For the accounting industry, September is one of the most challenging months. With heightened quarterly filings, increased tax extension challenges, and staff burnout, CPA firms are constantly seeking ways to survive this period by implementing proper resource capacity planning and achieving increased profit margins. The September busy season CPA crunch can hamper the growth trajectory for CPA firms by stretching their resources thin, causing staff stress, missed deadlines, and even revenue leakage if not done properly.

To overcome this stressful period, CPA firms often turn to outsourcing as a practical and scalable solution. With the right accounting outsourcing partner by their side, CPA firms can reduce strain, manage peak workloads, and ensure service excellence without compromising accuracy. In this blog, we will explore the growing use of outsourcing by accounting firms as an effective solution to turn stress into scalable success. So let us begin.

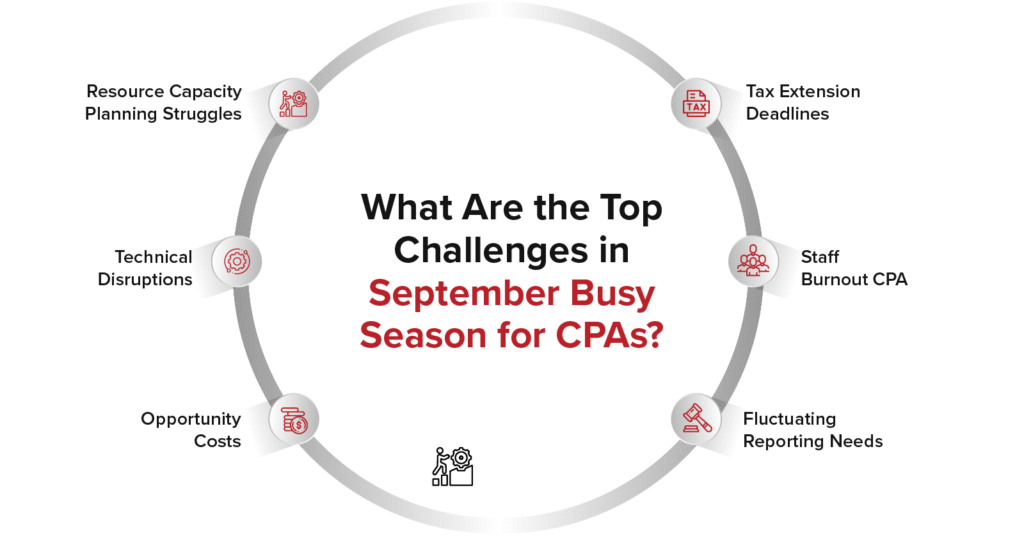

Top Challenges in September Busy Season for CPAs?

As the September busy season CPA rush approaches, internal teams, firm partners, and associates are suddenly faced with increasing workloads, constantly tightening statutory deadlines, and a growing risk of staff burnout. The common challenges that the September busy season throws at CPAs include:

- Tax Extension Deadlines: With fast-approaching September 15 deadlines, followed by September 30 audits, CPA firms often find themselves facing a staff capacity crunch.

- Staff Burnout CPA: The staff burnout rates at CPA firms increase sharply, with as many as 55% of accountants citing increased stress and emotional exhaustion during September, compared to only 41% in other jobs.

- Fluctuating Reporting Needs: The constant changes in tax law and the complex demands of clients require CPA firms to accommodate diverse reporting needs.

- Resource Capacity Planning Struggles: During the peak September period, the internal teams at CPA firms might be required to work as many as 50+ hours/week just to “keep up”.

- Technical Disruptions: With the increasing push to digitize the entire accounting function, CPA firms must contend with technical disruptions, such as data mismatches on tax portals, which hinder their compliance workflows and risk management.

- Opportunity Costs: If your internal team is frantically running here and there to keep up with the deadlines and extensions, the chances of them delivering high-value advisory services takes a back seat, resulting in you missing out on some growth opportunities.

Key Takeaway: The September busy season CPA crunch elevates the risk factor for CPA firms, increasing the chances of costly errors and burnout within their internal teams.

How does outsourcing help CPA firms manage increased workload and tight deadlines?

Partnering with a seasoned CPA outsourcing service provider gives you instant access to a rich pool of trained professionals who can help you with your peak season demands when you need them. This reduces a significant burden from your teams and prevents the overstretching of internal teams.

- Scalability on Demand: By opening their pool of trained professionals, outsourcing service providers allow you to scale your operations without hiring permanent staff during the September peak season.

- Workflow Efficiency: Outsourcing service providers have a team of seasoned bookkeeping, tax preparation, and reconciliation experts who take on these tasks from internal teams, resulting in ample free time for senior accountants to deliver client advisory services.

- Stress Reduction in Firms: Outsourced staff takes care of your increased workload, allowing you to work manageable hours and prevent staff burnout.

- Time Zone Advantage: In general, the offshore service providers operate in different time zones, which creates a 24-hour work cycle for your firm, while giving enough time for your internal staff to rest.

