The UK accountancy and finance industries have been rooted in tradition in their operations. For years now, industry has not undergone a seismic change. But that’s all a tale of the past. With the recent developments in technology, specifically with the rise of highly advanced AI agents and incredibly powerful processing units, the conventional accounting industry is experiencing a drastic transformation.

This massive transformation has enabled CAs in the UK to expand their service portfolio and explore new service avenues to grow and thrive. In this UK bookkeeping outsourcing guide 2025, we will explore how outsourcing has emerged and established itself as a strategic move for CAs and accountancy practices in the UK, looking to outgrow the competition.

Our UK bookkeeping outsourcing guide 2025 will help CAs in the UK learn how to outsource bookkeeping securely, best practices for outsourced bookkeeping, and an outsourcing quality control checklist. If you’re in the market looking beyond traditional bookkeeping methods to thrive in the UK accounting space and outgrow the competition, bookkeeping outsourcing is the way to do so. Here’s how –

Bookkeeping Outsourcing – A Modern Alternative to The Relic of Slower Times

For ages now, the UK accounting and finance space has relied on the expertise and skill of in-house accounting experts. While these experts did offer a hands-on touch on all the services they provided, they often were slower, lacked detailed analytics and actionable insights, and were highly unscalable. This is why the CAs and accountancy firms that still rely on the expertise of these in-house experts frequently find themselves struggling to keep up with the growing demand of the profession and the evolving needs of their clients.

This brings us to bookkeeping outsourcing in the UK. Crafted to meet evolving client requirements, modern UK bookkeeping outsourcing services leverage the advanced technology ecosystem to empower accounting experts to execute incredibly accurate financial tasks—such as bank reconciliations, data entry, and ledger maintenance. These experts are often located offshore, with completely secure IT infrastructure, and they cost a lot less than building a team of in-house accounting experts.

These modern bookkeeping outsourcing services providers adhere to best practices for outsourced bookkeeping, offering real-time dashboards, automated invoicing, and seamless integration with legacy systems. As finance and accounting technology advances, we will see more advanced trends emerge, and we will be offered some real-life success stories through bookkeeping outsourcing case studies. For now, some of the most prominent bookkeeping outsourcing trends that we can foresee emerge include –

- Cloud-native accounting and bookkeeping platforms enabling real-time collaboration

- AI/ML integration for faster and more accurate bookkeeping

- Niche-specialized outsourcing firms serving UK accountants exclusively

What CAs Can Expect from UK Outsourcing Bookkeeping?

While traditionally outsourcing has always been seen as the source of cost cutting, that certainly is not the case anymore. The modern outsourcing bookkeeping service providers in UK serve more as a strategic growth partner for their clients as opposed to just help them save some bucks. With their immensely skilled pool of accounting resources complemented by state-of-the-art technology ecosystem, here’s everything chartered accountants can expect from a top-tier UK outsourcing bookkeeping service provider –

- ~50–60% cost savings in comparison to in-house teams

- Access to qualified bookkeepers familiar with UK GAAP and HMRC requirements

- Scalability to add or reduce resources as your firm grows

- Ability to regain focus on client relationships and strategic advisory

Preparing Your CA Firm for Outsourcing – A Checklist

The answer to how to outsource bookkeeping securely, can be easily found inside the thorough assessment of your CA practice. As part of best practices for outsourced bookkeeping you must dive deep into your processes and workflows to establish whether your firm is ready to outsource. Here’s a concise checklist to help you assess your firm’s outsourcing requirements

- Are your accounting and bookkeeping processes/workflows standardized and documented?

- Is your accounting and bookkeeping tech stack cloud-based?

- Do you struggle to keep up with accounting and bookkeeping deadlines?

- Are you looking to expand your accounting function without hiring more staff?

If your answer to two or more of those questions is a staggering “YES,” your firm is ready to outsource.

