Perhaps the most common recipe for Holidays for CPAs worldwide is excitement and stress mixed in equal proportions. While clients are busy decorating their lawns and wrapping gifts, CPAs/CPA firm owners and partners are busy battling deadlines, staff vacations, and mounting client demands. If you’re a CPA firm owner or a partner at one, you know what we are talking about here.

In such times, the CPA firms that plan ahead and leverage smart solutions, such as outsourcing, are the ones that thrive. With the 2025 Holiday season already upon us, CPAs & CAs across the USA, UK, and Canada are running frantically to keep up with the abundant stress that comes with it. If you do not want to be a part of that group, let us tell you, you still have time. With strategic planning and the right solutions by your side, you certainly can deliver exceptional service to your clients without burning your team.

If that is something you’re interested in, keep on reading. We have designed this blog to serve as a comprehensive guide for you to prepare your CPA business this holiday season leveraging accounting and bookkeeping outsourcing as a strategic growth lever during holiday season.

Prepare Your CPA Firm for a Stress-Free 2026 Tax Season

Designed for CPA firm owners, partners, and professionals preparing for a busy season. Stay organized, boost efficiency, and reduce last-minute extensions with this complete checklist.

Why Does Accounting and Bookkeeping Outsourcing During Holidays Make Business Sense?

There is growing acceptance of accounting and bookkeeping outsourcing as a strategic growth lever worldwide during the holiday season. According to the American Institute of CPAs (AICPA), CPA firms experience a 45% increase in workload during the October-December quarter. Furthermore, the inner staff takes an average of 8-10 days off during this same period.

Accounting and bookkeeping outsourcing for CPA Firms worldwide has become a strategic necessity. It protects your firm from compromising on service quality or overworking your team by leveraging outsourcing as a smart solution to manage year-end closings, tax planning, and regular monthly work simultaneously.

Partnering with an outsourcing service provider during the holiday season helps CPA firms bring in experienced accounting and bookkeeping professionals who can seamlessly integrate into your workflow, transforming the season from survival mode into an opportunity for growth. These professionals bring in years of accounting and bookkeeping experience, helping you maintain service standards, keep your team’s morale intact, and actually have the capacity to take on those last-minute engagements that often become your best long-term clients.

Key Takeaway: The absence of staff, combined with seasonal workload, creates a significant capacity gap for accounting and bookkeeping firms, threatening service quality and team wellbeing. However, strategic outsourcing helps you fill this gap while maintaining your firm’s standards.

Why Should You Consider Accounting and Bookkeeping Outsourcing During Holidays?

If you haven’t outsourced your accounting and bookkeeping tasks already, you might wonder why now, when things are already all chaotic. Therefore, to make things easy for you, here are the key benefits:

- Ease of Scalability without the overhead of hiring: Outsourcing offers you instant access to additional bandwidth without the overhead of hiring internal staff.

- Cost efficiency: Outsourcing does not incur a fixed cost; you pay for what you use.

- Expertise on demand: Outsourcing service providers have teams of accounting and bookkeeping experts who can handle time-consuming, technical tasks.

- Risk mitigation: Outsourcing minimizes staff burnout and helps you maintain business continuity even when people are on vacation.

From a market perspective, the global finance and accounting outsourcing (FAO) market is booming. According to Grand View Research, the finance & accounting BPO market was worth around USD 64.86 billion in 2024 and is projected to reach USD 110.74 billion by 2030, growing at a compound annual growth rate of 9.3%. Meanwhile, Insignia Resources notes that companies can save 20–60% on finance operations by outsourcing accounting tasks.

Key Takeaway: For CPA firms in UA, UK, and Canada, accounting and bookkeeping outsourcing during the holidays is not just a workaround, it is a strategic lever to scale, save, and stay sharp.

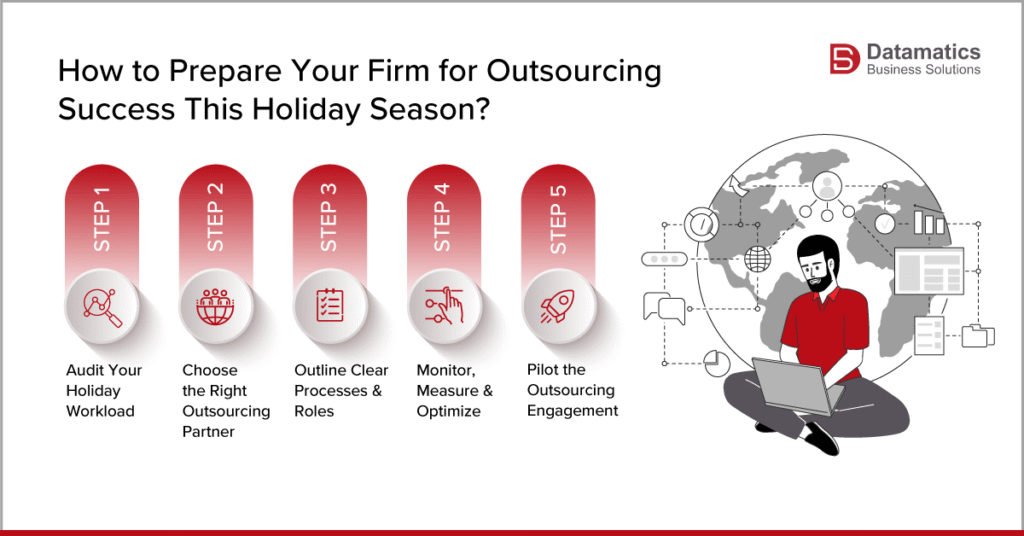

To have a fruitful holiday season as a CPA firm, you must get started early. If you are getting your firm ready for accounting and bookkeeping outsourcing during the holidays, here is a roadmap tailored to CPA practices in the UK, US, and Canada.

