Table of Contents

Introduction

Any modern business that does not effectively manage its accounts payable (AP) will hurt itself in the long run. Accounts payable for any business is an integral process to manage. In its simplest form, accounts payable are the money your company owes. It could be in the form of bills, invoices, and other pending payments you incur while running a business. These can come from inventory providers, office supplies, bills for services like phone and internet, and the list can go on and on.

Every CPA client we have worked with has needed help managing accounts payable for their clients. Thus, they explicitly look for accounting and bookkeeping outsourcing service providers that can help them effectively manage accounts payable for their clients. However, even before you can start managing accounts payable effectively, it is critical to understand the role of accounts payable in your business and why accounts payable are important for modern businesses. So, let us start by understanding what accounts payable are.

What is accounts payable?

For the uninitiated, Accounts payable (AP) for any business is a short-term liability or money that a company owes to its vendors for availing their services/goods. On the balance sheet for any company accounts payable is generally listed as a current liability.

Accounts payable are integral for any business’ operation as they ensure that all the pending bills and invoices are cleared on time. This translates into an improved credit score for the company and also prevents them from incurring any extra charges in the form of late fees. AP is also crucial in improving the cash flow management for the company by tracking all the pending bills and when the payment needs to be made. Furthermore, AP also reduces the risk of fraud by enabling proper processing and authorization of bills. While accounts payable is an industry accepted term, there are various types of accounts payable that depend upon the business you might encounter, let’s have a look at them.

Types of Accounts Payable

1. Trade Payables

Accounts payable incurred on purchase of goods and services used predominantly in normal course of business are termed as trade payables.

2. Accrued Expenses

Accrued expenses are accounts payable representing the expenses which have been incurred, however, they have not been paid for. Examples of accrued expenses include wages or rent expenses, which will be paid in the near future.

3. Other Payables

Taxes, interests, and every other account payable that does not fall under the aforementioned categories are called other payables.

Irrespective of the type of accounts payable process, each of them can be automated either using an outsourcing accounting service provider for CPAs. It not only helps streamline the entire process, but also minimizes the risk of errors. Depending upon the business need, you can select any solution to automate your accounts payable process.

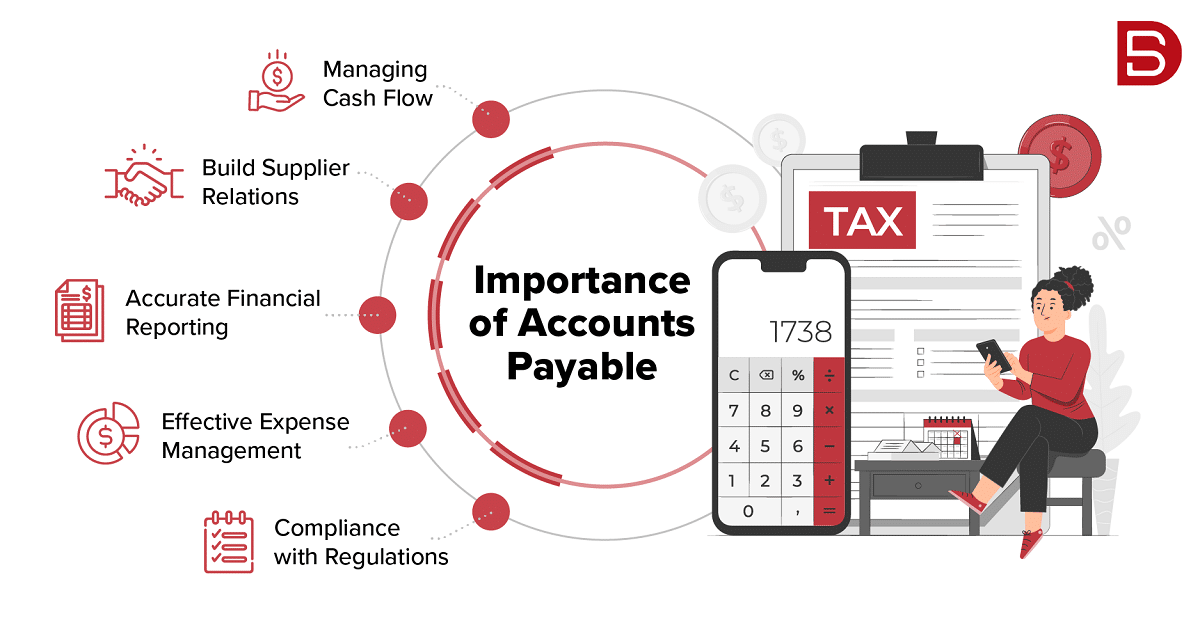

Why is accounts payable important?

Accounts payable are an integral part of any business’s financial management. Accounts payable allows you to track everything from improving cash flow to tracking your business expenses. Here are some of the vital reasons that make accounts payable so crucial for any business.

• Managing Cash Flow

Accounts payable help the business keep track of cash outflow by keeping track of all the cash obligations of the business and ensuring that all the payments are made well within the agreed credit terms. Compelling accounts payable management allows a company to optimize its cash flow, maintain healthy relations with its supplier, and take benefit of favorable payment terms.

• Build Supplier Relations

Timely and accurate payments are crucial in maintaining and nurturing healthy relations with your supplier. Accounts payable enables it for every business by ensuring all payments are made on time. This results in superior supplier relations, priority access to goods or services, and even better discounts.

• Accurate Financial Reporting

Accounts payable transactions are crucial for accurate financial reporting. Accounts payable transactions provide a deeper insight into the financial health and liquidity of the company, which helps in the accurate calculation of key financial ratios. Businesses with proper reconciliation of accounts payable transactions ensure accurate financial statements, making them reliable for compliance and even business decision-making.

