In the digital world, the software you use defines who you inherently are. The infamous Android and iOS fan clubs are a glaring example of it. While it holds for personal life, it isn’t too far away from the truth regarding business, especially when discussing the US finance and accounting professionals. Accounting and bookkeeping software for modern CPAs is more than just a digital ledger—it’s nearly the operational backbone of your business.

The accounting and bookkeeping software that the CPAs use makes it easy for them to manage multi-client books and file tax returns, and it empowers them to offer cloud-first, secure, and scalable accounting solutions.

It’s 2026, and there is no shortage of high-quality accounting and bookkeeping software for CPAs. In this blog, we will take a closer look at some of the best accounting software for CPAs and help you find the most suitable option for your CPA firm. We will also compare the leading software in the market to make it easy for you to make an informed and cost-effective choice.

But before we start, let us learn why selecting the right accounting software is critical for CPAs.

Why Is Choosing the Right Accounting Software Crucial for CPAs?

In the early days, CPAs were mainly considered number crunchers. We have come a long way since then. CPAs today have much more evolved roles and are regarded as strategic advisors to their clients. With the huge advent of finance and accounting technology, modern CPAs can easily be considered the catalysts of digital transformation for their clients, and hence, they must have the right tools to help them make their decisions effectively.

The right accounting software for CPAs will help them with –

✅ Multi-client management

✅ Multi-client management Real-time collaboration with clients

✅ Multi-client management Accurate tax compliance and filing

✅ Multi-client management Automation of recurring tasks

✅ Multi-client management Audit trails and data security

✅ Remote work capabilities

Having the proper accounting and bookkeeping software in your arsenal can save costs, scale operations, improve turnaround time, and remain competitive in the ever-evolving CPA industry.

Must have Features in Accounting Software for CPA firms

Before discussing the top accounting software contenders, knowing what exactly makes a good accounting software is imperative. If you’re in the market looking for good accounting software, here are all the key features that you must look for –

📈Scalability

👥 Multi-client Management

🔗Integrations with other software and platform

🧾Support for local, state, and federal tax filing

🗃️Ability to upload various documents and access reports for streamlining communication

✉️Minimize email clutter

🧠Auto-categorization

🏦Bank reconciliation,

📅 Scheduled reporting

🔗Integration with payroll software, CRM, time tracking tools, and document management systems.

💬 Responsive customer service and onboarding resources Feain

Ready to Grow Your Accounting Firm?

Discover proven strategies used by top CPA firms to scale faster. Grab your free copy of eBook and start unlocking growth today.

