Table of Contents

Introduction

Certified Professional Accountants (CPAs) across the USA and the UK are finally seeing the green shoots after the tumultuous times in recent years. With increased emphasis on data-driven decision-making, increased statutory requirements, and optimum resource management, CPA firms of small and large sizes alike are exploring new and advanced ways to conduct their business.

Outsourced accounting services or an offshore accounting company are one such way to cement its place in the CPA and accounting industry. In their attempt to augment their ROI model, CPA firms have found outsourced accounting services as an indispensable strategy, which can boost their productivity and help them achieve unparalleled profitability.

Welcome to our latest blog on “Boosting Productivity and Profitability: The Power of Outsourced Accounting Services.” With this blog, we will take a closer look at the many benefits and strategic freedom that CPA firms across the globe can avail by simply partnering with an outsourced accounting services provider. Whether you are looking to accelerate your financial growth or overcome the myriad economic challenges that the current socio-economic turmoil throws, this blog will help you with insights to overcome them all.

So, let us kickstart this journey to a world where outsourcing felicitates productivity and profitability together while enabling accounting and CPA firms to attain sustainable growth.

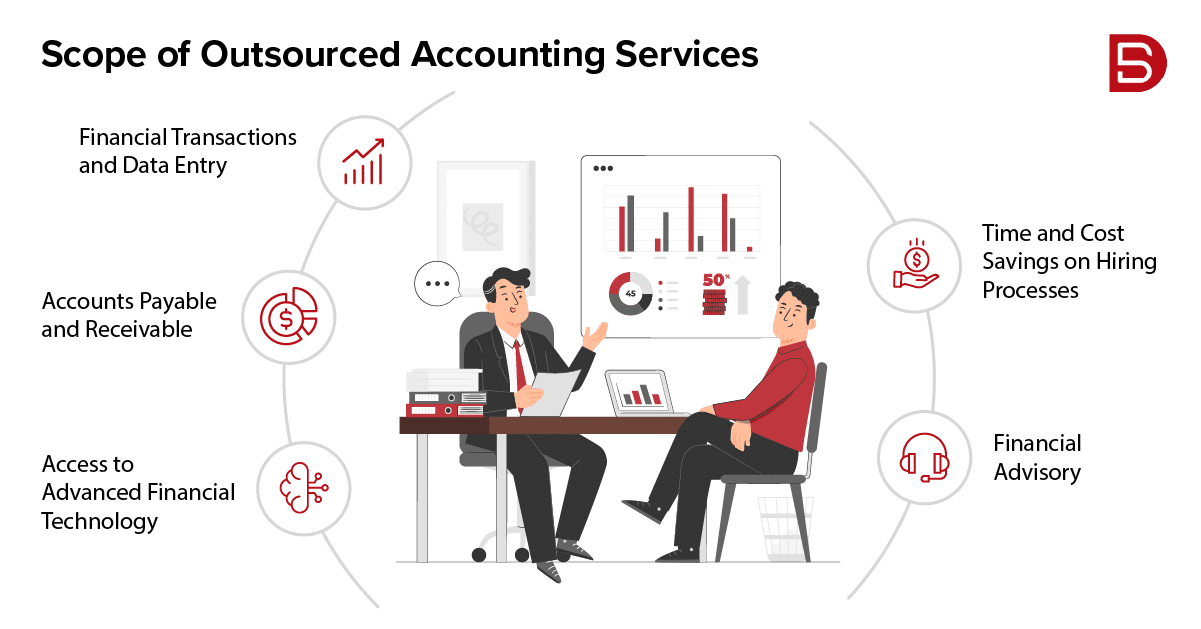

Understanding The Scope of Outsourced Accounting Services

Traditionally, any outsourced accounting work was presumed to be number-crunching and standard financial record-keeping processes. Those days, happily for the accounting industry, are long gone.

In the current economic and business landscape, outsourced accounting services are strategic financial partners to their clients, contributing actively to growing their productivity and profitability. It wouldn’t be an exaggeration to consider them an integral part of the smooth operation and functioning of modern CPA firms and accounting functions.

