We just crossed the halfway mark for the year 2025, with Q2 drawing fast to a close. This is the perfect time to pause, reflect, and address potential bookkeeping mistakes before they spiral into major issues in the second half of the year.

The conclusion of Q2 also presents these businesses with a thorough mid-year accounting review. As a business owner, it is time for you to identify, repair, and fix any possible bookkeeping mistakes before they snowball into bigger problems in the second half of the year. Whether you are a CPA firm owner, a business owner, a bookkeeper, or just a finance manager, it is time for you to identify and address these issues and save your business from annual headaches, lost revenue, and even penalties down the road.

In our latest blog, we take a closer look at 5 of the most common bookkeeping mistakes that you can easily fix before Q3 and why it is essential to have a mid-year accounting review. We will also be sharing some concrete financial reconciliation tips that will help you overcome your most pressing bookkeeping questions. So, let’s get started.

Mistake #1: Ignoring Transaction Errors

What Are Transaction Errors?

Although self-explanatory, transaction errors occur due to the incorrect recording of financial entries. These errors can occur for various reasons, some of the most common being typos, duplicate entries, missed invoices, or misapplied payments. Even though these errors sound pretty straightforward, they can wreak severe havoc on your financial statements.

Why Transactional Errors Are a Problem?

- Skewed income and expense reports

- Inaccurate tax filing

- Potential cash flow issues

How to Fix Transactional Errors?

Transactional errors can easily be fixed by regularly reviewing your bank statements and comparing them using any industry standard accounting software. You can also utilize transaction reconciliation tools to spot discrepancies and even train your team to double-check entries, particularly for high-value transactions.

Mistake #2: Mismanaging the Chart of Accounts

What Is the Chart of Accounts?

A chart of accounts is the backbone of any advanced bookkeeping system. It helps you organize all your financial transactions into categories such as assets, liabilities, income, and expenses.

Why Chart of Accounts Are a Problem?

- Overly complex or outdated account structures

- Misclassified transactions

- Missing or duplicate accounts

Why Does The Chart of Account Matter?

Having an ill-managed chart of accounts can easily result in unbalanced books, which can further lead to confusing financial reports, making it difficult to track business performance.

How to Fix It?

As a business owner, you can easily fix charts of accounts through timely review of your chart of accounts and simplifying them during your mid-year accounting review.

- Archive unused accounts and merge duplicates.

- Ensure every transaction is classified correctly.

1. Overwhelming Workload and Missed Deadlines

What Are Unbalanced Books?

Unbalanced books are caused due to a mismatch in the debit and credit entries. For any bookkeeper, it is a red flag for underlying transaction errors or misclassifications.

- Risks Involved

- Inaccurate financial statements

- Difficulty in securing loans or investments

- Increased risk of audits

How to Fix Unbalanced Books?

You can easily fix your unbalanced books using advanced accounting software for running regular balance checks. You can also investigate and resolve discrepancies using a professional review if the errors persist.

Mistake #4: Delaying Financial Reconciliation

Why Reconciliation Matters?

Financial reconciliation for any business is the process of matching internal records with external statements such as bank or credit card statements. Any delay in financial reconciliation can cause SMB bookkeeping problems.

Consequences of Delayed Financial Reconciliation

- Missed fraudulent transactions

- Overlooked fees or charges

- Compromised cash flow management

- Financial Reconciliation Tips

- Set a monthly reconciliation schedule.

- Automate reconciliation where possible.

- Keep supporting documents organized for quick reference.

Mistake #5: Overlooking SMB Bookkeeping Problems

Unique Challenges for SMBs

Some of the most common bookkeeping challenges faced by small businesses include limited resources, a lack of expertise, reliance on manual processes, mixing personal and business finances, failing to keep receipts or documentation, and infrequent bookkeeping updates.

How to Fix SMB Bookkeeping Problems?

- Separate business and personal accounts.

- Use cloud-based accounting tools for real-time updates.

- Schedule regular bookkeeping sessions, even if it’s just an hour a week.

Struggling with bookkeeping, tax prep, or accounting tasks?

Let us handle the operations while you focus on growing your firm.

