As we transition from spring to summer, the accounting fraternity worldwide prepares for audit season. With the last leg of May, the finance teams, CPAs, accountants, and CPA firm owners globally begin their audit season preparation for a busy and somewhat cumbersome annual audit. And while some are more prepared than others, there is no such thing as “completely ready” when it comes to auditing.

Hence, CPAs and CPA firm owners proactively prepare their practices for complete compliance and accuracy throughout the audit season. While preparing for audit season may seem like a straightforward task, it is easier said than done. Audit season cannot only induce unwanted stress but also causes severe errors with last-minute scrambling.

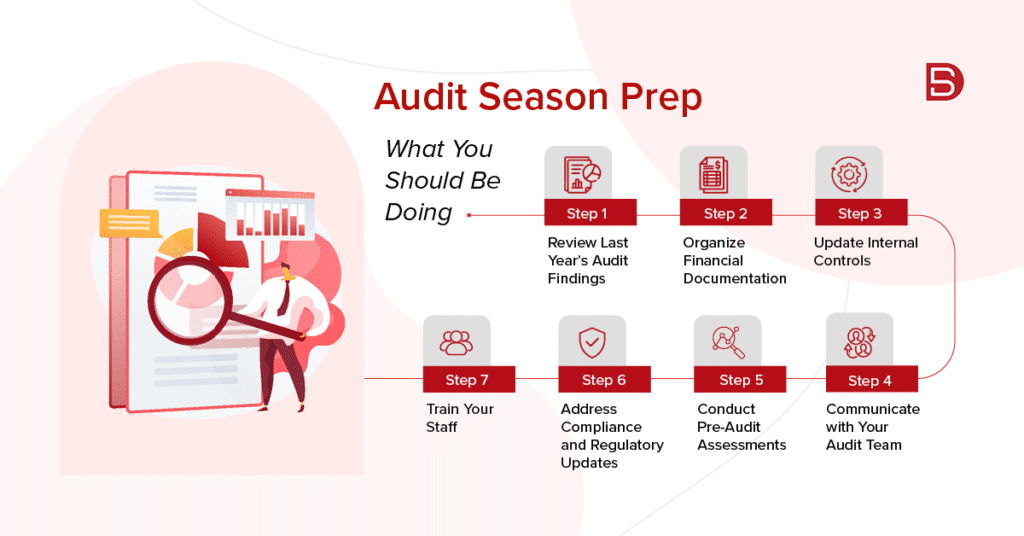

Thus, we will walk you through the critical audit preparation steps you should take early to ensure your audit process is smooth, successful, and efficient. In this blog, we have carefully drafted a CPA audit checklist with some of the essential steps that you, as a CPA firm owner, must adhere to if you want to have a stress-free audit season. So, let’s begin

Understanding the Audit Season Timeline

Audit season is defined by stringent timelines that every CPA/CPA firm owner needs to understand to ace the fiscal year-end audit planning. For most organisations, the annual audit period begins after the conclusion of the fiscal year-end, which often falls in June or December.

However, when it comes to audit readiness for CPA firms, it should begin well before the arrival of the auditors. CPA/CPA firms that begin preparing for their audit season in May get ample time to identify and address potential issues, organize necessary documentation, and ensure compliance with the latest regulations.

Key Steps for Audit Season Preparation

Prior planning is the key to a fruitful audit season. CPA firms that are proactive in their audit season preparation tend to get the maximum out of the process. Here are some audit season tips for accountants that you can take straight away to prepare for the impending audit season:

Step 1: Review Last Year’s Audit Findings

A good starting point for your audit readiness is revisiting the findings and recommendations from last year’s audit. It will allow you to flag any recurring issues or areas where your organization might have fallen short. Based on your findings, you can create a comprehensive plan to address the identified gaps and chart corrective measures that have been implemented or can be implemented.

Useful Tip:

- Document how you’ve resolved last year’s audit findings.

- Prepare evidence of improvements or changes made.

