Finance and accounting outsourcing in Canada has evolved into a strategic solution for firms seeking precision, scalability, and compliance. As talent shortages, wage pressures, and growing CRA and PIPEDA requirements challenge in-house teams, more organizations are partnering with outsourced accounting firms to ensure accuracy, data security, and timely delivery.

Selecting the right accounting outsourcing company can directly impact audit readiness, compliance outcomes, and client satisfaction.

This list highlights 10 leading outsourced accounting service providers that help Canadian firms enhance financial accuracy, control operational costs, and maintain regulatory compliance—backed by structured processes, automation, and professional expertise.

The 11 Best Finance And Accounting Outsourcing Service Providers

| Firm ▲▼ | Key Outsourced Accounting Services ▲▼ | Distinct Strengths ▲▼ | Pricing Transparency ▲▼ |

|---|---|---|---|

| Datamatics CPA | Bookkeeping, Tax, Payroll, Audit Support, GST/HST Filing | CRA-aligned accuracy, PIPEDA & SOC compliance, Automation-led workflows, Scalable models | Fixed & FTE-based pricing |

| Accounting Farm | Bookkeeping, Accounting, Payroll, Tax, Reporting | CRA-compliant workflows, Provincial tax expertise, Xero/QuickBooks certified, Fast turnaround | Service-based pricing |

| Enkel Backoffice Solutions | Bookkeeping, Payroll, AP/AR, Reporting | Cloud-first operations, Canadian compliance, Reliable delivery, Dedicated support | Monthly plans |

| CapActix Business Solutions | F&A Outsourcing, Controllership, Virtual CFO | Structured workflows, ISO-certified, CFO expertise, KPI-led governance | Custom pricing |

| Flatworld Solutions | Bookkeeping, AP/AR, Payroll, Reporting | Multi-currency handling, ERP integration, Standardised control, Real-time visibility | Quote-based |

| Mindspace Outsourcing | Bookkeeping, GST/HST, Payroll | CRA compliance, Cloud-certified staff, Secure handling, Timely output | Fixed packages |

| Invensis | P2P, R2R, O2C, Payroll | Documented workflows, 24×7 delivery, Dashboard visibility, Process governance | Scope-based |

| eClerx | Finance Ops, Reporting, Analytics | Automation-led accuracy, Data analytics, Enterprise control, IFRS alignment | Contract-based |

| RSM Canada | Accounting, Payroll, Tax, Control | Audit-grade quality, ASPE/IFRS reporting, Certified teams, Transparent delivery | Engagement pricing |

| MNP Digital Outsourcing | Bookkeeping, Payroll, Accounting, Advisory | Bilingual support, National coverage, Automated delivery, Advisory-driven | Tailored pricing |

1. Datamatics CPA

Datamatics CPA provides end-to-end outsourced accounting services to accounting firms and enterprises. Its service portfolio spans bookkeeping, accounts production, management reporting, payroll processing, audit support and tax preparation—all delivered within a structured compliance framework.

Backed by over five decades of outsourcing experience and a team of 1,500 qualified finance professionals, Datamatics CPA operates within a robust ecosystem aligned with CPA Canada standards, CRA compliance, and PIPEDA, ensuring precision, transparency and business continuity.

Core outsourced accounting services

- Bookkeeping

- Tax Preparation (T1, T2, T3, T5013, T3010)

- Audit Support

- GST/HST and provincial sales tax returns

- Audit support and financial statement preparation

Key strengths

- CRA-aligned processes for Canadian individual, corporate, trust, partnership, and NPO filings

- SOC-compliant, GDPR-conformant security with robust SLAs for service assurance

- Flexible outsourcing models, including dedicated FTE and per-file options

Technology-enabled workflows and automation across finance and accounting operations

2. Accounting Farm

Accounting Farm provides comprehensive outsourced accounting and bookkeeping services to CPAs and accounting firms across Canada. The company brings hands-on experience with federal and provincial taxation and CRA guidelines, delivering accurate and efficient services.

Core outsourced accounting services

Bookkeeping

Accounting

Payroll Processing

Tax Preparation

Financial Reporting

Key strengths

Expert knowledge of federal and provincial taxation and CRA guidelines

Xero and QuickBooks certified professionals

Fast turnaround times with streamlined workflows

3. Enkel Backoffice Solutions

Enkel supports organizations with cloud-based accounting and financial reporting designed for transparency and compliance with Canadian tax standards.

Core outsourced accounting services

- Bookkeeping

- Payroll

- Accounts Payable and Receivable

- Financial Reporting

- Cloud Accounting

Key strengths

- Cloud-based accounting workflows

- Experienced Canadian bookkeepers

- Timely payroll and compliance management

Dedicated client support team

4. CapActix Business Solutions

CapActix offers finance and accounting outsourcing solutions tailored for North American clients, including Canadian CPA firms. The firm combines process governance with ISO-certified operations to ensure accuracy, audit-readiness, and compliance across bookkeeping and controllership functions.

Core outsourced accounting services

- Finance & Accounting Outsourcing

- Controllership

- Virtual CFO

- Financial Reporting

Key strengths

- Structured and documented workflows

- ISO-certified delivery processes

- Virtual CFO and advisory expertise

KPI-based governance

5. Flatworld Solutions

Flatworld Solutions provides finance and accounting outsourcing to global and Canadian firms, managing high-volume transactions, payroll, and tax preparation. Its ability to integrate with multiple ERP platforms and maintain process uniformity ensures efficiency and visibility for Canadian clients.

