Since its first mention as a method of keeping accounts back in the Babylonian era, bookkeeping has been the cornerstone of precise and orderly record-keeping. But, sadly or gladly, this isn’t 2600 BC, and modern CPAs do not use clay tablets to keep records.

In the contemporary realm of accounting, CPAs harness the power of advanced and compelling computing devices for the systematic and orderly recording of financial transactions. Furthermore, these records help businesses maintain financial order with absolute accuracy, regardless of the organization’s size.

However, bookkeeping is about more than just meticulously keeping financial records. In the modern accounting landscape, bookkeeping is a powerful tool for businesses to weave their way through the complex financial ecosystem while fulfilling their diverse needs. Thus, to survive and thrive in such times, CPAs need the specialization to grow and the adaptability to understand the nuances of bookkeeping successfully.

Whether you cater to large conglomerates or upcoming startups or serve non-profit organizations, you need to acquire the ability to thoroughly understand and practice the intricacies of the global accounting landscape. This blog will share the critical types of bookkeeping that modern CPAs must know if they intend to establish themselves as the true bookkeeping maestros for their clients. So, let us get started.

Table of Contents

Why do I need to know the types of bookkeeping?

As a CPA, you are critical in determining and maintaining your client’s financial health. Your duties encompass a wide range of financial tasks, including bookkeeping. By knowing the types of bookkeeping, you gain a certain competitive edge over your counterparts in more ways than one. Here are some compelling reasons why knowing the types of bookkeeping is an intelligent feather to add to your CPA hat.

Ability to Create Custom Solutions

From offering single-entry bookkeeping to a small business to recommending specialized accounting regulations to a complex business entity, whatever it is that you provide, knowing the types of bookkeeping best suited to the business need gives you the ability to create custom solutions. As a result, you get to serve your client better.

Increased Efficiency and Minimized Errors

Knowing your client’s most efficient financial recording system helps you save time and resources for each client. It also means that you get a deeper understanding of the financial records of your clients and, as a result, reduce errors.

Easy Client Acquisition

Knowing your strengths and expertise makes it easy to take your services to the market and acquire the clients looking for those services. Expertise in different bookkeeping types gives you a competitive edge over a general practitioner, making it easy to acquire clients and open new revenue streams.

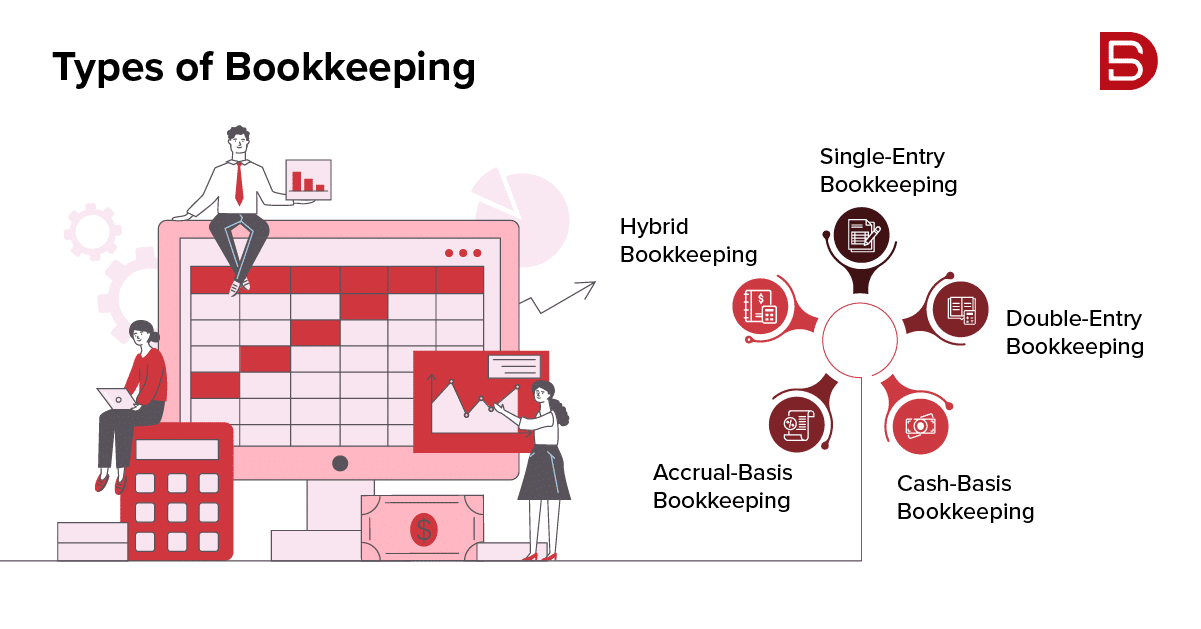

Types of Bookkeeping and The Right One for You

Like everything in life, knowing the various types of bookkeeping is the only way to find and choose the right one for you. When wandering through the intricate accounting maze, knowing the distinction between various types of bookkeeping serves as a guiding light for guiding your clients to the right financial path. Thus, if you are wondering which one is the proper bookkeeping for you, the subsequent sections will help you figure that out. So, let us get started.

Single-Entry Bookkeeping

Perfectly suited for smaller businesses with limited transactions or startups, single-entry bookkeeping involves recording every transaction through single-entry. While it’s easy and suitable for smaller companies with limited transaction records, it has a dearth of financial data and cannot be used to infer detailed insights.

Double-Entry Bookkeeping

A tad more accurate and balanced method, double-entry bookkeeping involves recording each financial record twice. It is also a bit more complex and delivers a detailed view of the business’s overall economic health. Double-entry bookkeeping is perfect for businesses with a bit of complex financial history and is ideal for regulatory compliance.

