Table of Contents

Understanding A Stress-Free Tax Filing Season for CPAs

Tax seasons being stress-free is as oxymoronic as it can get. Whether you are an individual, an enterprise, or a well-oiled CPA firm, a stress-free tax filing season seems impossible. It can get excruciatingly tough for a Certified Professional Accountant (CPA) firm.

It can be a demanding period for Certified Public Accountants (CPAs) laden with looming deadlines, clients looking for expert guidance, and the immense pressure to adhere to and keep up with the constantly changing tax regulations, deadlines, and more.

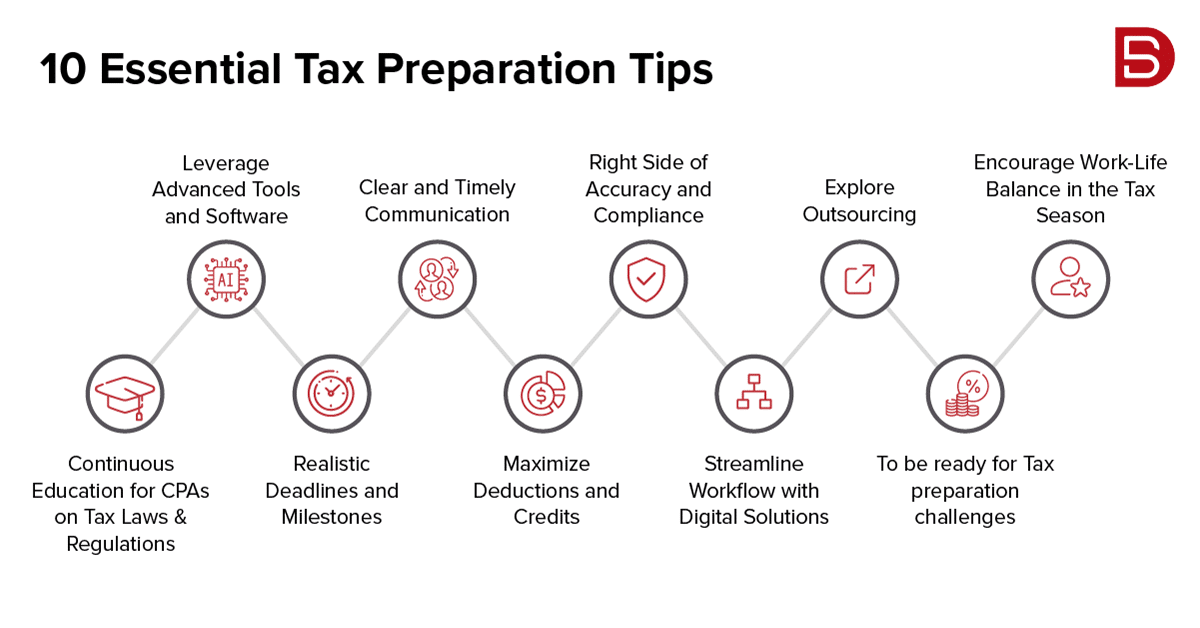

However, irrespective of how oxymoronic it sounds, there are ways in which CPAs can have a stress-free tax filing season. This blog discusses ten essential tax preparation tips to help CPAs navigate the challenging tax season and elevate their service standards for their clients.

These tax preparation tips for CPAs combine effective time management strategies, workflow streamlining maneuvers, and a clear focus on professional development and the well-being of the resources available. By leveraging these tax preparation tips, CPAs can not only sail through the tumultuous tax season with great ease but also elevate the standards of their services.

So, without further ado, let us give you the ten essential tax preparation tips and help you have a stress-free tax season.

1. Continuous Education for CPAs on Tax Laws and Regulations

The taxation landscape is ever evolving, with constant changes and updates to federal, state, and local tax regulations. As a CPA, the onus is on you to stay at the forefront of all these changes, make necessary amendments to your service offerings, and update your clients on the impact of the updates/changes.

Continuous education for CPAs on tax laws and regulations is an investment every CPA firm must make in favor of their growth. By adapting to changes and staying informed, you ensure professional development for you and your client’s financial well-being.

2. Leverage Advanced Tools and Software for Organizing Client Data

The modern CPAs are spoilt with choices regarding advanced tools and accounting software. All these tools improve data accuracy and security, giving them an incredibly efficient way to organize client data. Using technologies like Optical character recognition (OCR), CPAs can easily extract data from scanned documents, significantly reducing human error and manual labor.