Core outsourced accounting services

- Bookkeeping

- Accounts Payable/Receivable

- Payroll

- Financial Reporting

Key strengths

- Multi-currency transaction capability

- ERP and accounting system integration

- Quality-assured process control

Real-time reporting and visibility

6. Mindspace Outsourcing

Mindspace delivers outsourced bookkeeping and accounting services to Canadian accounting firms and businesses, supporting cloud-based systems like Xero and QuickBooks. It ensures accuracy and compliance under CRA regulations while managing client books securely through GDPR and PIPEDA-aligned protocols.

Core outsourced accounting services

- Bookkeeping

- GST/HST Filing

- Payroll

- Management Accounts

Key strengths

- Xero and QuickBooks-certified professionals

- CRA and PIPEDA compliance

- Timely bookkeeping and reconciliations

- Secure and reliable data handling

7. Invensis

Invensis provides standardized finance and accounting outsourcing across procure-to-pay, record-to-report, and payroll functions for Canadian enterprises. It is known for its consistent process management, governance-driven delivery, and focus on real-time financial visibility.

Core outsourced accounting services

- Procure-to-Pay

- Record-to-Report

- Order-to-Cash

- Payroll

Key strengths

- Documented F&A workflows

- 24×7 operations across time zones

- Centralized reporting dashboards

Process and compliance governance

8. eClerx

eClerx delivers finance operations, analytics, and reporting outsourcing to large Canadian organizations. It supports CFOs and finance teams through automation, data analytics, and compliance-ready documentation aligned with IFRS and Canadian reporting standards.

Core outsourced accounting services

- Financial Operations

- Reporting

- Analytics

- Compliance Support

Key strengths

- Automation-led financial reporting

- Data-driven decision insights

- Enterprise-grade control environment

- Scalable service delivery

9. RSM Delivery Centre

RSM Canada provides finance and accounting outsourcing solutions that cost-effectively improve finance functions for middle market companies.

Core outsourced accounting services

- Transactional Accounting

- Payroll

- Financial Control

- Tax Compliance

Key strengths

- Canadian audit and tax expertise

- ASPE and IFRS-aligned reporting

- Certified Canadian accounting teams

- Governed and transparent delivery

10. MNP Digital Outsourcing

MNP Digital Outsourcing, part of MNP LLP, supports Canadian businesses with outsourced bookkeeping, accounting, and financial management services. The firm’s local teams provide bilingual (English and French) support, integrating automation to improve accuracy and visibility.

Core outsourced accounting services

- Bookkeeping

- Payroll

- Accounting

- Financial Management

- Technology Integration

Key strengths

- National presence with local expertise

- Bilingual delivery capability

- Automation-enabled accounting

Strong client advisory focus

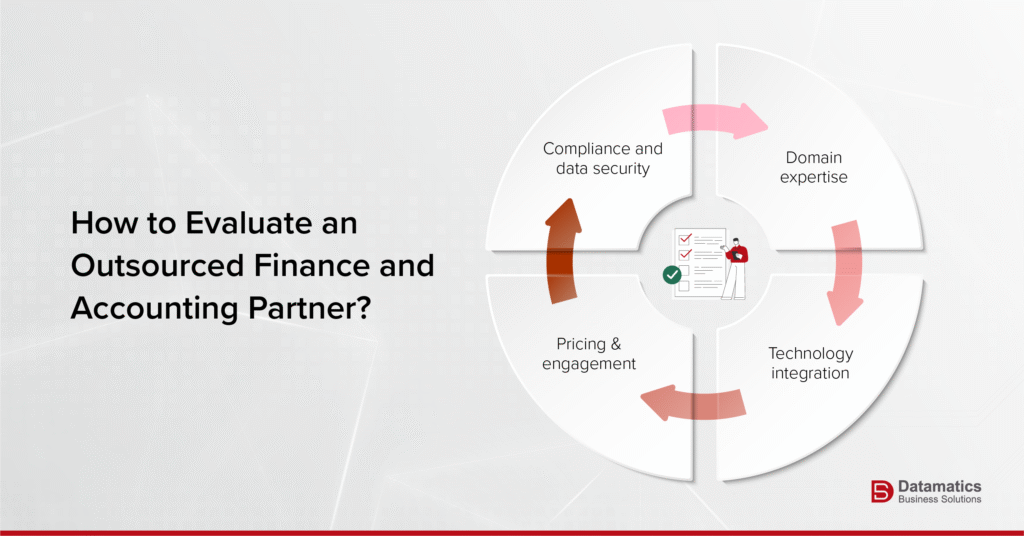

- Compliance and data security

- Domain expertise

- Technology integration

- Engagement models and flexibility

💡 Is Outsourcing Right for Your Firm?

Take our quick self-evaluation to assess whether outsourcing or offshoring fits your firm’s goals. Instantly discover how it can impact cost savings, capacity, and growth potential.

🚀 Start the EvaluationNo commitment. Just tailored insights in less than 2 minutes.

Why Datamatics CPA Is a Trusted Finance and Accounting Outsourcing Partner in Canada

Selecting the right finance and accounting outsourcing partner defines how well a firm manages compliance, scalability, and cost efficiency.

Datamatics CPA combines experienced professionals and automation-led delivery to support over 200 CPA and CA firms globally. With 40+ years of outsourcing expertise, it ensures CRA-aligned accuracy, PIPEDA-compliant data security, and transparent workflows across every engagement.

Its structured model supports outsourced accounting services, payroll, audit, and financial reporting, helping firms achieve audit-ready outputs with consistency and control.

Datamatics CPA enables accounting firms in Canada to reduce costs, enhance compliance, and scale operations with confidence.

Looking to simplify your accounting operations with accuracy and control?

Get in touch with our accounting outsourcing partners today.