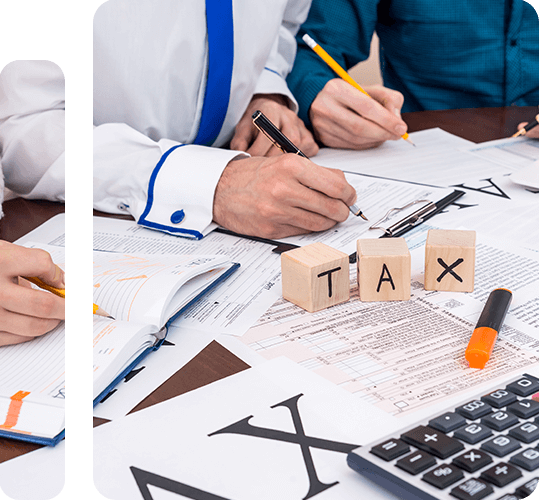

HMRC-Compliant Tax Preparation Services That Save Time, Cut Costs & Boost Accuracy

Corporation Tax Outsourcing UK for Accountants

The latest UK government stats suggest that nearly 44% of businesses now outsource all or some of their corporation tax functions, while just 22% do it fully in-house.

With growing tax legislation complexities, stringent HMRC compliance requirements, and a widening corporation tax gap, UK accountants and accountancy firms are facing severe pressure to deliver error-free services. With our outsourcing corporate tax compliance and preparation services, we help them grow strategically while protecting client relationships and reputation.

If your UK accountancy firm is struggling with resource constraints, deadline pressure, or keeping up with tax changes, our HMRC-compliant corporation tax preparation outsourcing solution in the UK & outsourced corporate tax services in the UK can deliver the reliability and scalability you need.

Client testimonials.

Usually our work speaks for itself. At times, our delighted customers say a few nice things about our teams & their work.

Play Video

Play Video

Director, Lince Salisbury Ltd.

CPA Firm from Ohio

CPA Firm in Boston

Leading CPA firm based in Florida

US Based CPA Firm

US-based CPA Firm

Book a Complimentary Call

Our UK Corporate Tax Outsourcing

Services for Accountants.

We specialise in UK corporate tax compliance outsourcing tailored for accountancy firms of all sizes, from boutique practices in Manchester to national firms in London.

Corporation Tax Return Preparation & Filing

We offer HMRC-compliant CT600 (and related schedules), ensuring accurate computation of taxable profits and timely submission, helping you stay compliant with UK tax outsourcing services for accountancy firms.

Tax Reliefs, Allowances & Planning

We identify and apply R&D credits, capital allowances, group relief, loss carry-forwards, and patent box claims, helping you optimize your tax outcomes while ensuring compliance with HMRC standards.

Compliance Reviews & Quality Assurance

We check every return thoroughly, ensuring audit trail, documentation, and consistency, reducing risk for you and your clients.

Data Management & Secure Portal Integration

We adhere to global data and information protection standards by ensuring document exchange (via encrypted portals) and integration with all leading cloud accounting systems, aligning with Making Tax Digital and UK data protection laws.

Why Datamatics?

Cost Efficiency & Flexibility

We have a team of trained in-house tax experts, which helps our clients scale their operations up and down as needed, while paying only for what they use.

Access to Specialist Expertise

Frequent tax legislation changes make it challenging for accounting firms to stay up-to-date. However, with our experts who live and breathe UK corporate tax, we keep you ahead, reducing the risk of errors or missed reliefs.

Mitigated Compliance Risk

The compliance requirement of HMRC has grown significantly. We help you safeguard quality and adherence to HMRC expectations.

Time Savings & Focus

While we take care of your corporation tax preparation, your team gets time to focus on advisory, client growth, and high-value work.

Competitive Edge

We deliver accurate, timely, and efficient services, helping your firm stand out in the crowded UK accounting market.

How Datamatics’ Outsourcing Services Work

(for UK Accountancy Firms).

Onboarding & Needs Assessment

Data Collection & Documentation

Tax Return Preparation

Review & Client Sign-off

Ongoing Maintenance & Support

The Datamatics advantage.

We specialise in UK corporate tax compliance outsourcing tailored for accountancy firms of all sizes, from boutique practices in Manchester to national firms in London.

Experience

CPA Talk Series.

CPA Talk Series features accounting leaders navigating rapid change—AI, regulations, talent shifts, and global volatility. Here we unpack real challenges, share bold ideas, and spark fresh thinking to fuel sharper decisions, stronger teams, and future-ready finance.

Insights from the CA World.

Get the latest and hottest takes, trends, and insights on the topics relevant to CAs.

Frequently Asked Questions (FAQs).

Can an accountant legally outsource UK corporate tax work?

Yes. The legal responsibility for accurate filing remains with the accountant; however, the tax preparation outsourcing model for UK accountants is fully permissible when the provider aligns with HMRC-approved standards.

How do you ensure data security & GDPR compliance?

We use encrypted portals, NDAs, data processing agreements, and strictly limit access. All systems meet GDPR and UK data protection laws.

Will the turnaround times align with HMRC deadlines?

Yes — we work to your calendar and HMRC deadlines. Our internal scheduling ensures that no submission dates are missed.

Frequently asked questions.

Can an accountant legally outsource UK corporate tax work?

Yes. The legal responsibility for accurate filing remains with the accountant; however, the tax preparation outsourcing model for UK accountants is fully permissible when the provider aligns with HMRC-approved standards.

How do you ensure data security & GDPR compliance?

We use encrypted portals, NDAs, data processing agreements, and strictly limit access. All systems meet GDPR and UK data protection laws.

Will the turnaround times align with HMRC deadlines?

Yes — we work to your calendar and HMRC deadlines. Our internal scheduling ensures that no submission dates are missed.

Outsource Corporate Tax Preparation in the USA.

If your CPA firm wants to reduce workload during busy season, improve accuracy, and deliver more value to clients, our outsourced corporate tax services USA are the answer.