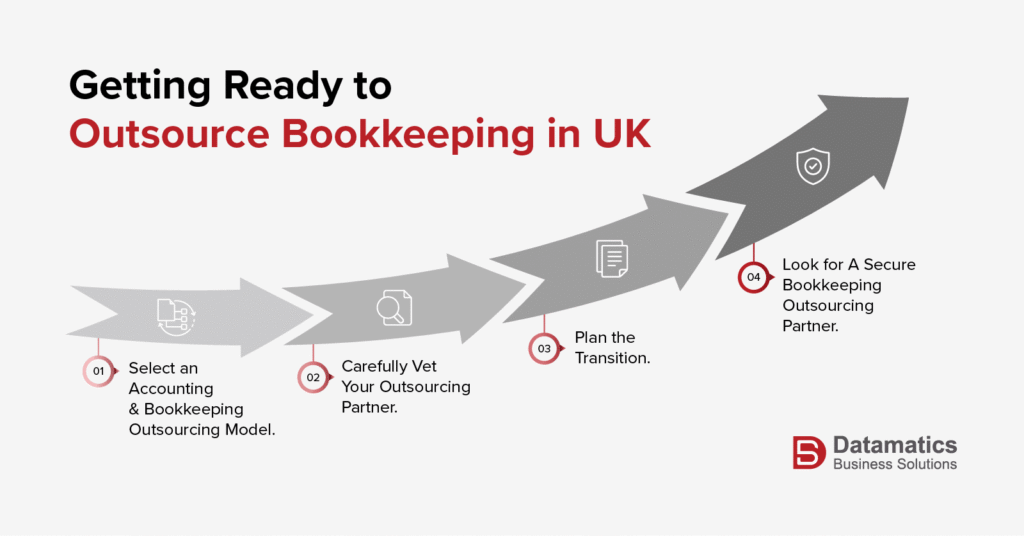

Getting Ready to Outsource Bookkeeping in UK

Once you’ve assessed your CA firm for outsourcing, you can take the plunge and outsource your accounting and bookkeeping functions. However, to make the most of your outsourcing engagement, you must be meticulous and adhere to this step-by-step process to outsource bookkeeping in the UK.

1. Select an Accounting and Bookkeeping Outsourcing Model

FTE Model: A team of dedicated accounting/bookkeeping resources works only with your firm

Task-based model: You outsource the work that needs to be addressed on priority. This model is perfect for smaller CA firms.

2. Carefully Vet Your Outsourcing Partner

When finalizing your accounting and bookkeeping partner, you must ensure that they have the necessary UK compliance expertise, the necessary certifications (ACCA, ICAEW, etc.), prompt response times, and communication skills.

3. Plan the Transition

You must define the SOPs (Standard Operating Procedures) carefully, have a dedicated transition manager for your outsourcing engagement, and establish realistic onboarding timelines (typically 2–4 weeks).

4. Look for A Secure Bookkeeping Outsourcing Partner

When partnering with an outsourcing service provider, you must ensure that they have –

- ISO 27001 certification

- GDPR-compliant data handling policies

- Encrypted file transfer protocols (e.g., SFTP, 2FA portals)

- Signed NDAs and Data Processing Agreements (DPAs)

Best Practices for Outsourced Bookkeeping

If you are looking to transform your initial bookkeeping outsourcing partnership into a long-term fruitful partnership, here are some best practices for outsourced bookkeeping that you must adhere to –

1. Establish Transparent Communication & Collaboration

To make the most of your outsourcing engagement, you must use the right project management tools, such as Asana or Trello. You must also have regular meeting/review calls with your offshore team to ensure everyone is on the same page. Also, ensure that all your data is stored on Cloud-based systems for significantly better and more secure access.

2. Quality Control

Even before you put pen to paper, you must clearly define KPIs (turnaround time, error rate, responsiveness) for quality control. You should also conduct or observe regular data audits and provide timely feedback in case of any discrepancy or mismatch.

3. Documentation

For any recurring task you plan to have for your engagement with your outsourcing partner, you must have clear SOPs and backup protocols. Also, to ensure that you understand what is going on, you must adhere to clear naming conventions for shared files.

The Path Ahead of Outsourced Bookkeeping for UK CAs

For CA firms in the UK and worldwide, outsourcing is no longer just a means to address mundane/recurring tasks. With heavy technological advancements and the rise of agile workflows, outsourcing bookkeeping can be a strategic growth lever for UK CA firms. If profitability, agility, and efficiency are what you want for your CA practice, accounting and bookkeeping outsourcing is the best option to achieve it.

Whether you are a solo practitioner or a 50-member CA firm, we have accounting and bookkeeping outsourcing solutions designed to help you achieve maximum profitability for your firm. Just write to us at marketing@datamaticsbpm.com, and we will help you deliver better, faster service to your clients.