For anyone running a CPA firm or working inside one in the USA, the pressure of rising client expectations, growing compliance complexity and the severe shortage of qualified tax professionals is no longer “breaking news.” All these forces not only hamper the growth of your CPA firms but also squeeze your profit margins. As a result, every CPA firm in the USA is in dire need of an effective solution to overcome these challenges. Moreover, this is where corporate tax outsourcing comes into play.

Corporate tax outsourcing services are fast becoming a tried and tested means to grow your CPA firm, as opposed to being considered merely a cost-cutting measure. Every modern, forward-thinking CPA firm in the USA is leveraging corporate tax outsourcing services to scale their practices, boost service delivery, and compete on all fronts. Corporate tax outsourcing solutions are not about replacing your existing team; they are about helping your team amplify what your firm can accomplish.

In our latest blog, we answer all the practical questions that CPAs and firm owners are asking: How does corporate tax outsourcing actually work? Why are established firms shifting to corporate tax outsourcing consulting? How do you maintain quality and client relationships? And most importantly, how do you evaluate whether corporate tax preparation outsourcing is the right move for your practice?

Whether you’re considering corporate tax outsourcing services for the first time or looking to optimize an existing arrangement, this blog provides the tactical insights and step-by-step guidance you need to make informed decisions.

How do we define modern corporate tax outsourcing services in the current regulatory environment?

In the current regulatory environment, corporate tax outsourcing is a strategic partnership between a CPA firm and a third-party tax preparation outsourcing service provider to handle tax preparation, tax calculation, corporate tax consulting, and compliance with corporate returns (e.g., Forms 1120, 1120-S, 1065).

As opposed to the “body shopping” days of the past, modern corporate tax outsourcing solutions offer specialized services. They provide:

- Tax Preparation & Technical Review: Preparation of workpaper, handling data entry, and preliminary tax return reviews.

- Provision Support: Assistance with ASC 740 tax provisions for larger corporate clients.

- Niche Expertise: Access to specialists in R&D credits, state and local tax (SALT), or international tax compliance (Forms 5471/8858).

💡 Is Outsourcing Right for Your Accountancy Firm?

Take our quick self-evaluation to assess whether outsourcing or offshoring fits your firm’s goals.

Instantly discover how it can impact cost savings, capacity, and growth potential.

No commitment. Just tailored insights in less than 2 minutes.

Why are established CPA firms shifting to corporate tax outsourcing consulting?

For most CPA firms, the key driver behind the shift is effective capacity management. By partnering with a strategic outsourcing service provider, CPA firms can offload the “grunt work” of data entry and basic reconciliation. As a result, their senior staff and partners can pivot to focus on tax planning, M&A due diligence, and high-level client strategy.

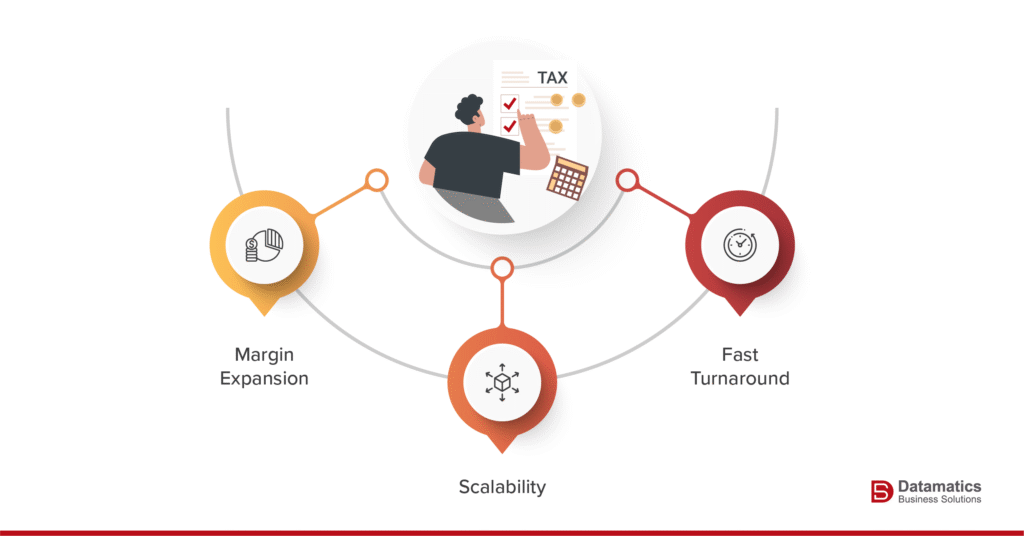

Key benefits include:

- Margin Expansion: Leverage offshore or domestic outsourcing hubs to bring down cost-per-return and maintain competitive pricing while increasing firm profitability.