Step 2: Organize Financial Documentation

Clear and easy-to-understand documentation goes a long way. It is critical for your audit readiness for CPA firms. You can begin your journey by collating all necessary financial records, such as:

- General ledger and trial balances

- Bank statements and reconciliations

- Invoices and receipts

- Payroll records

- Tax filings

- Contracts and agreements

Ensuring the absolute correctness of these documents will ensure that your documents are accurate, easily accessible, and up-to-date. To further make the process streamlined, you can opt for digital documentation and cloud storage. This audit documentation checklist helps minimize last-minute errors.

Step 3: Update Internal Controls

Internal controls essentially consist of your policies and procedures, which are deployed within your firm to safeguard your organization from any possible errors and fraud. May is the ideal time to update and review these controls to ensure they align perfectly with industry best practices and remain effective.

- Internal Controls Checklist:

- Segregation of duties

- Authorization and approval processes

- Access controls for financial systems

- Regular reconciliations

These are critical internal controls for CPA firms to maintain audit accuracy and compliance.

Step 4: Communicate with Your Audit Team

Communication is always the key to the successful completion of any business process. Thus, you must communicate openly with your auditors to avoid any potential misunderstandings or delays. You can communicate with your auditors in May regarding the following:

- Confirm audit timelines and deliverables

- Any significant changes in your organization (e.g., new systems, mergers, or acquisitions)

- Clarify documentation requirements

This is a key audit compliance step to maintain alignment with your external team.

Step 5: Conduct Pre-Audit Assessments

Conducting a pre-audit assessment serves as a mock audit within the organization, identifying and addressing any potential issues even before the real audit begins. Conducting a pre-audit assessment helps you:

- Uncover errors or discrepancies

- Test internal controls

- Evaluate compliance with policies and regulations

This is one of the best answers to how to prepare for audit season proactively.

Step 6: Address Compliance and Regulatory Updates

Global regulatory requirements are ever evolving. May is an ideal time to update yourself and your team on any changes or updates to new laws, standards, or guidelines that may impact your audit. You must always ensure that your procedures and policies align perfectly with audit compliance steps and regulatory updates.

Action Steps:

- Subscribe to industry newsletters

- Attend webinars or training sessions

- Consult with compliance experts

Step 7: Train Your Staff

Your in-house team has a huge role to play in the success of your audit season. You must begin training staff for audit season preparation:

- Educate staff about audit processes and expectations

- Review documentation standards

- Reinforce the importance of compliance

This is especially vital when addressing what CPAs should do before audit season begins.

Common Audit Preparation Mistakes to Avoid

While you might adhere to every critical step for getting ready for a fruitful audit season, there still are some common pitfalls that you might run into along the way. Here are some pitfalls you must avoid:

- Procrastination: Just as with everything in life, procrastination on your audit too leads to errors and stress.

- Incomplete Documentation: Nothing infuriates auditors more than missing or disorganized records. Avoid it at all costs.

- Ignoring Previous Findings: Never ignore your previous findings, always learn from them and address them ahead of the audit season.

- Lack of Communication: Maintaining clear communication goes a long way.

- Overlooking Regulatory Changes: Not staying updated can lead to non-compliance.

Set the Stage for a Stress-Free Audit

While audit season might seem like an intimidating time of the year, it does not have to be that way. With proper planning and guidance, you can easily overcome the stress and the overwhelming feeling that comes with it.

As a CPA or a CPA firm owner, all you need to do is start your audit season preparation early in May, and you can set yourself for a smooth, efficient, and successful audit. We have listed all the key audit preparation steps that you ought to be taking ahead of the impending audit season.

Ready to Make This Audit Season Seamless?

Discover how our Audit & Assurance experts can help you stay compliant, reduce risk, and breeze through audit season.

Partner with Datamatics and ensure your financials are in perfect shape.

However, if you still need a guiding hand to prepare for the audit season, you can always write in to us at marketing@datamaticsbpm.com. Remember, early and thorough preparation is the key to audit success.

When should I start preparing for the audit season?

Ideally, start your audit preparation at least two to three months before your fiscal year-end. May is a great time for most organizations.

What documents do auditors typically request?

Auditors usually request financial statements, bank reconciliations, invoices, contracts, payroll records, and tax filings — all part of a solid audit documentation checklist.

How can I make audit preparation less stressful?

Stay organized, communicate with your audit team, and use technology to streamline documentation and reporting. This forms the backbone of how to prepare for audit season successfully.