The Canadian accounting industry is undergoing a rapid digital evolution, mirroring global trends driven by shifting client expectations and cutting-edge technologies. For CPA firms in Canada, embracing digital transformation is no longer optional — it’s essential. With increasing regulatory demands, cloud-based platforms, and the growing need for efficiency, Canadian Chartered Professional Accountants (CPAs) are reimagining how they deliver value.

Looking to digitize your Canadian CPA firm? Discover how digital transformation is reshaping accounting in Canada — from cloud adoption and AI to automation tools built for compliance, speed, and client satisfaction.

In this blog, we explore the digital revolution sweeping Canadian CPA firms, the challenges that come with it, and the benefits that await those who embrace innovation. Whether you’re a Chartered Professional Accountant in Canada or managing an accounting practice, here’s your roadmap to future-proofing your firm.

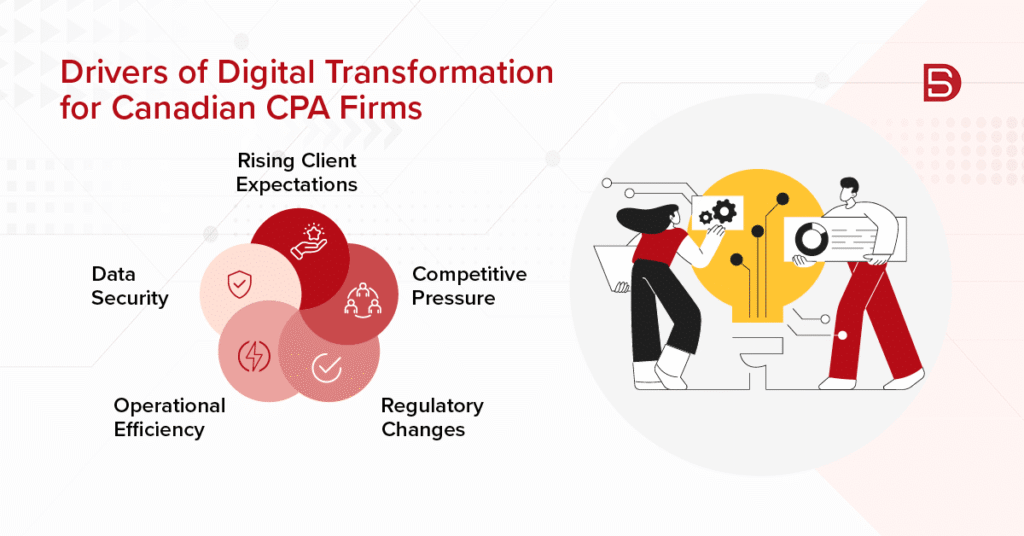

Drivers of Digital Transformation for Canadian CPA Firms

The digital shift in Canada’s accounting sector is fueled by:

Rising Client Expectations: Clients now demand real-time access, faster reporting, and proactive support. Going digital is essential to meet these evolving needs.

Competitive Pressure: Fintech startups and global firms are disrupting the industry. Canadian accounting firms must modernize to stay relevant.

Regulatory Changes: Initiatives like the Canada Digital Adoption Program (CDAP) and the Retail Payments Activities Act are accelerating tech adoption in accounting.

Operational Efficiency: Manual bookkeeping is outdated. Canadian CPA firms are leveraging automation to cut costs, reduce errors, and save time.

Data Security: With strict data privacy laws in Canada, firms are prioritizing secure digital solutions that ensure client compliance and protection.

The Rise of Modern Accounting Systems in Canada

Legacy systems are rapidly being replaced by modern accounting software in Canada, enabling:

- Real-time financial reporting

- Cloud-based bank feed integrations

- Automated expense tracking

- Seamless multi-user collaboration

Platforms like Xero Canada, QuickBooks Online Canada, and Sage Intacct are gaining traction as firms seek scalable, secure, and client-friendly solutions.

If you’re ready to begin your digital transformation journey in Canada, start here:

- Assess Internal Systems: Identify outdated tools and inefficiencies in your workflow.

- Set Clear Goals: Define outcomes — better reporting, higher accuracy, or improved client experience.

- Choose Canadian-Compatible Tools: Opt for trusted platforms like QuickBooks Online Canada or Xero Canada.

- Train Your Team: Upskill your workforce to confidently use new systems.

- Start Small, Then Scale: Test tools with a pilot before rolling them out firm-wide.

- Track Performance: Monitor KPIs to ensure continuous improvement.

Conclusion

Digital transformation in Canadian accounting is unlocking new avenues for growth, efficiency, and compliance. Whether you’re looking to automate tasks, adopt cloud accounting, or enhance data security, now is the time for Canadian CPA firms to invest in the future. With the right tools and training, you can scale your firm while delivering world-class service.

Canadian CPA firms are adopting digital transformation to stay ahead — from cloud accounting platforms to automation and AI. Learn how your firm can lead the change.

Need help building your digital roadmap? Contact us at marketing@datamaticsbpm.com, and our experts will guide you with a tailored digital transformation plan for CPA firms in Canada.

What is driving digital transformation in Canadian accounting?

Key drivers include Canadian regulatory changes, tech-savvy clients, cloud platforms, and automation for operational efficiency.

How can Canadian accounting firms digitize their processes?

Begin with a tech audit, adopt cloud accounting tools like QuickBooks Online Canada, train your team, and phase out manual practices.

What are the benefits of digital tools for Canadian CPA firms?

They offer faster reporting, greater accuracy, cost savings, better client collaboration, and compliance with Canadian data regulations