Step 1: Audit Your Holiday Workload

You must start by assessing how the holiday season is looking for your firm. You can do so by evaluating:

- Which clients have year-end reporting or tax-prep deadlines?

- What internal tasks, such as reconciliations, payables, receivables, etc., tend to pile up?

- Who on your team is likely to be on vacation and when?

Once you have assessed your pain points, you can blend them with outsourcing solutions much more accurately.

Step 2: Choose the Right Outsourcing Partner

When looking for an outsourcing partner, consider the following:

- Time-zone alignment: Identify what works best for you: onshore, nearshore, or offshore?

- Regulatory compliance: Does your outsourcing partner have specialization in UK tax law, IRS rules, or Canadian GAAP?

- Quality control: What SLAs (Service Level Agreements) do they offer for turnaround, accuracy, and security?

- Technology stack: What are the cloud tools, automation (RPA), or AI-enabled dashboards they use?

For different geographic regions, outsourcing service providers will have different ecosystems:

- In the UK, you need outsourcing partners that are familiar with UK CA regulations.

- In the US, you need partners who understand the US CPA-firm workflow.

- In Canada, the outsourcing partner must be familiar with Canadian GAAP, GST/HST, and provincial rules.

Step 3: Outline Clear Processes & Roles

Ahead of the holiday rush, lay out processes:

- POC from your side as well as from your outsourcing partner’s side (e.g., a holiday “outsourcing lead”)

- Make a list of tasks that you will outsource, such as bookkeeping, AP/AR, tax prep, reporting, etc.

- Assess the security measures in place, e.g., access controls, data encryption, etc.

- Establish the review, approval, and delivery processes.

You need to ensure you are on the same page with your outsourcing service provider regarding communication channels, deliverables, and escalation points.

Step 4: Pilot the Outsourcing Engagement

The holiday season is not the best time to take a risk. What if something breaks? Hence, it is always better to start small with a pilot engagement, as opposed to going all-in during the first holiday period:

- Start with a subset of tasks (e.g., AP or month-end close).

- Run it for a few weeks pre-season to iron out workflows.

- Measure performance — accuracy, turnaround time, cost — and iterate.

Starting with a small pilot run gives you ample runway to test the relationship before scaling up into the peak holiday period.

Step 5: Monitor, Measure & Optimize

Tracking different engagement metrics lets you assess how things are going. You can do so by using dashboards or simple trackers to monitor:

Performance Metrics: Holiday Period TrackingThis table summarizes our key accounting performance metrics and comparisons between established targets and actuals for the recent holiday period.

| Metric | Target | Actual (Holiday Period) |

|---|---|---|

| Volume of transactions processed | e.g., 1,000 invoices/week | |

| Turnaround time | e.g., 48 hours | |

| Error rate | < 2% | |

| Cost per transaction | internal cost × outsourcing rate |

Metrics are tracked weekly and reviewed post-holiday to ensure continuous process improvement. Upon careful consideration, you must conduct a debrief to discuss wins, bottlenecks, and adjustments for next holiday season.

The Strategic Advantages of Outsourcing for CPA Firms in the US, UK & Canada

Here, we have categorically listed the benefits of accounting and bookkeeping outsourcing during holidays for firms across the major geographies.

- Cost arbitrage: The US CPA firms can significantly reduce their overhead by leveraging outsourcing and channel those funds into advisory services.

- Scalable compliance: For the CPA firms in the USA, outsourcing helps meet the surge in demand around year-end tax filings and 1099/W-2 processes.

- Technology Leverage: Outsourcing firms help you gain instant access to cloud and RPA, giving US CPAs access to automation without the upfront capex.

- Regulatory support: Outsourcing service providers are familiar with Canadian GAAP, GST/HST, and provincial tax rules, which helps Canadian CPA firms ease seasonal burdens.

- Nearshore options: Canadian CPA firms also benefit greatly from the nearshore outsourcing providers in similar time zones, which eases communication.

- Efficiency gains: By outsourcing during the holiday season, you gain the ability to free up your internal resources to deliver high-value strategic advisory or business development during the financial year closing.

- Year-end resilience: Outsourcing enables UK CA firms to seamlessly manage crunches around financial year-end, audit prep, and statutory reporting.

- Specialist experts: The UK CA firms gain instant access to seasoned CA professionals with in-depth knowledge, without the long-term commitment of hiring.

- Global reach: The UK firms that serve international clients gain access to outsourcing partners in different regions to provide 24/7 support, even during UK holiday breaks.

Conclusion

The Holiday season can be stressful for many reasons; the growing workload and overworked teams should not be among them. By leveraging advanced accounting and bookkeeping outsourcing during holidays, you give your CPA firm the ability to survive the year-end rush while you thrive. Your firm gains the ability to scale up without permanent hiring, gets improved service quality, and maintains your team’s sanity.

Whether you are a US CPA firm, UK CA practice, or Canadian CPA business looking to leverage outsourcing this Holiday season, we have solutions tailored to your business needs. Just write to us at marketing@datamaticsbpm.com to explore our services and plan a pilot.

What tasks are best suited for accounting and bookkeeping outsourcing during holidays?

You can outsource year-end close, reconciliations, AP/AR, payroll, and reporting — especially those high-volume, repeatable tasks that don’t require client-facing advisory.

How do I ensure data security when outsourcing?

Look for providers with strong encryption, access control, multi-factor authentication, and compliance with relevant standards (e.g., GDPR, SOC 2).

Will the quality of work suffer if I outsource during a busy season like the holidays?

Not if you plan properly. A good partner will offer SLAs, sample reviews, and periodic audits. With a pilot phase, you can validate their quality before scaling.