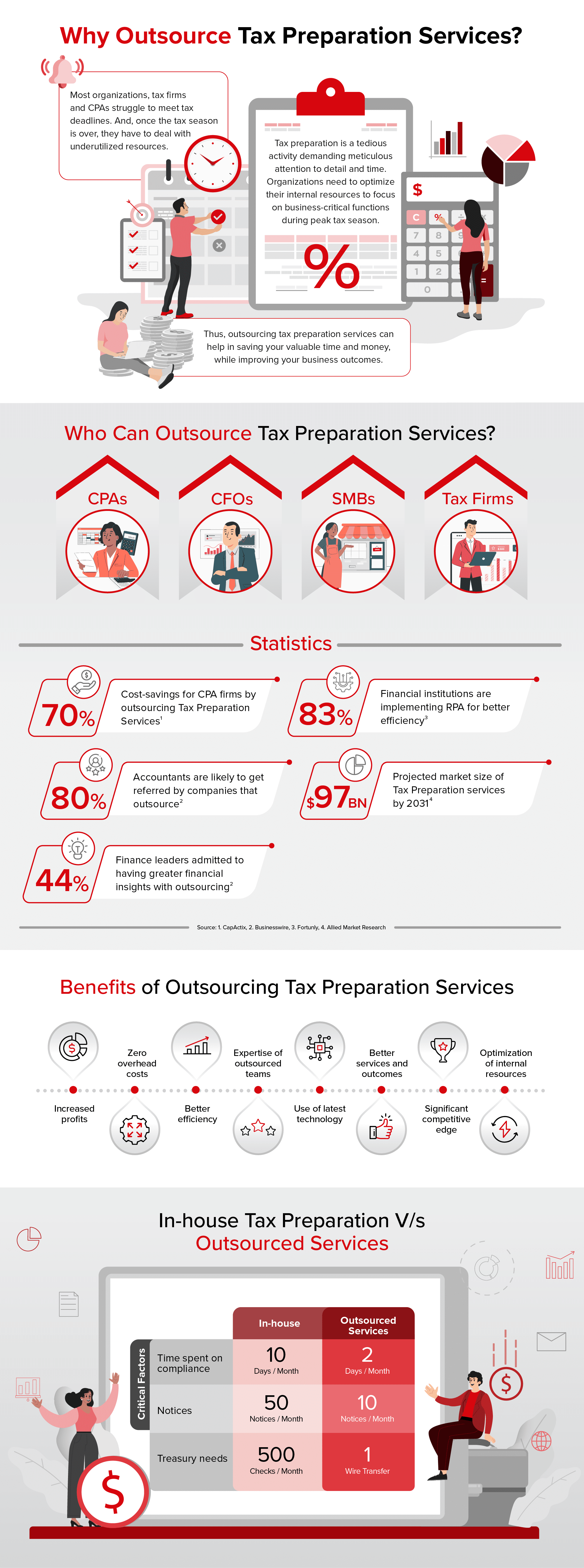

Towards the fiscal year end, companies often find themselves doing more business than at any other time of the year, which means more revenue. While these are good tidings, the tax season always puts businesses in a tight spot. Most small and medium-sized CPA firms have a limited operating budget. When the workload is extremely high during tax season, they hire seasonal employees to scale their operations. However, in such cases, the hiring costs go through the roof – there is salary to consider, fringe benefits, insurance, infrastructure, training, onboarding, and so on.

When tax season is over, CPA firms’ workload decreases. As a result, these newly hired employees are rendered obsolete. To avoid these situations, many CPA firms outsource a portion of their tax preparation services to get the best out of their in-house staff. They can scale up while saving money on resource costs with outsourced tax preparation services.

Outsourcing improves accuracy, quality, and timeliness in tax preparation tasks, not to mention the considerable cost savings and numerous other advantages of using a trustworthy service provider. Additionally, outsourced tax preparation services can free up your valuable time, allowing you to concentrate on more critical aspects of your business, such as product development, sales, marketing, custom acquisitions, and so on.

Another critical reason for outsourcing tax preparation services is to reduce risks and fraudulent activities. Outsourcing tax return preparation and accounting will assist you in ensuring complete transparency and accuracy regarding balances and journal entries.

Businesses can make the most of their team and administrative procedures with outsourced tax preparation.