Key Takeaway: Outsourcing helps CPA firms manage workload efficiently while aligning their resources properly and protecting them from any immediate stress, ensuring deadlines are consistently met.

What functions are best suited for outsourcing during the peak season?

While outsourcing certainly is one of the most effective solution to September stress, it is important to know what accounting functions will be most benefitted by outsourcing. If you are thinking about leveraging outsourcing this September, here are some accounting functions that you must outsource:

- Tax Preparation: With extended deadlines and increasing number of quarterly filings, tax preparation certainly is one area that can be efficiently handled by expert outsourced professionals.

- Bookkeeping: Routine entries and reconciliations take up a lot of time and hence are best suited for delegating them to outsourced accounting service providers. This will ensure increased accuracy and freeing up of useful time for your staff.

- Payroll Processing: With mid-year adjustments coming into effect in September outsourcing payroll processing is a smart way to ensure compliance and timeliness.

- Accounts Payable/ Accounts Receivable: AP and AR demands highest level of precision but not senior-level oversight. Thus, you are better off outsourcing these services.

- Audit Support: For audit function, you can easily offload the additional data checks and document processing, while the auditors focus on higher-level review.

Key Takeaway: By harnessing the power of advanced accounting outsourcing solutions for tax, bookkeeping, payroll, and audit support, CPA firms gain the ability to efficiently manage complex client demands during the September busy season and CPA rush.

Can outsourcing improve accuracy and reduce burnout among CPA firm staff?

September’s peak season workload has a severe adverse effect on the staff’s well-being and overall accuracy in accounting tasks. Exhausted employees can lead to an increase in errors and prolonged working hours for tasks that can be completed on time through outsourcing. Here’s how CPA firms can leverage outsourcing to boost their overall accuracy and reduce staff burnout.

- Error Reduction: By having dedicated teams to handle your tax, audit, or bookkeeping tasks, CPA firms work in structured workflows, with multiple review layers, and harness the power of advanced accounting tools to reduce errors in general.

- Staff Well-Being: By offloading time-sensitive and routine accounting tasks, CPA firms gain the ability to ease mental and physical strain on their in-house team. This reduced overtime helps reduce staff burnout and CPA concerns.

- Improved Client Satisfaction: By timely delivering tasks and beating the deadlines, outsourcing firms help establish your firm as a trusted accounting partner for your clients.

- Sustained Growth: By having teams that are not under severe stress, your in-house team gains the ability to deliver high-value advisory services, improving long-term profitability.

Key Takeaway: While outsourcing certainly is a great solution to bring down your overhead costs, it helps immensely in reducing your staff burnout, improving accuracy, and ensuring that your team thrives during the toughest part of the year.

The September busy season CPA crunch is a recurring event. But your team does not have to undergo stress, burnout, and late nights every year. By embracing CPA firm outsourcing benefits, you can seamlessly manage tax extension challenges, improve accuracy, and build a healthier work environment for your staff.

Whether you are looking to outsource tax preparation, routine bookkeeping, or enhance client service delivery, accounting outsourcing solutions can help you accomplish everything, providing the necessary scalability and expertise you need. If you are looking for a reliable outsourcing partner for your CPA firms that can help you navigate the September peak season workload efficiently, write in to us at marketing@datamaticsbpm.com, and we will have our accounting experts reach out to you with solutions perfectly tailored to meet your needs.

What makes September particularly challenging for CPA firms?

September is tough due to tax extension deadlines on September 15 and audits by September 30, causing increased workload, staff burnout (about 55% report stress), and stretched resources that risk errors and missed deadlines.

What are the most common challenges CPA firms face during the September busy season?

Challenges include tight tax extension deadlines, staff burnout, fluctuating reporting needs, resource capacity planning struggles (50+ work hours/week), technical disruptions in digital workflows, and opportunity costs from shifting focus away from advisory services.

How does outsourcing help CPA firms during the September busy season?

Outsourcing provides scalable access to trained professionals who handle peak workload tasks like bookkeeping and tax prep, reducing staff stress, improving workflow efficiency, enabling a 24-hour work cycle across time zones, and ensuring deadlines are met.

Which accounting functions are best suited for outsourcing during September?

Tax preparation, bookkeeping, payroll processing, accounts payable/receivable, and audit support are ideal to outsource, allowing internal teams to focus on high-value advisory work while maintaining accuracy and compliance.

How does outsourcing improve accuracy and reduce burnout for CPA firm staff?

Dedicated outsourced teams work in structured workflows with multiple reviews, minimizing errors. This reduces overtime and mental strain on internal accountants, improving staff well-being and client satisfaction during the hectic September period.

Can outsourcing help CPA firms sustain growth despite September’s busy season pressures?

Accordion Content

What is the key benefit of partnering with an outsourcing firm for CPA seasonal challenges?

The key benefit is seamless scalability and expert support that alleviates workload pressure, helping CPA firms handle tight deadlines, improve service quality, and maintain a healthier work environment.