Advanced accounting software also offers faster and more accurate data analytics, which substantially helps CPAs identify tax-saving opportunities, trends, and anomalies within client financial data. CPAs leveraging these tools will always have an edge over their counterparts and will deliver superior service to their clients.

3. Set Realistic Deadlines and Milestones

Tax preparation and filing, irrespective of whether you are an individual or a seasoned CPA firm, is a meticulous process. It requires an eye for detail, careful planning, and timely execution. One of the most effective tax preparation tips to have a fruitful tax season for Certified Public Accountants (CPAs) is to have realistic and achievable deadlines.

Having realistic deadlines gives you a structured approach and workflow for your tax preparation. It will enable you to allocate time and resources accordingly, ensuring the entire process is carried through systematically and smoothly. Furthermore, having achievable milestones will allow CPAs to prioritize tasks based on their severity and complexity.

This will ensure that you tackle time-sensitive tasks first, thus consequently minimizing the last-minute rush and any potential risk of error.

4. Ensure Clear and Timely Communication

Maintaining clear and timely communication with your clients during tax season is essential for seamless onboarding. These practices also allow CPAs to foster firm client relationships, ensuring all your clients are well informed and prepared to navigate the tax season with absolute transparency. You must communicate the necessary documents, timelines for each phase, and any permission from your client for efficient tax processing.

5. Maximize Deductions and Credits

As a CPA, you must stay current with every impending or ongoing change in local, state, and federal tax laws and regulations. Understanding the latest rules will allow you to identify any helpful deduction or credit that can benefit your client. You must also encourage your clients to maintain detailed records of all their expenses, incomes, and financial transactions. These records will make it easier to establish if they are eligible for any deductions or credits.

6. Stay on the Right Side of Accuracy and Compliance

As a CPA, you are responsible for ensuring that your clients’ tax preparation and filing is done with absolute accuracy and according to the applicable tax rules. You must carefully review all client documents, such as W-2s, financial statements, supporting documentation for deductions and credits, and 1099s.

It would help if you also took the necessary measures to verify the accuracy of the information shared by your client. If possible, you must introduce a systematic process for double-checking all data entries manually or using any relevant accounting software.

7. Streamline Workflow with Digital Solutions

We live in a digital world; streamlining your tax preparation and filing workflow using digital solutions must always be atop the CPA’s priority lists. You can make your workflows efficient and significantly boost the client experience by giving them an incredibly safe, accessible, and collaborative work environment for tax preparation services. Furthermore, transitioning to a paperless workflow by digitizing your processes and documents using document management software will make storing documents easier, sharing them with relevant authorities, and cutting down on the clutter you see on your desks.

8. Explore Outsourcing

Outsourcing has emerged as an effective strategic decision for CPAs looking to minimize their tax preparation operational costs while improving overall efficiency and maintaining a high standard of service.

You must explore the different outsourcing options if you’re looking for the same. However, when considering outsourcing as an alternative for your tax preparation needs, you must do proper due diligence, plan everything carefully, and maintain transparent communication with your outsourcing partner. This will ensure that the services you are availing are suited to your business needs and compliant with all relevant regulations.

9. Prepare for Unexpected Tax Preparation Challenges

It’s impossible for any CPA firm, irrespective of its size, to accurately predict tax preparation challenges that might arise. Thus, you must prioritize educating your team on complex tax laws, introducing proper cybersecurity measures, and maintaining client communication to build an agile and resilient tax function. You must conduct periodic assessments of your tax preparation processes and practices to address any possible shortcomings or areas of improvement.

10. Encourage Work-Life Balance in the Tax Season

The hectic tax season can easily cause heavy burnout. Thus, it would help if you took the necessary precautionary measures to care for yourself and your team as and when needed. You need to maintain a positive work environment during the tax season by prioritizing your and your team’s mental and physical health.

This will allow you to function at an optimum level and avoid burnout. Remember to celebrate every small or significant milestone and achievement, acknowledging your team’s hard work and accomplishments. These small celebrations can do wonders for the morale of your team.

Final Words

While these are some of the most effective tax preparation tips, you must explore additional ways to create a stress-free and healthy environment for your team during peak tax season. All these tips will help you enhance the effectiveness of your overall service offering, broaden your valuable services to clients, and help you seamlessly navigate tax season with ease and success. If you need any further help, you can always reach out to us at marketing@datamaticsbpm.com, and we will have our tax experts reach out to you with a solution to address your tax woes.