software to help your clients maintain digital records and submit quarterly updates.

How will making tax digital affect accountants?

While making tax digital will through some challenges at accountants in terms of software change-over, educating the clients, and changed workflows, there will be ample opportunities too for stronger client relationships, increased service-touchpoints, and higher-value advisory.

What does ‘MTD’ mean?

For UK accountancy firms, MTD stands for “Making Tax Digital,” an initiative by HMRC to move tax reporting and record-keeping into a digital, software-driven environment. https://en.wikipedia.org/wiki/Making_Tax_Digital?

What clients are in scope for MTD for Income Tax and when?

Clients who are sole traders and/or landlords whose gross income from self-employment + property exceeds the thresholds. From April 2026 (£50k), April 2027 (£30k), April 2028 (£20k).

What software do accountants need to support “making tax digital accountants” for their clients?

You’ll need MTD-compatible software that can at minimum: record digital transactions line by line, and generate quarterly updates. You can access the full list of software here.