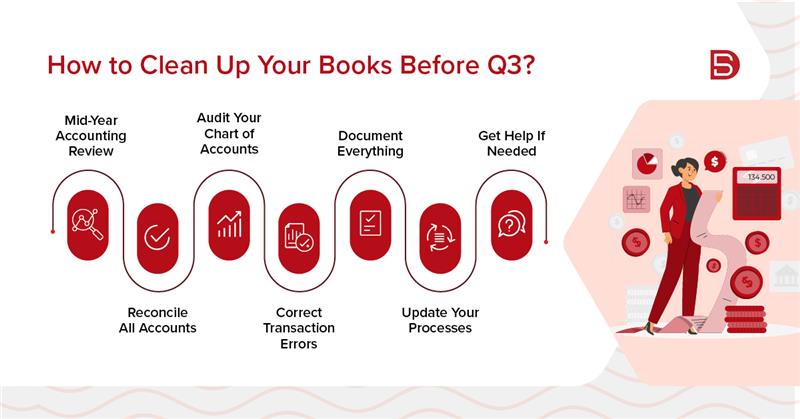

How to Clean Up Your Books Before Q3?

Now that you know the five most common bookkeeping mistakes small to medium-sized businesses make regularly, it is time to fix them. Here’s a step-by-step plan:

- Mid-Year Accounting Review: Just before the end of the first half of the year or immediately once it is over, you must allocate some time to review your financial records to eradicate or identify any possible mistakes.

- Reconcile All Accounts: You must thoroughly check all your bank, credit card, and loan accounts to make sure that they match your books.

- Audit Your Chart of Accounts: You must simplify and update your chart of accounts as frequently as possible.

- Correct Transaction Errors: Once you’ve identified the transaction errors and mistakes, you must fix them and make sure all your transaction records are accurate and complete.

- Document Everything: It is always a good idea to keep digital copies of receipts, invoices, and statements.

- Update Your Processes: You can update your bookkeeping process by harnessing the power of automation or by simply reconciling the accounts wherever it is possible.

- Get Help If Needed: If there is a need, always seek professional help to review your books thoroughly.

Outsourcing a Mid-Year Bookkeeping Review – A Smart Move

While most small to medium-sized businesses hesitate to outsource their mid-year bookkeeping review, the smart ones do outsource, and so should you. Especially if:

- You lack in-house expertise

- Your books are several months behind schedule

- You’ve experienced rapid growth or significant changes

Benefits of Outsourcing:

- Access to experienced bookkeeping professionals

- An objective review of your financials

- More time to focus on running your business

How to Choose a Provider:

- Look for CPA outsourcing service providers with SMB experience

- Ask about their review process and turnaround time

- Check client testimonials and references

Conclusion

While the common perception is that fixing common bookkeeping mistakes is all about identifying and fixing the errors, it actually is a lot more than that. Fixing common bookkeeping mistakes ahead of Q3 sets your firm for success in the second half of the year by carrying out a thorough mid-year accounting review, reconciling your accounts, and addressing bookkeeping problems head-on. As a result, you will have cleaner books, better cash flow, and greater peace of mind. If you are battling unbalanced books or if your bookkeeping process is marred with too many unidentified mistakes, it might be time for you to consider outsourcing your bookkeeping process. And you can do so by simply writing to us at marketing@datamaticbpm.com and we will have our bookkeeping experts reach out to you with a solution perfectly tailored to match your business requirements.

What are common bookkeeping mistakes businesses make?

Some of the most common bookkeeping mistakes include:

- Ignoring transaction errors

- Mismanaging the chart of accounts

- Letting books go unbalanced

- Delaying financial reconciliation

Overlooking SMB-specific bookkeeping problems

How do I clean up my books before Q3?

Start with a mid-year accounting review. Reconcile all accounts, fix transaction errors, update your chart of accounts, and consider outsourcing if needed. Use cloud-based tools and set regular schedules for ongoing maintenance.

Should I outsource a mid-year bookkeeping review?

If you’re short on time, lack expertise, or want an objective review, outsourcing can be highly beneficial. Choose a provider with experience in your industry and a proven track record.