Here is a brief scope of outsourced accounting services for modern CPA firms, along with some of the critical functions they perform as part of their role in the active growth trajectory of their clients:

• Financial Transactions and Data Entry

The fundamental tasks allocated to outsourced accounting services include maintaining accurate financial transactions through bookkeeping, precise data entry for maintaining ledgers, and ensuring proper data entry. These tasks help their clients make accurate financial decisions based on economic data and meticulous records, which is instrumental when charting your growth path.

• Accounts Payable and Receivable

Outsourced accounting services oversee cash flow for their clients through accounts payable and accounts receivable, ensuring that all the payments are made on time and that the client has an optimal cash flow.

• Access to Advanced Financial Technology

Most offshore accounting service-providing companies serve a wide range of clients worldwide. This requires them to have expertise and experience working with various financial tools and software. As a result, when you work with these firms, you automatically get access to these tools and software with the required amount of expertise, along with support from the highly tech-savvy team of the offshore accounting company.

• Time and Cost Savings on Hiring Processes

Whether you are a small or a large firm, you will agree that recruitment is a relatively rigorous task. It takes much time and cost to get it right. As a result, you cannot dedicate your entire time to executing your core activities. Partnering with an offshore accounting firm or an outsourced accounting services provider saves you from all that struggle while saving you heavily in terms of recruitment, training, and other hidden costs.

• Financial Advisory

Most modern outsourced accounting firms serve as financial advisor to their clients, helping them deliver strategic guidance on critical financial matters. Some crucial areas where outsourcing firms excel with their financial advisory include insights on cost reduction, investments, and revenue enhancement strategies.

In this brief scope of outsourced accounting services, it becomes rather evident that these services have an integral role in the everyday business operations of any CPA or accounting firm. Partnering with these service providers gives you access to focus on core activities, attain higher efficiency, and even grow your profit margins.

How Outsourced Accounting Services Boost Productivity & Profitability?

Since the beginning of time, outsourcing has always been associated with profitability and productivity; businesses across industries have leveraged outsourcing to save time and money, and the accounting industry is no different. While the role of outsourcing accounting companies has changed over time, they remain one of the most trusted ways to boost productivity and profitability.

Here are the reasons why:

• Business Scalability

Accounting as an industry sees the volume of work go up during the peak tax season and various other occasions. This makes capacity planning a tricky task for accounting leaders and CPAs; however, outsourcing accounting services allows you to scale your financial management processes effortlessly without any prolonged planning. The best thing is that you can save time on hiring additional resources to adapt to your evolving requirements.

• Hands-on Financial Management

Most outsourcing accounting service providers adopt a hands-on approach to financial management for their clients. They proactively deliver real-time insights and analysis to help their clients formulate growth strategies and mitigate risks.

• Get Your Focus Back on Business Growth Activities

One of the most significant advantages of outsourcing accounting services is that it frees up ample time for your in-house employees, allowing them to contribute to the business growth activities actively. By outsourcing mundane and repetitive tasks, you heavily boost the productivity of your in-house teams while making processes streamlined and growing the profit margins.

• Business Continuity and Stability

Outsourcing accounting service providers have a team of accounting experts who are trained to handle an impending ill-effect of economic turmoil, providing the necessary business continuity and stability you need. These service providers can also withstand any unforeseen global disruption, making them the ideal partner to have by your side in the modern business landscape.

• Adherence to Compliance

Outsourcing accounting service providers stay updated with all the recent financial regulations and policies to deliver up-to-date services with absolute adherence to compliance. These service providers also take all precautionary measures to minimize any potential error or non-compliance.

Through all the aforementioned strategies, outsourced accounting service providers help CPAs and accounting leaders boost productivity and profitability while staying compliant with regulatory regulations and policies.

Closing Arguments

Outsourcing has been a game-changer in the business world across industries. It is the same with the CPA and the accounting world. By partnering with a professional outsourcing accounting services provider, you can save valuable time, cost, and resources in your day-to-day operations while streamlining operations and processes to accelerate your core operations.

By partnering with an outsourcing firm, you not only lighten the burden of mundane financial tasks for your employees but also get instant access to advanced technology and specialized skills to innovate and grow. If growth is what you are after at your CPA firm, we have a comprehensive suite of services tailored to meet business needs to the core. Just write to us at marketing@datamaticsbpm.com, and we will have one of our accounting specialists reach out to you in a jiffy