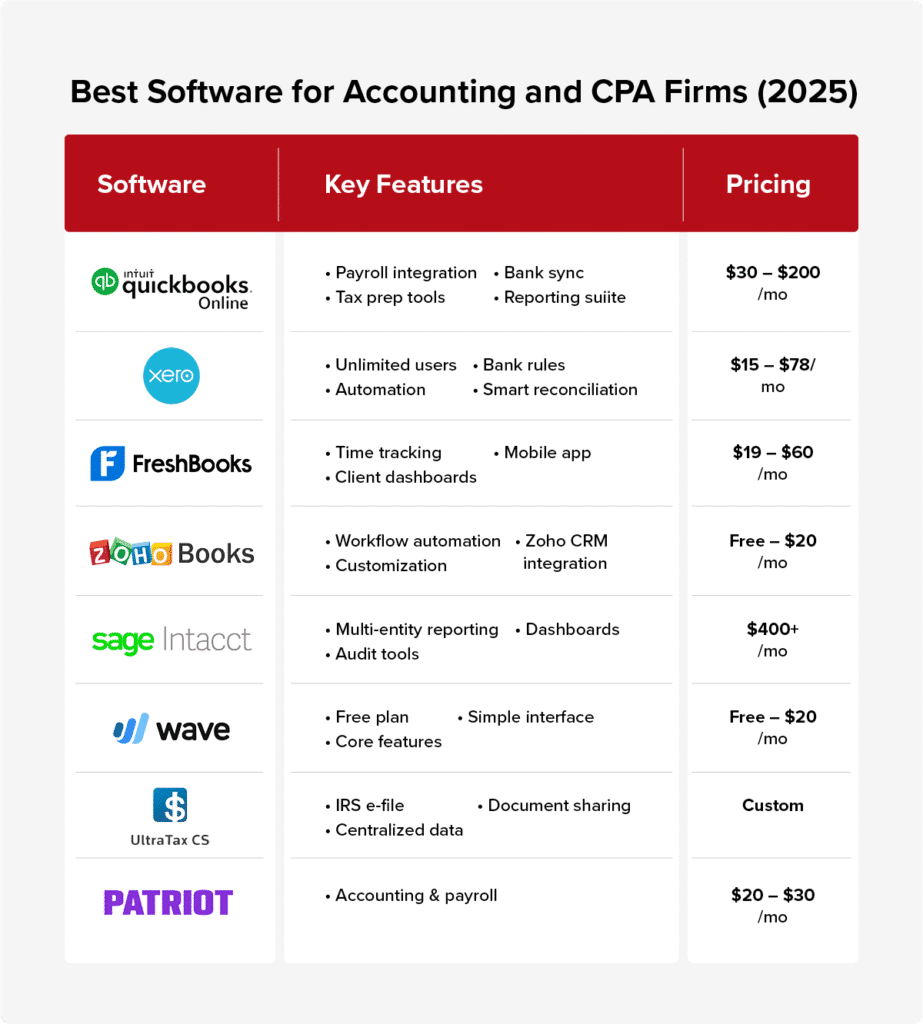

Top 8 Best Accounting Software for CPAs (2026 Edition)

Now that you’ve understood the significance of having the right accounting software by your side and the key features that make a great accounting software. Let us take you through the eight accounting software programs necessary for any CPA.

1. QuickBooks Online

The most used platform in the US, QuickBooks Online offers a robust set of features equally crucial for freelancers, small businesses, and multi-CPA firms. The key features of QuickBooks Online include:

- Payroll integration

- Tax prep tools

- Bank sync

- Reporting suite

Time tracking

QuickBooks Online tools are perfect for CPAs who manage multiple small—to mid-sized businesses. Depending on the business need, QuickBooks Online can cost between USD 30/Month and USD 200/Month.

Pros:

- Established ecosystem

- CPA-specific reporting templates

- Integrates with TurboTax and ProConnect

Cons:

- Cost scales quickly with features

- Occasional sync issues with banks

2. Xero

Xero is QuickBooks’s closest international competitor and is gaining serious ground on QuickBooks with its sleep UI and advanced automation features, which are ideally suited to modern CPA firms. Xero is an ideal platform for CPA firms looking for ease of use and seamless third-party integrations. Xero’sIts pricing ranges from $15 to $78/month.

Pros:

- Unlimited users in all plans

- Beautiful dashboard and UI

- Bank rules and smart reconciliation

Cons:

- Tax features are less comprehensive than QuickBooks

- The learning curve for U.S.-specific compliance

In the Xero vs. QuickBooks debate for tax firms, Xero excels in user experience and multi-user flexibility but may lack U.S.-centric tax features.

3. FreshBooks

Started as an invoicing tool, FreshBooks is now a well-established, full-fledged accounting and bookkeeping software solution ideally suited for small CPAs, solo practitioners, and bookkeeping freelancers. The FreshBooks pricing ranges from $19 to $60/month.

Pros:

- Outstanding time tracking

- Client-facing dashboards

- Strong mobile experience

Cons:

- Not built for high-volume accounting

- Weak double-entry accounting features

If your accounting and bookkeeping outsourcing requirement involves handling simple accounting tasks and stringent client communications but not complex tax work, FreshWorks is just the perfect tool.

4. Zoho Books

Zoho has a comprehensive suite of enterprise tools, including Zoho Books, which offers state-of-the-art automation and accounting ecosystem compatibility. Zoho Books stands out with its incredible value-for-money ratio, making it one of the market’s most powerful accounting and bookkeeping software. If your firm already leverages the Zoho ecosystem for automation and defining marketing workflows, then Zoho Books is just the perfect tool. One of the most impressive features of Zoho Books is that if your revenue is under $50,000, it is free for you; for enterprises with revenue above $50,000, it can cost you around $20/month.

