For accounting and CPA firms in the USA, the document that determines the rhythm of their tax season is Form 1040. The seemingly straightforward-looking two-pager Form 1040 is the keystone of individual income tax reporting, yet when you are juggling multiple clients with varying income sources, deductions, credits, and life circumstances, it becomes rather complex.

To make it easy for our CPA friends in the USA, we have designed this comprehensive blog covering every aspect of Form 1040 you need to know. This post goes beyond the basics of Form 1040 and helps you gain a deep understanding of its practical, real-world application. So, whether your client walks in with a complicated partnership K-1, rental properties, or cryptocurrency transactions, this resource will help you handle every possible curveball your clients can throw at you.

What Is Form 1040?

The Legal Framework

The Form 1040, officially known as the “U.S. Individual Income Tax Return,” is the standard Internal Revenue Service form for U.S. taxpayers to file their annual income tax returns. Form 1040 is mandated under the Internal Revenue Code, primarily Section 6012, and serves as the main source through which individual taxpayers must report their income, claim deductions and credits, and calculate their tax liability or refund for any tax year.

The Current Form Structure

Form 1040 was consolidated into a more streamlined format in the 2018 tax year, following the Tax Cuts and Jobs Act. The days of Form 1040A and 1040EZ for US taxpayers are over now. They just need to use Form 1040, with various schedules attached depending on the taxpayer’s specific circumstances.

The main Form 1040 has been divided into several key sections, including:

- Filing status and personal information (top section)

- Income (Lines 1-9, culminating in total income on Line 9)

- Adjusted Gross Income (Lines 10-11, showing AGI on Line 11)

- Tax and Credits (Lines 12-24)

- Other Taxes (Lines 25-31)

- Payments (Lines 32-34)

- Refund or Amount Owed (Lines 35-37)

💡 Is Outsourcing Right for Your Accountancy Firm?

Take our quick self-evaluation to assess whether outsourcing or offshoring fits your firm’s goals.

Instantly discover how it can impact cost savings, capacity, and growth potential.

No commitment. Just tailored insights in less than 2 minutes.

Why is Form 1040 the most critical touchpoint for client engagement?

The main purpose of Form 1040 for US taxpayers is statutory compliance. However, for CPA firms, the Form 1040 also serves as a valuable diagnostic tool. This difference is reflected in several key functions:

- Data Matching: The IRS utilizes Form 1040 to reconcile third-party information (1099s, W-2s, K-1s) through the Automated Underreporter (AUR) program.

- Financial Planning: Reviewing the tax return highlights potential opportunities for clients to benefit from tax-advantaged strategies, such as HSA contributions, Section 199A optimization, or backdoor Roth conversions.

- Lending & Credibility: Form 1040 is commonly used as the primary document for mortgage applications, business loans, and FAFSA filings.

What are the specific scenarios that CPAs often overlook regarding filing obligations?

Most professionals know the gross income thresholds based on filing status, but top CPA firms focus on hidden triggers:

- Self-employment: Net earnings of $400 or more.

- K-1 Trigger: Even without other income, a K-1 showing a loss can require filing to preserve Net Operating Losses (NOLs) or basis.

- Premium Tax Credit (PTC): Advance PTC recipients must file to reconcile, regardless of income.

- Dependents with Unearned Income: The Kiddie Tax threshold (about $2,500) requires a return or a parent election via Form 8814.

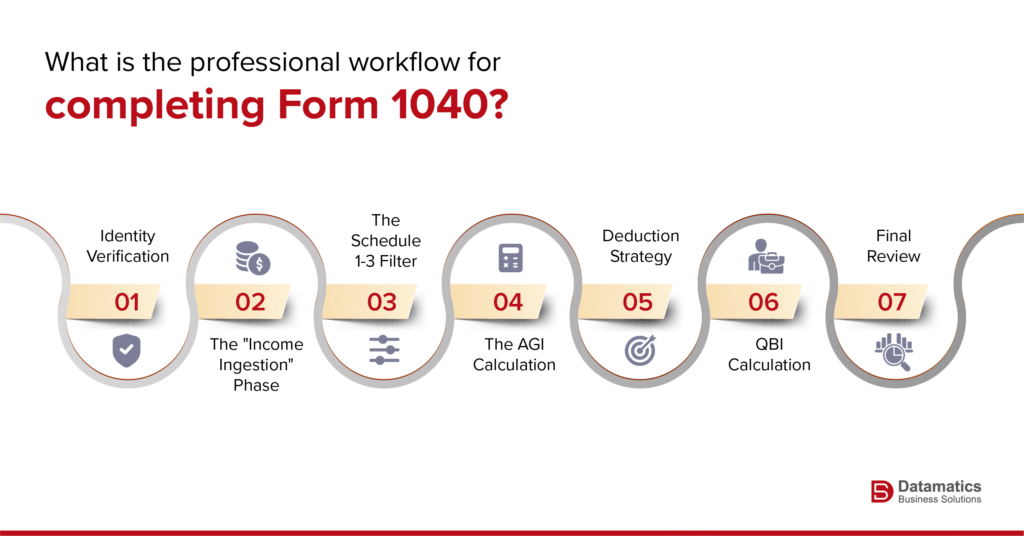

If you are looking for a structured approach for completing Form 1040, here it is for you:

Step 1: Identity Verification

Start by confirming filing status and Social Security Numbers or Individual Taxpayer Identification Numbers (SSNs/ITINs). (Note: the Head of Household filing status is always a high-audit area.)

Step 2: The “Income Ingestion” Phase

Reconcile 1099s, W-2s, and K-1s. Leverage Optical Character Recognition (OCR)- enabled software to push data into the tax engine. However, make sure you verify the “1z” total manually.