- Scalability: By outsourcing your grunt work, CPA firms can increase their capacity for corporate clients without hiring new full-time employees in a tight labor market.

- Fast Turnaround: Most outsourcing service providers work in different time zones, which allows work to be processed while your domestic team sleeps, often resulting in “overnight” delivery of draft returns.

What is the difference between corporate tax outsourcing services, corporate tax outsourcing solutions, and corporate tax outsourcing consulting?

Corporate tax outsourcing services encompass various aspects of corporate taxation, often bundled into a package. If you are considering corporate tax outsourcing, let us give you the details of some common terminology you’ll encounter:

- Corporate Tax Outsourcing Services: These services involve the delivery of tax work, including the preparation of corporate returns (1120, 1120S, 1065), compliance work, tax provision calculations, research memos, extension filings, and other tasks.

- Corporate Tax Outsourcing Solutions: These solutions encompass broader infrastructure and systems that often enable outsourcing through technology platforms, workflow management tools, secure data exchange systems, quality control frameworks, and the operational model. These solutions connect your firm with external resources.

- Corporate Tax Outsourcing Consulting: These advisory services help your firm evaluate, implement, and optimize an outsourcing strategy. These services include help regarding process design, vendor selection, change management, staff training, and ongoing performance optimization.

What types of corporate tax work are commonly outsourced?

The spectrum of corporate tax outsourcing services ranges from routine to complex:

Most commonly outsourced services:

- Corporate income tax return preparation (1120, 1120S, 1120-F)

- Partnership return preparation (1065)

- Multi-state tax return preparation

- Extension preparation and filing

- Quarterly estimated tax calculations

Specialized outsourced services:

- R&D tax credit studies and calculations

- Cost segregation studies

- Transfer pricing documentation

- International tax compliance (Form 5471, 8865, 8858)

- Sales and use tax returns

- Tax research memoranda

Advisory Work (less commonly outsourced, but possible):

- Tax planning scenario modeling

- M&A tax due diligence support

- Entity structure analysis

What types of CPA firms benefit most from corporate tax outsourcing?

Corporate tax outsourcing is beneficial for CPA firms of all sizes. However, certain profiles see the greatest benefit:

Small to mid-sized firms (5-50 professionals):

- These have the capacity to grow; however, they lack the resources to efficiently recruit and retain specialists.

- These firms often have seasonal capacity issues, but can’t justify full-time hires.

- These are the firms that intend to offer sophisticated services (international tax, R&D credits) without hiring niche experts.

Growing firms actively pursuing new clients:

- These firms need to scale rapidly to keep serving new businesses.

- These firms are on an acquisition spree and need to integrate capacity.

- These firms are expanding into new geographic markets or service lines.

Firms with high staff turnover or recruitment challenges:

- These firms are located in markets where recruiting qualified accountants and tax professionals is difficult.

- These firms experience high turnover and need stability.

- These firms are competing with larger firms or the industry for the same talent pool.

Firms seeking to reposition toward advisory services:

- The firms are looking to move up the value chain from compliance to advisory.

- The firms that need to free up senior staff time for client-facing work

- The firms are trying to improve realization rates by having appropriate-level staff doing appropriate-level work.

Final Takeaways: Why Corporate Tax Outsourcing Matters for CPA Firms?

Corporate tax outsourcing is no longer about cutting costs; it is about strategically doing the right work at the right level. By leveraging corporate tax outsourcing services, CPA firms gain flexibility, protect margins, and enable their senior resources to deliver high-value advisory conversations.

If you are a CPA firm in the USA facing talent shortages, rising client expectations, and tighter deadlines, we offer corporate tax outsourcing, consulting, and solutions to deliver the structural advantage your firm needs. Just write in to us at marketing@datamaticsbpm.com, and we will have our tax experts reach out to you to understand your business goals and tailor solutions accordingly.

Is corporate tax outsourcing suitable for firms that already have an in-house tax team?

Yes. Many firms use corporate tax outsourcing to augment their existing team, not replace it. It helps absorb seasonal spikes, reduce overtime, and free senior staff from prep-heavy work so they can focus on review, planning, and client advisory.

What types of corporate tax work should never be outsourced?

Final tax positions, complex elections, strategic tax planning, and client-facing advisory should stay in-house. Outsourcing works best for structured, repeatable execution work that follows clear instructions and review protocols.

How quickly can a CPA firm see ROI from corporate tax outsourcing?

Most firms see measurable ROI within the first busy season, through reduced turnaround time, fewer bottlenecks, improved realization rates, and better staff utilization.