Pros:

- Deep automation workflows

- Easy customization

- Integration with Zoho CRM and Projects

Cons:

- Fewer tax-specific features

- Complex initial setup

For its price, Zoho Books offers unmatched value for anyone looking for a fully integrated, automated workflow.

5. Sage Intacct

Sage Intacct accounting software is a Cloud-based ERP accounting solution developed for scale. The tool is perfect for mid- to large-sized CPA firms that manage large volumes of data and multiple entries. Also, if you are looking for granular reporting, Sage Intacct is the perfect solution for you. Pricing for Sage Intacct begins around $400/month.

Pros:

- Advanced multi-entity reporting

- Audit-ready compliance tools

- Real-time dashboards

Cons:

- A tad expensive for small firms

- Too steep learning curve

If you are a CPA firm and manage multiple subsidiaries or international clients, Sage Intacct can be a great value addition to your operation.

6. Wave Accounting

Wave Accounting is a perfect lifesaver and ideal solution for smaller CPA firms or freelancers starting. If you are on a tight budget or do not have a deeper pocket to get an established accounting software, Wave Accounting software is just the perfect solution for you. You can start with Wave Accounting for free or get a plan for as low as $20/month.

Pros:

- 100% free core accounting features

- Clean and simple dashboard

Cons:

- No phone supports

- Lacks depth in features

For solo practitioners or small CPA firms that cannot afford expensive accounting software such as QuickBooks, Wave Accounting is your friend.

7. UltraTax CS by Thomson Reuters

As the name suggests, UltraTax CS by Thomson Reuters is built specifically for tax professionals looking to ease up their burden a bit during the tax filing season. The pricing for UltraTax CS can be customized according to your firm’s needs.

Pros:

- IRS e-file integration

- Centralized client data

- Secure document sharing

Cons:

- Requires dedicated training

- Expensive for small teams

If you’re a CPA looking to sail through the high-volume tax return requests during peak season, UltraTax CS is the way to go.

8. Patriot Software

Patriot is primarily for small to mid-sized CPA firms in the USA looking for practical tools for managing accounting and payroll workloads simply yet effectively. While it mainly focuses on accounting tasks, it also seamlessly offers coffers capabilities for accounting functions. The pricing for Patriot starts from $20–$30/month, and for an additional $2an 0/month, you can include payroll as part of the package.

Pros:

- Made in the USA, great support

- Very easy to use

Cons:

- Limited integrations

- Not suitable for large firms.

Best Accounting Software for CPA Firms in 2026 (Quick Summary)

- QuickBooks Online – All-around favorite with solid features for small to mid-sized firms.

- Xero – Clean UI and unlimited users; excellent for automation and collaboration.

- FreshBooks – Best for solo CPAs and freelancers; excellent time tracking.

- Zoho Books – Inexpensive with extensive automation; ideal for Zoho users.

- Sage Intacct – Cloud ERP with enterprise-level features; ideal for large, multi-entity firms.

- Wave Accounting – Free core functionality; ideal for startups and small CPA practices.

- UltraTax CS – Designed for tax-dominant firms; automates high-volume filings.

- Patriot Software – Easy, U.S.-manufactured solution with optional payroll add-ons.

Considering the diverse nature of work that every CPA firm delivers in the USA, it would be highly unfair to rank one accounting and bookkeeping software as “the best” software out there. This is why, depending upon the nature of your CPA firm’s work or the client base you cater to, you can easily pick the best accounting software for you, which can be entirely different from the one that works for your counterpart.

Hence, when you’re in the market looking for the best accounting and bookkeeping outsourcing software for your business,

- Consider your business model

- Team Size

- Client base

- Workflow preference

Before putting money down the table. If you still are not able to make up your mind, write into us at marketing@datamaticsbpm.com and we will have our accounting and bookkeeping experts reach out to you with software and a solution tailored perfectly to your business needs.

Struggling with bookkeeping, tax prep, or accounting tasks?

Let us handle the operations while you focus on growing your firm.