Step 3: The Schedule 1-3 Filter

Take care of “Above-the-Line” adjustments (Schedule 1), Additional Taxes (Schedule 2), and Non-refundable Credits (Schedule 3).

Step 4: The AGI Calculation

Adjusted Gross Income (AGI) = Gross Income – Schedule 1 Adjustments

Step 5: Deduction Strategy

Compare standard and itemized deductions (Schedule A) and select the more beneficial option.

Step 6: QBI Calculation

For business owners, calculate the Section 199A deduction (Form 8995/8995-A).

Step 7: Final Review

Conduct a thorough “two-year comparison” for spotting any possible missing 1099s or unexpected adjustments in effective tax rates.

Which schedules are causing the most friction for CPA practitioners today?

With the redesign of the “Postcard,” several core functions got split into supplemental schedules. In order to make the most of it, you need to master the linkages:

Schedule 1 (Additional Income/Adjustments)

This is where income from sources such as crypto (Digital Assets), gambling winnings, and jury duty pay resides.

Schedule C (Sole Proprietorship)

Perhaps the schedule that gets scrutinized the most is the one that ensures that “Travel and Meals” are properly accounted for.

Schedule E (Supplemental Income)

This schedule is vital for real estate investors. As a CPA or a CPA firm owner, you must track “At-Risk” and “Passive Activity” loss limitations (Form 8582).

Schedule SE (Self-Employment Tax)

This schedule is critical to ensuring that the employer-equivalent portion of self-employment tax is properly deducted on Schedule 1.

What are the most important dates and deadlines related to Form 1040?

- April 15: The standard deadline for filing and payment.

- June 15: Deadline for U.S. citizens living abroad.

- October 15: The extension deadline. Pro-tip: Remind clients that an extension to file is not an extension to pay.

- Estimated Tax Deadlines: April 15, June 15, Sept 15, and Jan 15.

Who Must File Form 1040?

Every US citizen must file Form 1040 if their income exceeds certain thresholds that vary by filing status, age, and dependency status. For tax year 2025, these income thresholds are:

Single filers:

- Under 65: $14,600

- 65 or older: $16,550

Married Filing Jointly:

- Both under 65: $29,200

- One spouse 65+: $30,750

- Both 65+: $32,300

Married Filing Separately:

- Any age: $5 (yes, just $5)

Head of Household:

- Under 65: $21,900

- 65 or older: $23,850

Qualifying Surviving Spouse:

- Under 65: $29,200

- 65 or older: $30,750

Special Circumstances That Can Trigger Filing Requirements

You must file a return even if income is below these thresholds in special cases, such as:

- Self-employment income is more than $400 (net earnings)

- If you owe alternative minimum tax

- You have wages of $108.28 or more from a church or qualified church-controlled organization, exempted from employer Social Security and Medicare taxes.

- You received HSA, MSA, or Coverdell ESA distributions.

- You owe household employment taxes (the “nanny tax”)

- You had recaptured taxes (like the first-time homebuyer credit repayment)

When Should You File Even If Not Required?

As a CPA, this is where you actually add value. You must advise your clients to file even when not required in case:

- Federal income tax was withheld from their pay (they are eligible for a refund)

- They qualify for refundable credits (Additional Child Tax Credit, Earned Income Credit, and American Opportunity Credit)

- They intend to contribute to a Health Savings Account (need to file to report contributions)

- They want to establish earned income for future Social Security benefits.

Conclusion

As a CPA, mastering Form 1040 can get you a competitive edge in client service. By accelerating your prep, you get more time for planning, fewer amendments help increase retention, and well informed optimizations, such as stacking credits, enhance your firm’s value. If you want to train your team and watch tax season transform from scramble to showcase, this blog has everything you need. If you still have any queries, you can always write to us at marketing@datamaticsbpm.com, and our tax experts will reach out with a solution tailored to your business needs.

What is a 1040 form?

Form 1040 is the primary federal income tax return used by individuals in the United States. It’s where taxpayers report income, claim deductions and credits, calculate tax liability, and reconcile taxes already paid through withholding or estimated payments.

What is the purpose of a 1040 form?

The purpose of Form 1040 is to determine whether a taxpayer owes additional federal income tax or is entitled to a refund. It pulls together all income sources, adjustments, deductions, and credits into one final calculation.

Who is required to file Form 1040?

Most U.S. individuals must file Form 1040 if they:

- Earn income above IRS filing thresholds

- Owe federal income tax

- Want to claim a refund

- Have self-employment income over $400

- Receive certain credits (EITC, premium tax credit reconciliation)

- Have investment, retirement, or pass-through income

CPAs commonly see Form 1040 filings for employees, freelancers, business owners, retirees, investors, and dependents with taxable income.

What information is needed to fill out a 1040 form?

Personal details (SSNs, filing status, dependents)

- Income documents (W-2s, 1099s, K-1s, SSA-1099)

- Business or rental income and expense records

- Investment and brokerage statements

- Retirement contribution and distribution details

- Estimated tax payment records

- Prior-year return for carryovers and consistency

Clean documentation upfront dramatically reduces prep time and rework.

What are the different types of 1040 forms?

The IRS uses several versions of Form 1040 depending on taxpayer circumstances:

- Form 1040: Standard individual income tax return

- Form 1040-SR: Simplified version for taxpayers age 65+

- Form 1040-NR: For non-resident aliens with U.S. income

- Form 1040-X: Used to amend a previously filed return

Each serves a distinct purpose but follows the same foundational structure.

What does the 1040 form help calculate?

Form 1040 calculates:

- Total taxable income

- Adjusted gross income (AGI)

- Federal income tax liability

- Applicable credits and adjustments

- Total tax payments made

- Final refund or balance due

For accounting firms, this calculation isn’t just compliance—it’s the final checkpoint where accuracy, planning, and advisory value come together.