• Effective Expense Management

By tracking and controlling all the expenses, accounts payable give you visibility into the company’s outstanding obligations and consequently allows for effective expense management through budgeting and forecasting.

• Compliance with Regulations

Timely payment of bills is critical for every business for regulatory compliance. Failure to comply with payment obligations can attract penalties and legal disputes and even hamper the company’s reputation. Accurate accounts payable management ensures the business complies with tax regulations, contractual obligations, and financial reporting standards. This reduces any risk that might come with non-compliance.

Ready to Grow Your Accounting Firm?

Discover proven strategies used by top CPA firms to scale faster. Grab your free copy of eBook and start unlocking growth today.

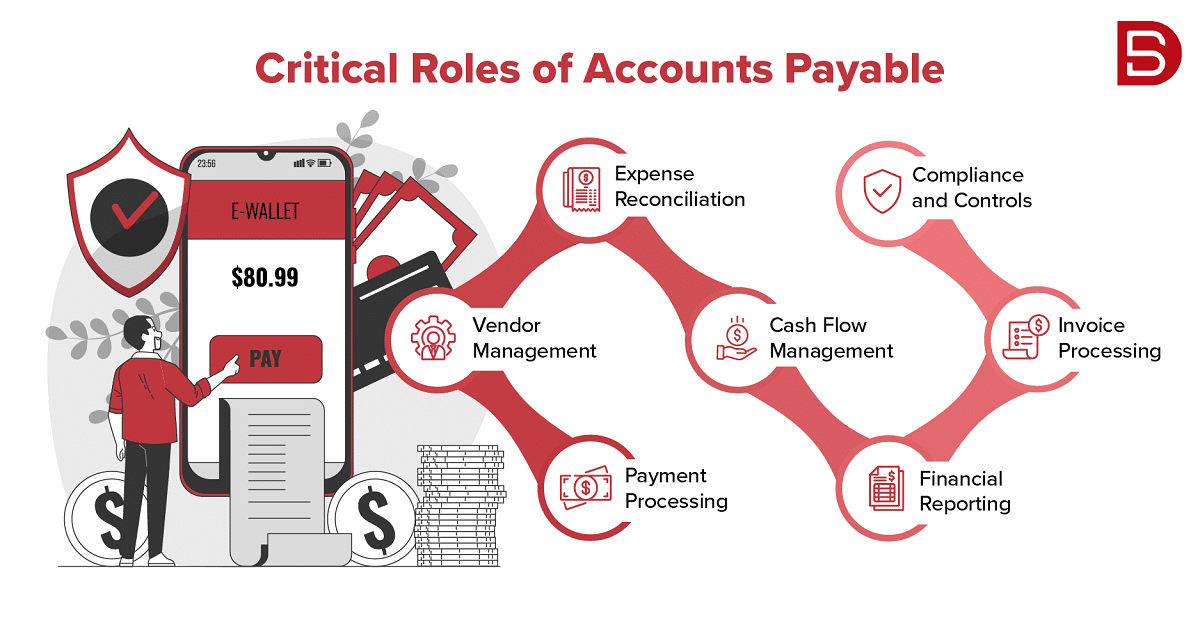

The role of accounts payable in your business

For any business, the accounts payable function manages the organization’s financial obligations to suppliers or vendors. However, there are plenty of other roles that accounts payable plays in any business.

Here are some critical roles of accounts payable

• Invoice Processing

The accounts payable team is responsible for getting and processing invoices from suppliers with absolute accuracy, diligence, and completeness. They are responsible for verifying the details of invoices, including goods and services received, terms of the deal, and pricing.

• Payment Processing

Upon successful verification of invoices, the accounts payable department is responsible for executing and releasing supplier payments. They also ensure that the payments made are in accordance with the agreed-upon terms, taking full advantage of any available discount.

• Vendor Management

Accounts payable often is the POC (point of contact) for vendors and suppliers regarding payments, any discrepancy in payment terms, or any possible issue resolution. They are responsible for maintaining open communication between the organization and the vendors by addressing any possible concerns and maintaining an overall healthy relationship with them.

• Expense Reconciliation

The accounts payable team is responsible for reconciling invoices and payment records to ensure that all the expenses are recorded accurately and, in the organization’s, financial statement. Reconciliation will involve matching invoices with purchase orders and validating the accuracy and completeness of all transactions.

• Cash Flow Management

Effective accounts payable management could result in optimized cash flow management for the organization. The accounts payable team ensures that all payment obligations are met without negatively impacting the company’s liquidity. They take advantage of any favorable credit terms available and optimize the timing of payments.

• Financial Reporting

The accounts payable team provides valuable data for financial reporting, including income statements, balance sheets, and cash flow statements. The accurate recording of accounts payable transactions is critical for generating reliable financial reports.

• Compliance and Controls

Accounts payable professionals ensure compliance with regulatory authorities and internal controls. They ensure that the organization adheres to all the regulatory policies and procedures, with proper documentation and approvals, and contributes to audits and financial reviews.

Conclusion

In summary, the accounts payable function effectively manages the organization’s financial obligation towards the vendors and suppliers. They ensure that the organization maintains accurate records, has optimized cash flow, and has controlled expenses. If, as a CPA firm, you are looking for an accounting and bookkeeping outsourcing partner for effectively managing your accounts payable process, we can help you get started instantly. So, write to us at: marketing@datamaticsbpm.com, and we will have our accounting and bookkeeping experts reach out to you with a solution tailored specially for you.

Struggling with bookkeeping, tax prep, or accounting tasks?

Let us handle the operations while you focus on growing your firm.