Cash-Basis Bookkeeping

Cash-basis bookkeeping is a relatively straightforward way of maintaining the organization’s cash flow record. While it gives a simple and easy-to-understand record of paid bills and cash when received, this bookkeeping method needs to provide information on unpaid bills and outstanding invoices. Thus, if, as a CPA, your client runs a large business with multiple complex transactions to maintain, this type of bookkeeping might be for someone else.

Accrual-Basis Bookkeeping

Accrual-basis bookkeeping is perfect for complex business and tax purposes as it accurately positions your financial position by recording income as and when it happens, irrespective of expenses.

Hybrid Bookkeeping

Hybrid bookkeeping systems allow CPAs to offer immense flexibility and customization, as these systems are tailored to meet the needs of specific clients. The hybrid bookkeeping systems are easy to integrate with the existing accounting software and thus enable efficient data management and elaborate financial analysis.

While these are some of the most prominent types of bookkeeping that modern CPAs must know, there are some new bookkeeping types in Cloud-based and computerized bookkeeping, which are getting popular among CPAs. When looking for a bookkeeping type perfect for your client, you must consider these bookkeeping types as well.

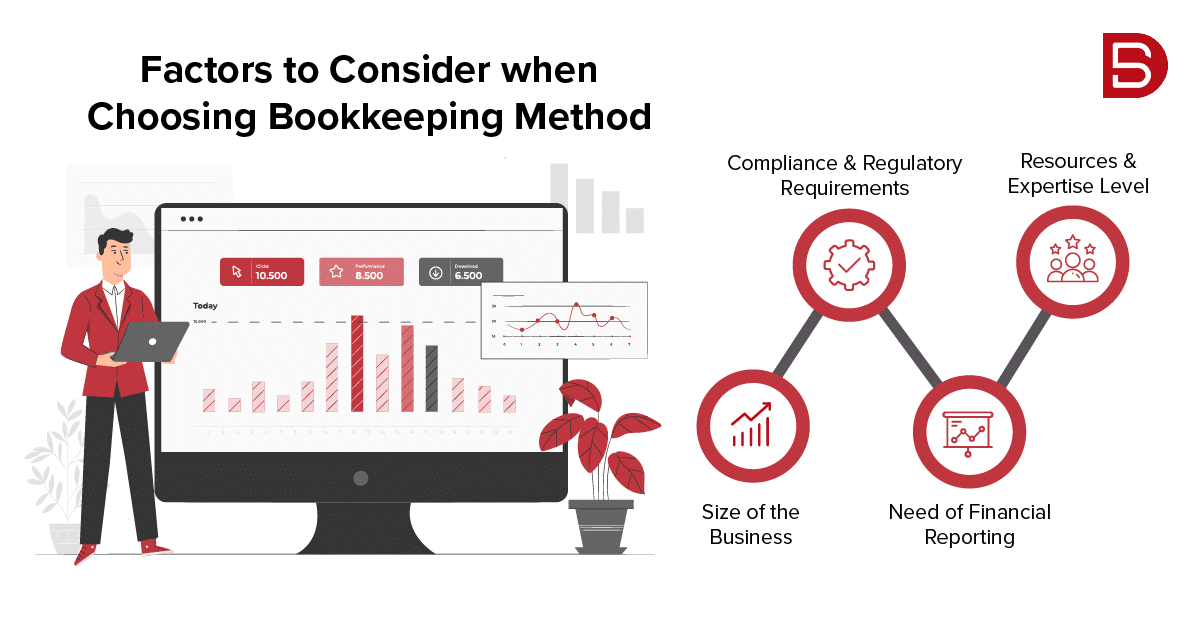

Factors to Consider when Choosing Bookkeeping Method

While all the bookkeeping above methods are highly effective and specific in nature, there are certain factors that you must consider when choosing a bookkeeping method. These factors will help you pick the best bookkeeping method for your needs. Let us look at some of those critical factors.

Size of the Business

Size of the business or just the complex nature of the financial transactions can play a crucial role in determining the most effective bookkeeping type. In case of large businesses or a financial record that involves multiple entries, double-entry bookkeeping delivers the accuracy and precision needed.

Compliance and Regulatory Requirements

While it’s not common, however, depending upon the region, industry, or legal system in place you might be required to use a specific bookkeeping method for tax and compliance purposes, so you must keep that in mind as well.

Need of Financial Reporting

For situations where you need in-depth financial insights, you need accrual-based bookkeeping or at least double-entry bookkeeping. Thus, depending upon the financial view you are aiming for you need to choose the bookkeeping method that fulfills your requirement to the core.

Resources and Expertise Level

The resources that you have and the expertise level you have in the field of bookkeeping can also determine the best bookkeeping option for you.

Bookkeeping enables optimization of financial operations, provides valuable insights on your overall financial health, and helps you grow your business. Selecting the right bookkeeping type is the key to unlock all those benefits that bookkeeping has to offer. Thus, as a CPA you must know the right type of bookkeeping that fits the need of your client and offer the same to them.

The Future of Bookkeeping in the Era of AI and Automation

Since its inception, bookkeeping has undergone a significant transformation, which, while predominantly driven by the technological advancements around us, was also fueled by the evolving needs of businesses. With the arrival of artificial intelligence (AI) and automation, we are seeing a significant emphasis on the automation of tasks such as data entry, account reconciliation, and categorization of transactions.

The trend of businesses leaning towards AI and automation will continue to prevail as companies try to leverage the services of CPAs more for strategic initiatives than operational and repetitive tasks. If, as a CPA, mundane tasks are bringing down your efficiency and keeping you tied to operational tasks, just reach out to us at marketing@datamaticsbpm.com, and we will help you transform your bookkeeping services with absolute ease.